ASX-listed BlueScope Steel Limited (ASX: BSL) shares jumped 5% following a profit upgrade on Thursday.

BlueScope Steel is an $8 billion Melbourne-based steel producer and supplier.

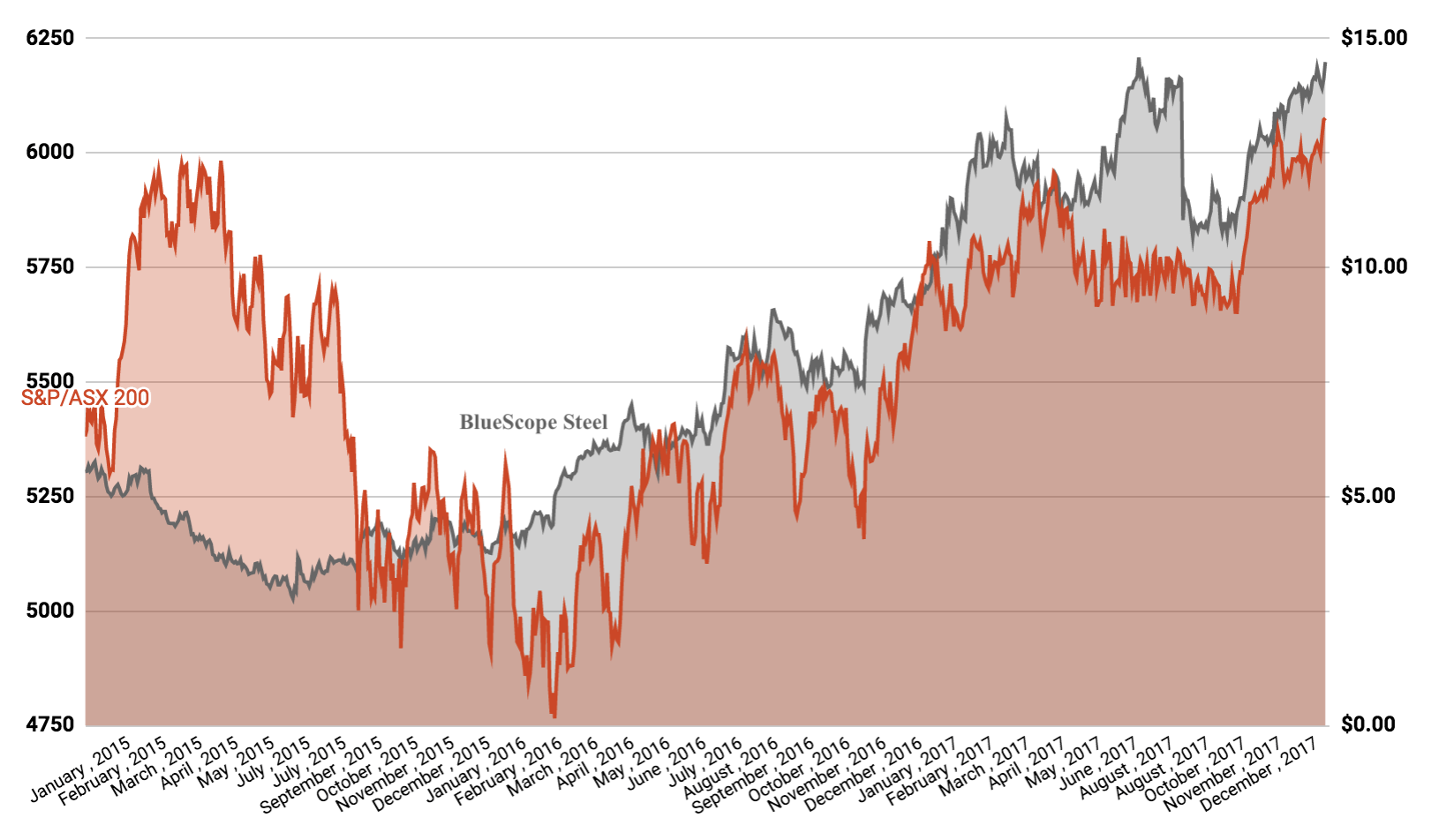

BSL Shares Vs. ASX 200

In an announcement to the ASX this morning, BlueScope Steel provided a financial update to investors. It expects earnings before interest and taxes (EBIT) to be $460 million for the six month period through December 2017. That compares to its previous forecast of $420 million.

Incoming Managing Director, Mark Vassella, said the improved financial performance is a result of better steel prices, improved productivity, volumes and its Indian JB venture.

“Across the rest of the portfolio, North Star BlueScope, New Zealand and Pacific Steel, and North America Buildings are expected to deliver performances generally in-line with prior performance.”

Looking ahead, Mr Vassella acknowledged positive macro conditions but noted rising material costs and competition from imports.

The price of iron ore, a key ingredient in steel, has fallen 20% over the past 12 months, according to indexmundi.

Tax Reform Boost

Overnight, the U.S. government made inroads for its tax reform package. BlueScope Steel said it is likely to benefit its North American operations.

“BlueScope expect its U.S. earnings will benefit through a lower federal tax rate, with an anticipated 7 per cent decrease in FY2018 and 11 per cent decrease thereafter.”

At the time of writing, BlueScope Steel shares were trading at $15.13.

Keep Reading: