The Jumbo Interactive Ltd (ASX: JIN) share price jumped 6% today following a positive trading update.

Jumbo Interactive is a $200 million company which uses technology to sell lottery tickets online. It is the name behind Oz Lotteries.

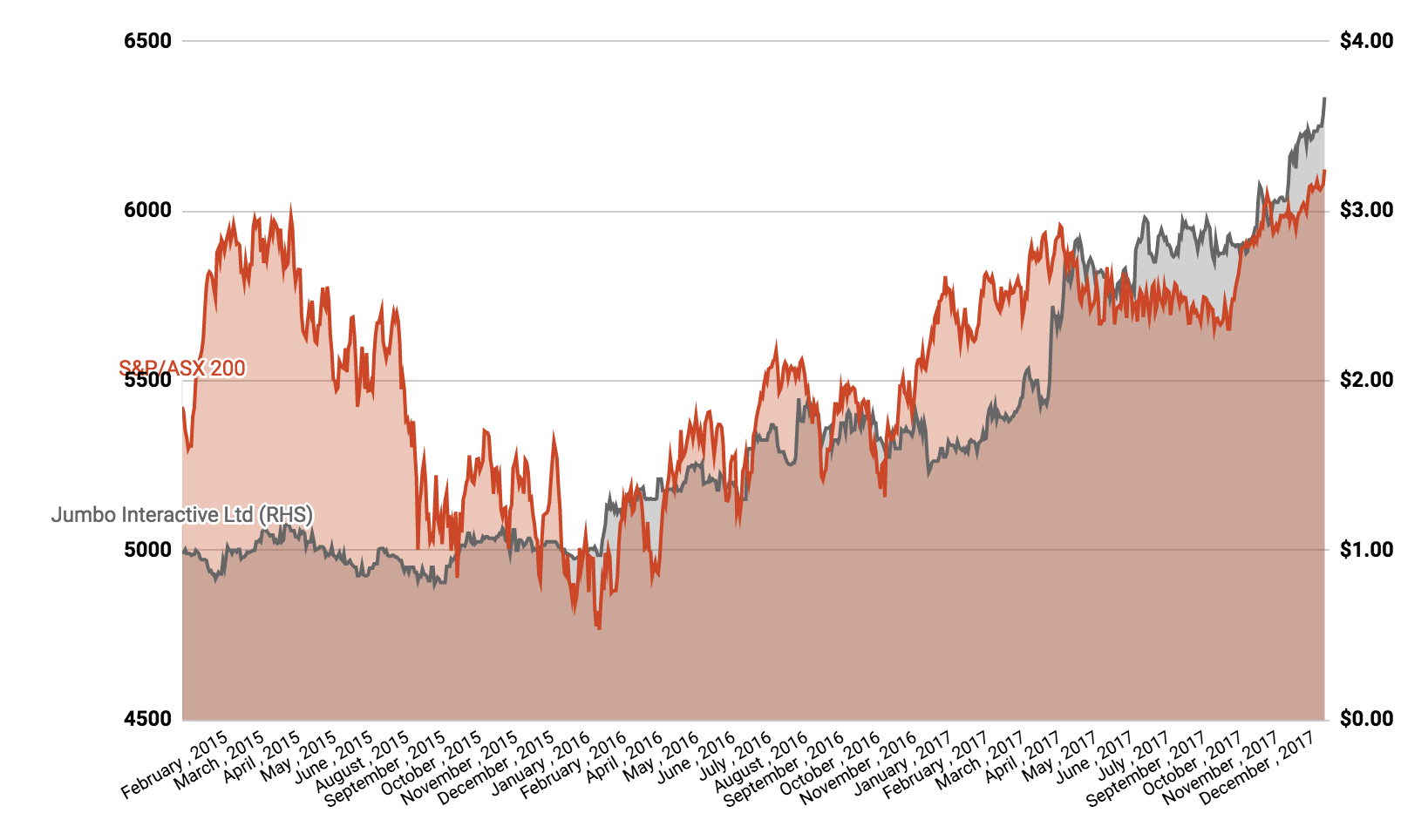

Jumbo Interactive Share Price

Despite a competitive landscape, which includes the likes of Tabcorp Holdings Limited (ASX: TAH) and other gambling companies, Jumbo posted a profit of $7.6 million last financial year.

Trading Update

This morning, Jumbo released a half-year trading update to ASX investors showing a 28% increase in transactions for the period, taking the total to $89 million. The company cited a favourable run of large jackpots, increasing engagement with existing and new customers, for a reason behind an increase in forecast profit.

The company now expects to report revenue of $19.2 million, up 20%, and profit of $5 million, up 43% on the half-year period from 2016.

“Performance is expected to exceed even the December 2015 half year when 24 major jackpots occurred compared to 18 in the recent half,” CEO and Founder Mike Veverka said.

“It has been a good start to the second half for both the Company and its customers, with large jackpots kicking off the New Year.”

After hitting a share price low of less than 90 cents in 2015, Jumbo shares have rallied more than 300% to trade at $3.90 today.

Other notable companies in the Australian gaming industry include Crown Resorts Ltd (ASX: CWN), Ainsworth Game Technology Limited (ASX: AGI) and Star Entertainment Group Ltd (ASX: SGR).