The Orocobre Limited (ASX: ORE) share price jumped another 5% on Wednesday following the announcement of stronger lithium carbonate prices.

Orocobre is a $1.4 billion lithium carbonate supplier and boron producer with operations in Argentina. It is a prime beneficiary of the ongoing push towards energy storage using batteries.

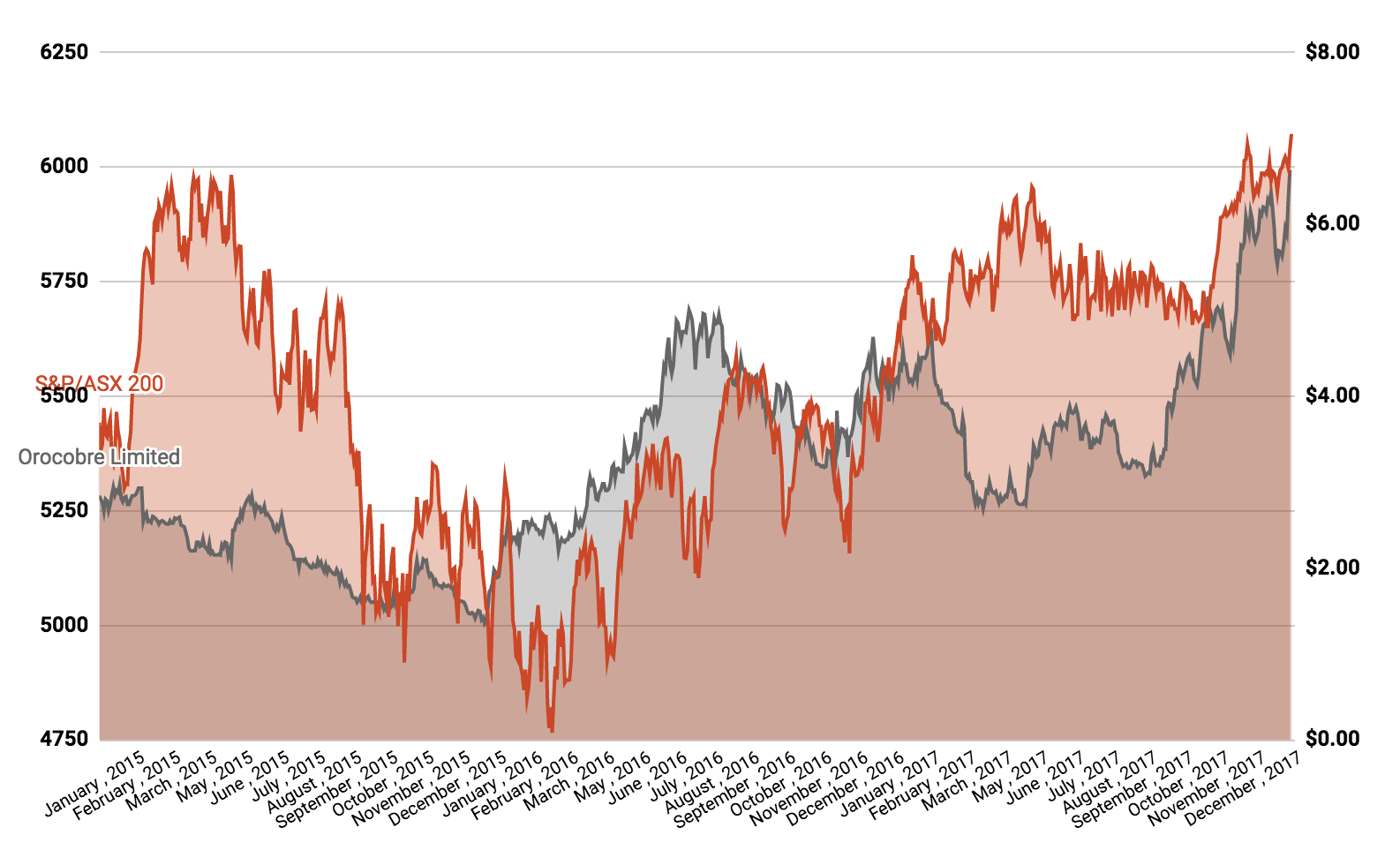

ORE Share Price v. ASX 200

In an announcement to the ASX on Tuesday, Orocobre gave an update on its expectations for lithium carbonate pricing going forward. It said delivery quantities have now been finalised for around 85% of production for the first half of 2018.

Pleasingly, it said tight market conditions should result in rising contract prices, up 25% in the half year to June 2018 compared to the prices received in the half year through December 2017.

“The company will meet previous pricing guidance for the December quarter of more than US$11,000/tonne,” it announced.

Managing Director and CEO, Richard Seville, said, “Contract prices are rising in all markets and

we expect this to continue in the foreseeable future as new demand for lithium chemicals exceeds new supply.”

Over the past three years, shares of Orocobre have risen 165% as the price of lithium continues to creep higher. Over the past 12 months alone lithium prices have risen 61% according to Trading Economics.

At the time of writing, Orocobre shares were trading for $6.95.

Keep reading: