Shares in explosives and chemicals business, Incitec Pivot Ltd (ASX: IPL), fell 3.5% today following a decision by Roy Hill Iron Ore not to proceed with its contract.

The $6 billion Incitec Pivot is the world’s second-largest explosives maker and a key supplier to many of Australia’s largest mining companies.

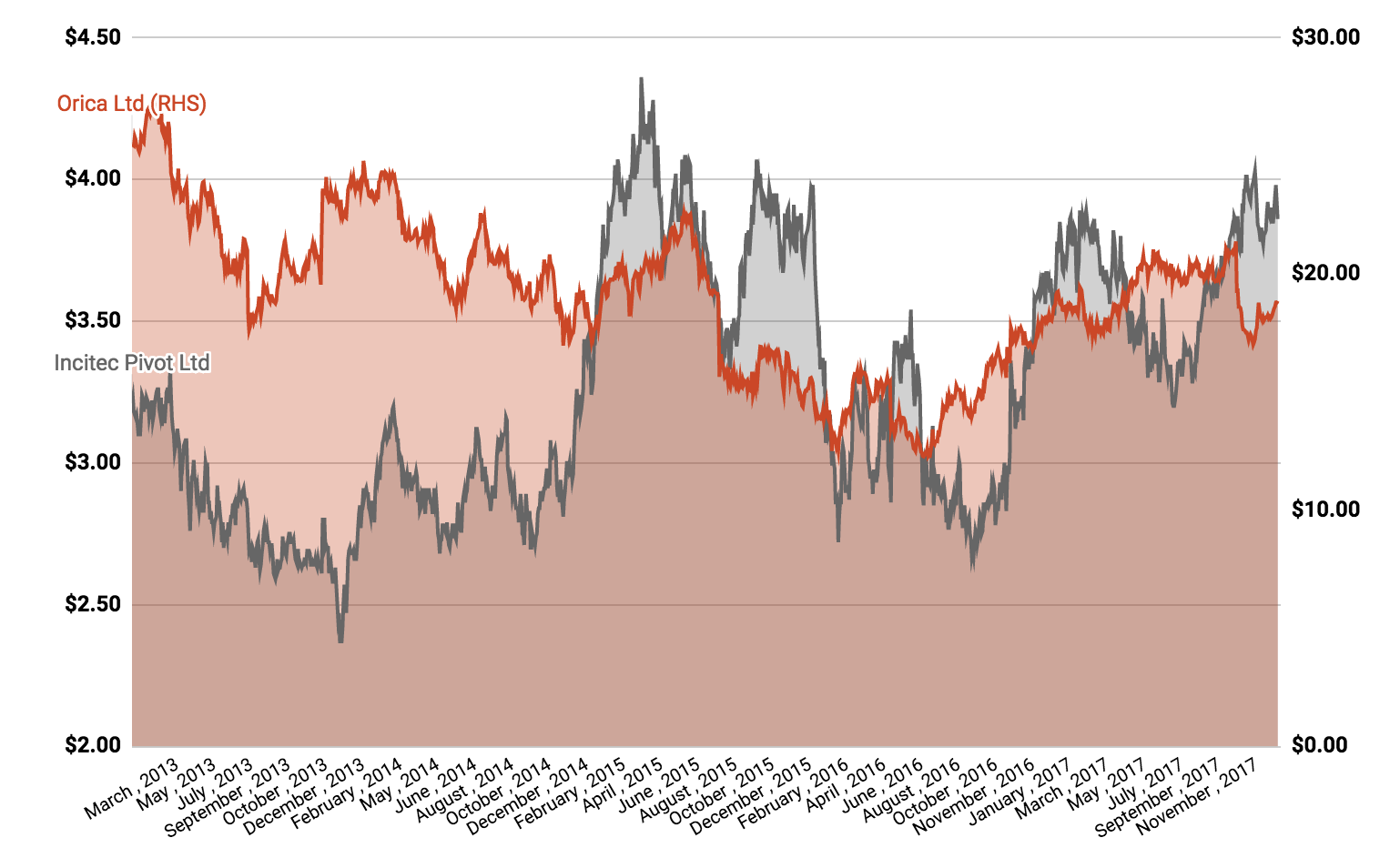

Incitec Pivot

Earlier today, Incitec announced that Roy Hill Iron Ore would cease its contract for explosives and services from February 9th.

The impact of the decision will cost the company about $5 million of profit in its 2018 financial year, increasing up to $20 million per year by 2022 before falling away.

However, Incitec says it may be able to counter some of the effects of the contract loss. The “impacts may be able to be mitigated to some extent by new commercial arrangements,” the company said.

The contract loss with Roy Hill follows a similar loss of contracts with BHP Billiton Limited (ASX: BHP) in December. Although BHP’s contract will not cease until 2019, it’s estimated to cost the company about $10 million in 2020 and $25 million in 2021.

Before the contract losses, analysts had forecast the company to make a profit of $443 million in 2020, according to Reuters.

Keep Reading