The GetSwift Ltd (ASX: GSW) share price will be in focus Monday morning when trading resumes following a scathing article in Fairfax Media Limited (ASX: FXJ) at the weekend.

GetSwift is a $500 million technology company which produces ‘last mile’ software to make deliveries more efficient. The GetSwift website reads:

“Simple software that streamlines your whole delivery business.”

The front men of GetSwift are Joel MacDonald, a former AFL player turn GetSwift managing director and tech multimillionaire, and Bane Hunter, “a global executive with over twenty years’ experience in media and financial services.”

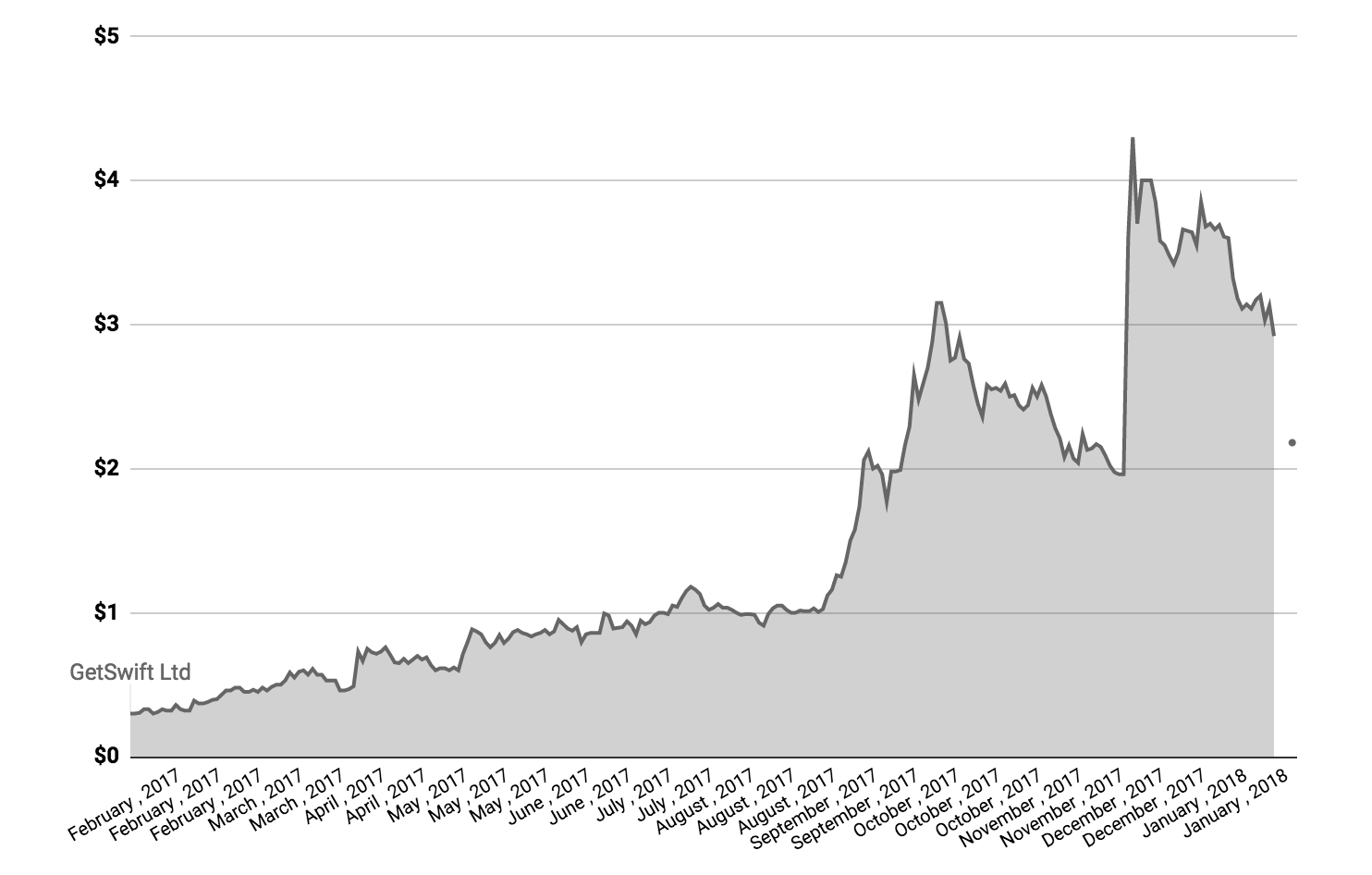

GetSwift shares listed on the ASX in 2016 at a price of 20 cents per share. But it has wasted no time rising higher, following seemingly promising market updates.

GSW Shares

Getswift shares are up 873% since it listed on the market, according to Google Finance. In December 2017, GetSwift raised $75 million by issuing new shares to large investors. It sold the new shares for $4 each.

GetSwift said, “The placement was over-subscribed and cornered by Fidelity International (FIL) who the Company is delighted to welcome to the register.”

In October, GetSwift said it, “is pleased to announce that it has exceeded 375,000 deliveries per month”. That’s approximately 4.5 million per year. In September 2017, GetSwift reported revenue of less than $1 million ($0.336 million).

Despite that, in recent times, GetSwift announced a string of seemingly large deals with the likes of Commonwealth Bank of Australia (ASX: CBA), Amazon, Yum!Brands, Fantastic Furniture and The Fruit Box Group.

WiseTech Global Ltd (ASX: WTC), another ASX-listed logistics software company which has a market value of $4 billion according to Morningstar data, has risen nearly 140% in that time. WiseTech’s software facilitated 44 billion transactions in 2017, according to its ASX filing. Wisetech reported revenue of $153.8 million in 2017.

Did GetSwift Tell Shareholders Everything?

Despite the meteoric rise of GetSwift shares, over the weekend, Fairfax Media’s AFR Weekend reported some potential inconsistencies with GetSwift’s deals.

“Fantastic Furniture and office delivery group The Fruit Box Company said they never used GetSwift’s last-mile logistics software after an initial trial, despite the company’s ASX announcements about multi-year deals with each,” Fairfax wrote.

ASX rules require companies to publicly disclose information that could have a material impact on the price of their shares. For example, if the substance of a previous market-sensitive announcement changes soon after the news was released.

In December, GetSwift announced a global deal with e-commerce giant Amazon.

“Due to the terms and conditions of the agreement and the highly sensitive nature, no further information will be provided by the company other than to comply with regulatory requirements for disclosure”, the ASX filing read.

The document was “market sensitive”.

Later that day, the ASX suspended trading in GetSwift shares, “pending the release of an announcement regarding further details in relation to the Company’s agreement with Amazon.”

GetSwift announced:

“The extent of the services to be provided and the revenues to be derived will be generated from specific transactions agreed with Amazon pursuant to the Master Services Agreement. Due to the terms of the agreement the number of deliveries this agreement may generate is currently not determinable.”

According to a report on its website, in 2017, some of GetSwift’s largest shareholders included Mr Hunter, Mr Macdonald and Regal Funds Management.

In response to the news, MacDonald had this to say on Twitter.

https://twitter.com/joelmac_/status/954386009218629632

Latest

Shares of GetSwift entered a trading halt on Monday, before the market’s open, following this request to the ASX.

“Pursuant to ASX Listing Rule 17.1, GetSwift Limited (ASX: GSW) (Getswift” or the “Company”) requests a trading halt in relation to articles published in the AFR and pending the company’s response.”

“The trading halt will remain in place until the earlier of the commencement of normal trading on Wednesday 24 January 2018, or until the release of the announcement in respect of the above matter.”

Wednesday 24th of January: Shares of GetSwift enter a voluntary suspension.

Thursday 25th of January: GetSwift responds, ASX extends GetSwift Suspension

Keep reading:

- ASX Continues GetSwift Suspension

- The Path To Financial Freedom

- Expert: Is Discovery Communications An Opportunity?

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.