Yowie Group Ltd (ASX: YOW) shares fell 28% on Wednesday following a downgrade to the chocolate company’s 2018 profit forecasts.

Yowie Group is a $33 million company which distributes the once popular Australian chocolate brand. Yowies are small chocolates which contain a toy inside and feature six characters. In the mid-90’s more than 65 million Yowies were sold in Australia and New Zealand.

Yowie Group purchased rights to the brand in 2012. In 2014, it began expanding its range of chocolates in the USA through partnerships with major retail chains like Wal-Mart Stores Inc. (NYSE: WMT).

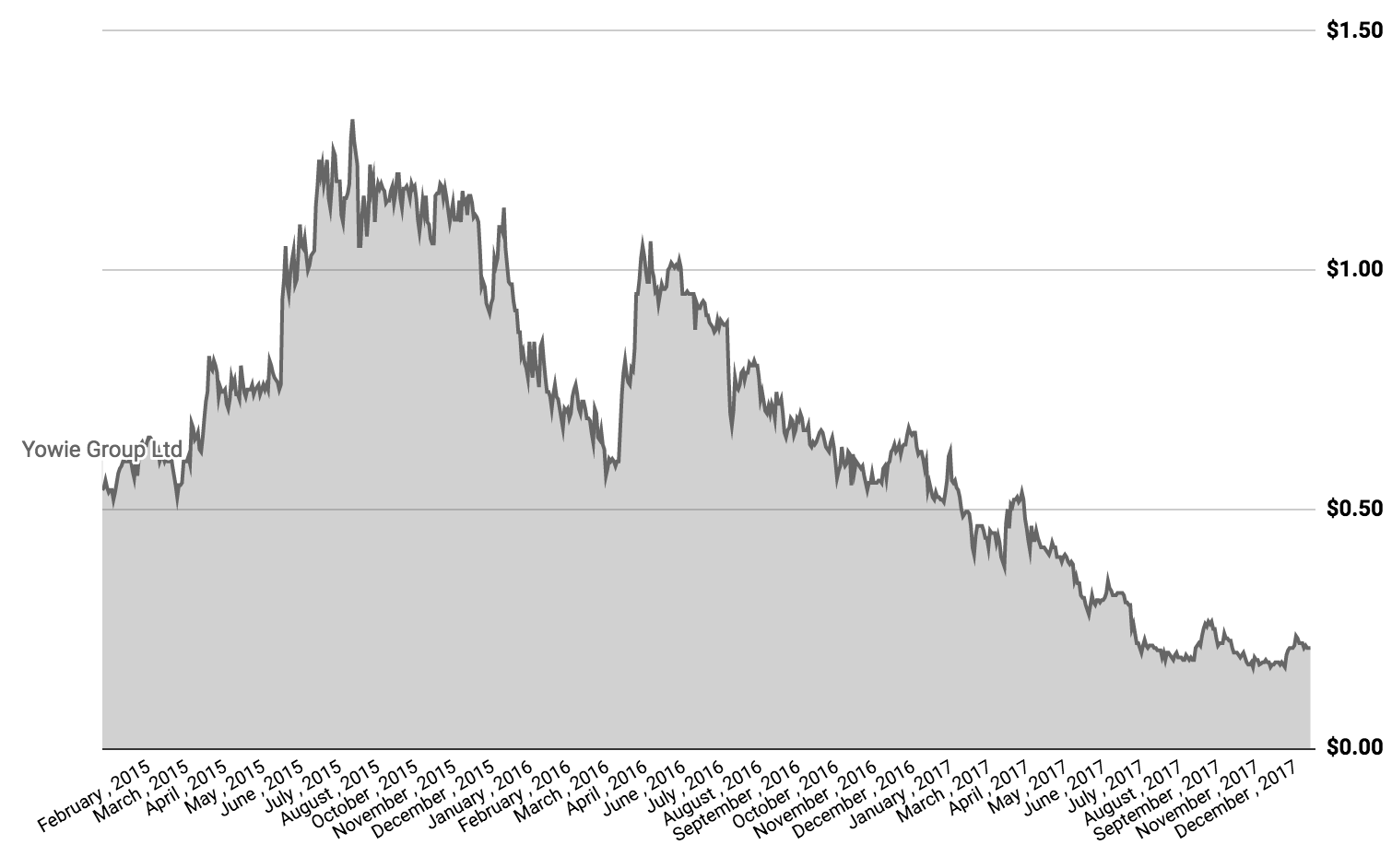

Unfortunately, the company has failed to impress investors with the Yowie Group share price falling 77% in the past year, according to Google Finance.

Yowie Share Price

This morning, Yowie Group reported a 23% increase in quarter two sales versus the prior reporting period a year earlier. It also revised downwards its 2018 financial year sales growth forecasts from 55% to 17%. It blamed the reduced expectations on its previous forecasts for Discovery World and a deferred launch in Canada. It also noted, “Reduced feature opportunities at Yowie’s largest US retailer”.

During the first half of its 2018 financial year, Yowie Group said its North American sales were $US 8.2 million, down 11.7% and “below plan”. In Australia, it achieved sales of $US 1 million.

Yowie Group also said that its gross margin remained steady at 55% while it performed above the “required threshold levels” in its major customer/retailer.

CEO Change

Yowie also announced a change of Chief Executive Officer with Bert Alfonso stepping down from his position as Global CEO effective yesterday. Mark Schuessler, formerly head of Yowie North America, will take over from Mr Alfonso.

Mr Schuessler will receive a salary of $US 522,600 and bonuses, in addition to rights to shares.

Keep reading: