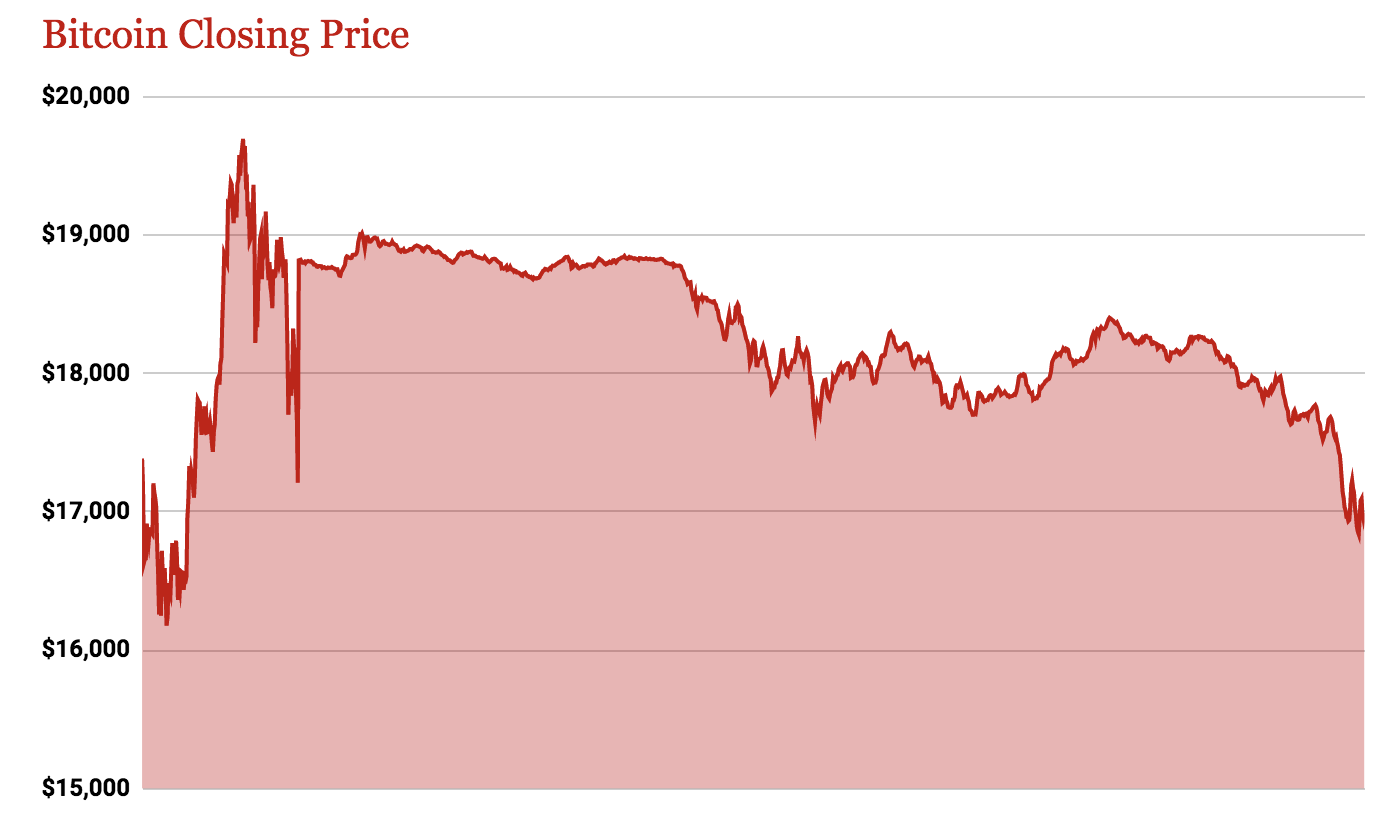

The Bitcoin price has fallen 10% in 24 hours and 13% since Sunday.

Oh, my…

Data source: Coindesk.com

Data source: Coindesk.com

According to Coindesk, Bitcoin prices have fallen from $US19,694 on the weekend to $US17,080 Wednesday morning. The $US2,614 fall represents a decline of more than 13%. The Ethereum (ETH) price has fallen from over $881 to $799.

“I would say an investment in bitcoin is right now the riskiest investment you can make. There’s an extremely high risk.”

That statement comes from bitcoin.com Co-Founder, Emil Oldenburg, who was quoted by Swedish site Breakit.

Emil and his 60-person Tokyo-based bitcoin team have been paid in bitcoin for years. However, Emil has sold all of his “Bitcoin” for “Bitcoin Cash”.

Confused yet?

A few months ago, Bitcoin split in two. There’s the $20,000 Bitcoin (the one that your janitor owns and is using to get-rich-quick) and “Bitcoin Cash” (the one which actually does something).

That’s right; it’s Bitcoin Cash which is best used to buy and sell things like groceries.

You: “Huh?”

It’s best explained with an example, so bear with me…

Whenever you buy a 20-pack of ribbed latex gloves using EFTPOS at Woolies a signal is sent across a payment network like Mastercard Inc (NYSE: MA) or Visa Inc (NYSE: V).

Whenever you ‘tap and go’ the little EFTPOS terminal sends a message to your bank to check if you have the cash to support your purchase.

If you have a Visa or Mastercard, you’ll get an answer in about 2 to 10 seconds.

Bitcoin, the $20,000 $17,000 cryptocurrency that your brother-in-law’s uncle’s dog’s sister owns can take up to 4 hours to process a transaction.

Can you imagine going to get ice cream with your hot date on a steamy summer night and waiting 4 freakin’ hours for your card to approve the payment?

Ultimately, ‘old’ Bitcoin can handle a few transactions every second while Mastercard and Visa can handle thousands.

The ‘new’ Bitcoin (Bitcoin Cash) requires a bigger hard drive to store the coins, but transactions are much more efficient.

Unfortunately, because no-one controls the Bitcoin market the ‘forking’ process into two different coins was a bit of a mess. Half of the key players with heaps of Bitcoin wanted to keep the Bitcoin market the way it was while others wanted to change it.

According to Emil, “The old bitcoin network is as good as unusable.“

Bitcoin futures, which listed on the CME index earlier this week, fell 10% overnight.

However, Bitcoin futures are now listed on two of the world’s biggest financial exchanges (CBOE and CME), which opens the trading instrument up to larger institutional players and adds legitimacy to the growing market.

Keep reading: