The Twitter Inc (NYSE: TWTR) share price jumped 11% on Monday following a broker upgrade.

Twitter is an $18 billion multinational social media platform with 330 million active monthly users.

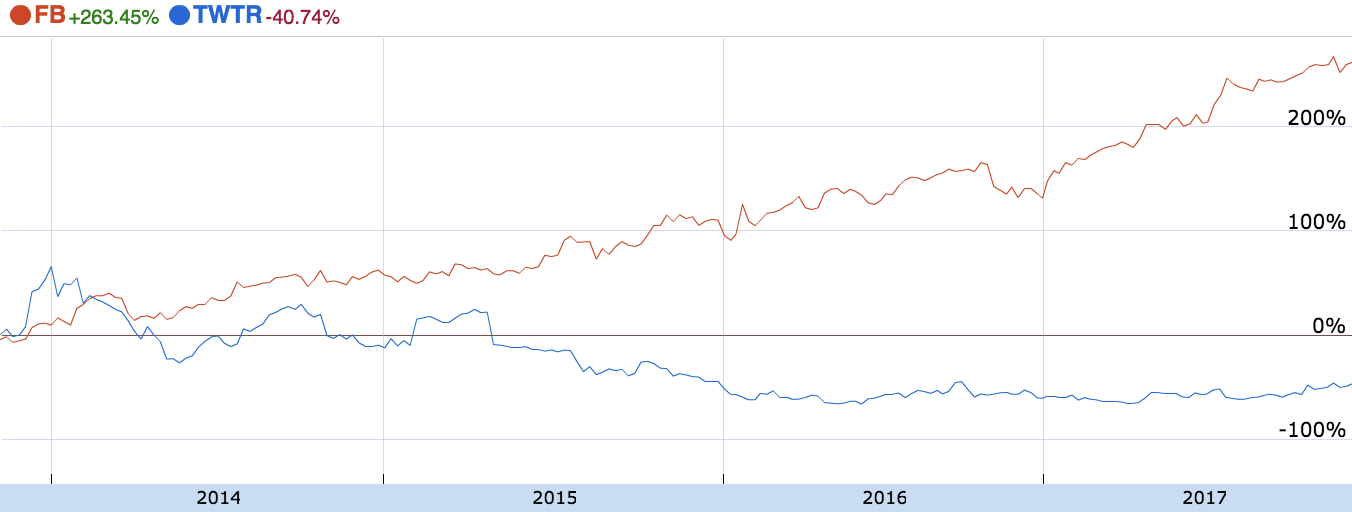

Despite listing its shares on the New York Stock Exchange in late 2013 at $26, and reaching a high of $69 in 2014, the company’s shares have been discounted by investors concerned about its lack of profitability.

Twitter V. Facebook

Over the same period, shares of Facebook Inc (NASDAQ: FB) have risen more than 200%.

The past 12 months have been a little better for Twitter shareholders, with company’s shares rising 32%. However, although Twitter’s most recent quarterly report revealed a 14% increase in daily active users its revenue fell 4%.

Broker Upgrade

Despite the fall in revenue, J.P. Morgan analysts have moved Twitter shares to “overweight” from “hold”, according to CNBC.

“We are upgrading TWTR shares to overweight with a $27 price target,” JPM analyst Doug Anmuth wrote. “We believe both the TWTR story and financial results will strengthen over the next year as the company continues to build on its differentiated value proposition for users & returns to revenue growth.”

A rise in live streaming, user growth, more revenue and improving profits were cited as the reasons to increase their valuation from $20 to $27 per share.

According to The Wall Street Journal, three analysts from a total of 36 currently rate Twitter shares as a “buy”.

Keep reading

Disclosure: The author of this article owns shares of Twitter.