The Bitcoin (BTC) price joined Ethereum (ETH) and Ripple (XRP) in free fall this week, as China and South Korea toyed with the idea of banning cryptocurrencies.

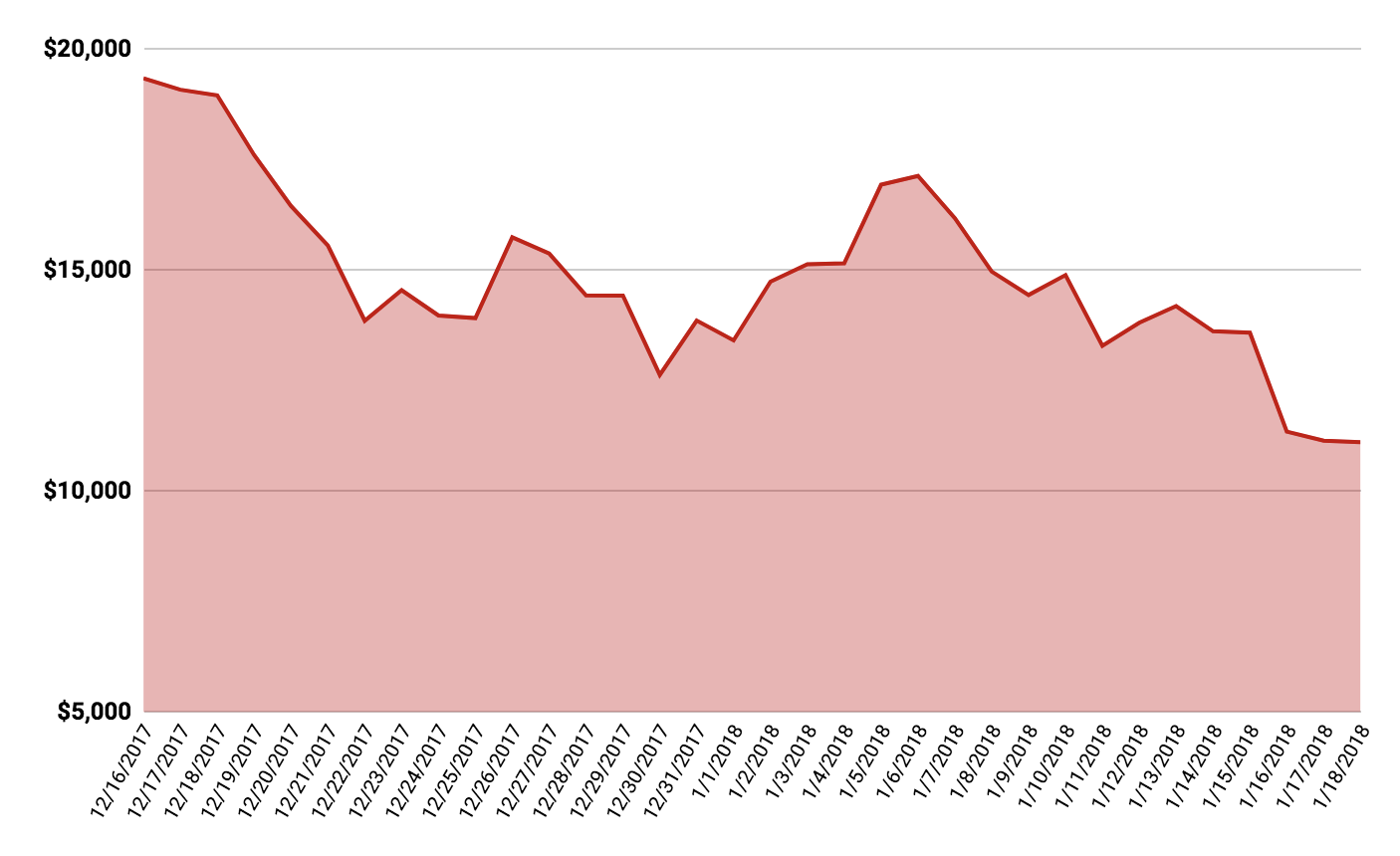

Bitcoin Price Chart

As can be seen above, the Bitcoin price has fallen from over $US19,000 to around $US 11,000 in one month, according to Coindesk.

“Don’t Worry, It’s Just a Ripple”

Similarly, Ripple and Ethereum have felt the pain of what’s being called the ‘Cryptopocalypse’.

Ripple, the market darling over Christmas, has fallen from $US3.69 per ‘token’ to $US1.33, according to Coinmarketcap. That’s a decline of 64%!

The total value of all Ripple tokens has fallen nearly $US 90 billion and the net worth of Ripple’s Co-Founder, Chris Larsen, has fallen more than $44 billion, according to CNBC.

Read: “Crypto: Is Ripple the New Bitcoin?“

Ethereum, a ‘currency’ which traders have used to buy ‘virtual cats’ (images of cats, or “Crypto Kitties”) fell from $US1,377 to $995 this week.

Me-ouch!

What’s Going On?

Earlier this week, Bloomberg reported that South Korea and China are contemplating banning the trading of cryptocurrencies. China has already moved to block ‘initial coin offerings’ (ICOs), which are similar to company IPOs.

In 2017, The Australian reported that China believed people were using the anonymous crypto markets to funnel money outside of the country.

Commentators now suggest Beijing is trying to curb the rapidly inflating prices and speculation, or the government is concerned about the rising power bills caused by Bitcoin mining.

China is home to the world’s biggest community of Bitcoin miners, the computer networks which ‘discovery’ or ‘produce’ new Bitcoin.

Meanwhile, South Korea, the most active market for cryptocurrencies in the world, is also considering closing exchanges.

“South Korea’s chief of the Financial Services Commission said: “(The government) is considering both shutting down all local virtual currency exchanges or just the ones who have been violating the law,” Reuters reported.

Finally, the first wave of institutional grade futures contracts on Bitcoin expired overnight, potentially stoking the selling pressure in the world’s largest crypto market. The birth of Bitcoin futures contracts allowed big investors to bet on downwards prices in Bitcoin.

What the-back-to-future is a Bitcoin futures contract? Read more here.

Our Most Popular Stories:

- Will Mortgage Interest Rates Rise in 2018?

- Expert Analysis: Is Discovery Communications A Hidden Gem?

- The Bank Royal Commission Wants YOU (to tell your story)

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.