Ardent Leisure Group (ASX: AAD) shares rose 7% on Wednesday following the announcement of a proposed sale of its bowling business.

Ardent Leisure Group is the owner of popular entertainment businesses like Dreamworld, Skypoint Observation Deck, AMF and Kingpin bowling, and Main Event in the United States.

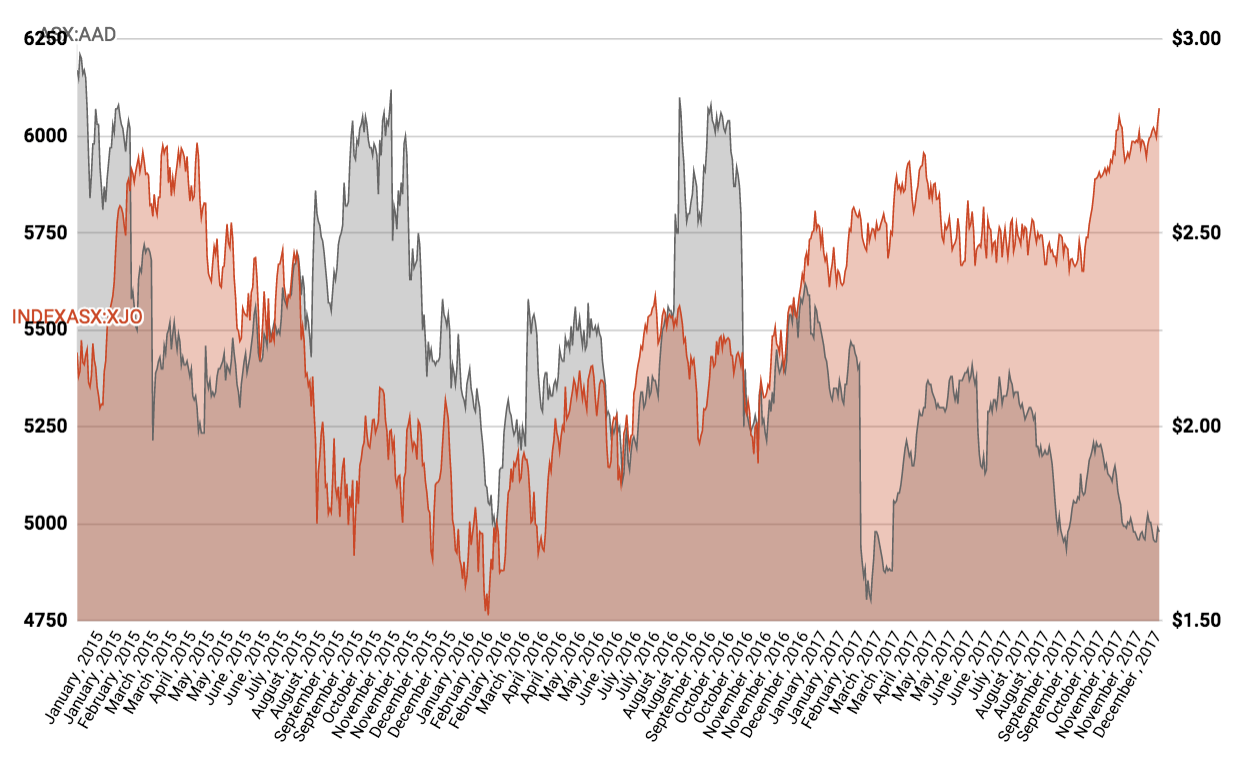

Despite that, the Ardent share price has struggled to keep pace with the broader Australian share market, or S&P/ASX 200 (ASX: XJO), over the past few years.

ASX 200 V. Ardent Leisure Group

This morning, Ardent detailed its decision to sell its bowling business to The Entertainment and Education Group (TEEG) for $160 million. The deal, Ardent said, represents an attractive multiple of 32 times core 2017 earnings before interest and taxes (EBIT).

For TEEG, Ardent’s bowling business represents a strategic asset with the company having recently bought Timezone.

“Following an unsolicited offer from TEEG, the decision to divest B&E reflects the attractive price offered and our focus on investing our capital in areas where we can earn the most attractive returns,” Dr Gary Weiss, Chairman of Ardent, said.

“While we are confident that the strategy for B&E will deliver improved earnings, this sale relieves Ardent of the requirement to make the significant further investment needed to support this strategy and provides Ardent with increased flexibility to continue the expansion of Main Event and the reinvigoration of Theme Parks.”

Main Event is an all-in-one entertainment hub which Ardent is growing in the United States.

“With additional financial flexibility, we will be in a good position to focus on driving constant centre revenue growth and accelerating our roll-out of Main Event Entertainment centres,” Dr Weiss added.

At the time of writing, Ardent shares were trading at $1.87, which compares to its highest share price of $3.39 achieved back in 2014.

Keep reading: