This morning, fashion retailer Lovisa Holdings Ltd (ASX: LOV) announced an 18.8% increase in sales for the second half of the 2017 calendar year.

Lovisa is a $710 million company which sells fashion jewellery and accessories. It has more than 300 stores in Australia, New Zealand and throughout the world.

Lovisa Shares Rise

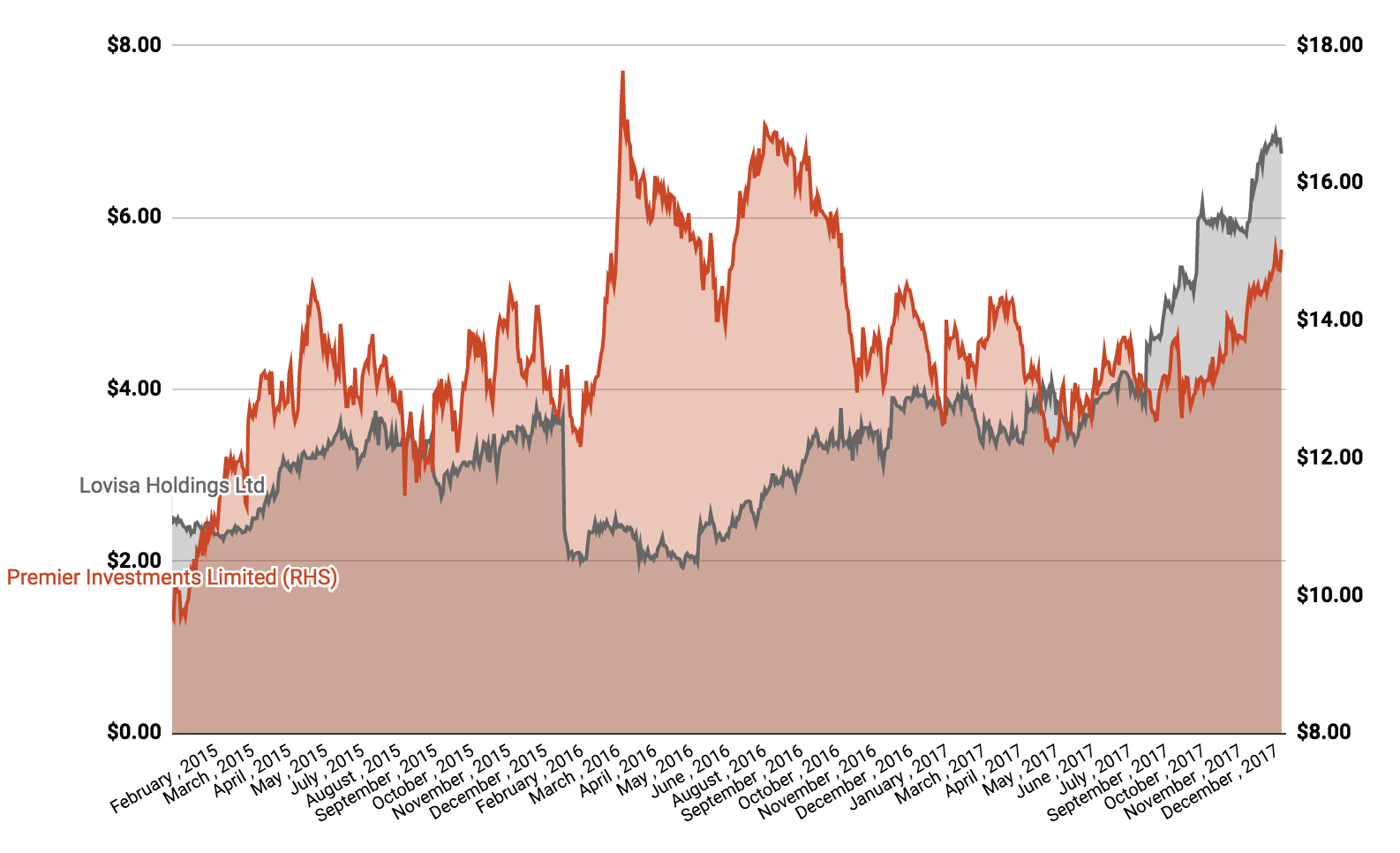

The chart above shows the share price of Lovisa and Premier Investments Limited (ASX: PMV) over three years. Premier Investments owns brands like Smiggle, Just Jeans, Peter Alexander and more.

This morning, Lovisa provided a trading update to ASX investors revealing an 18.8% increase in sales, or 7.4% after adjusting for new store openings.

Lovisa said strong fashion trends during the half year to 31 December 2017 assisted the positive trends from a year earlier, allowing it to build on its momentum. Christmas and Boxing Day were particularly favourable for the company, growing ahead of expectations.

“It’s pleasing that the business has been able to maintain the solid start to the year as we continue our global rollout”, CEO Steve Doyle said. The company ended the half with 319 stores.

Given the stronger-than-expected result, Lovisa now expects to report half-year operating profit (also called Earnings Before Interest and Taxes, or EBIT) between $34.5 million and $35 million. That’s up around 23% on the same period a year earlier.

The company will provide further details when it releases its first-half results in February.

According to The Wall Street Journal, the average analyst price target on Lovisa shares is $6.10 with an “overweight rating”.

Join Our Free Investing Club Today

Looking to get the latest news and information on investing in Australia? You can join our investing network today by clicking here. It’s free to join.

Keep reading: