Shares of insurance giant QBE Insurance Group Ltd (ASX: QBE) slumped 5% on Tuesday following a trading update and profit downgrade.

A $14 billion company, QBE is a household name in Australia for general insurances like home, contents and car protection. It also has a sprawling international business.

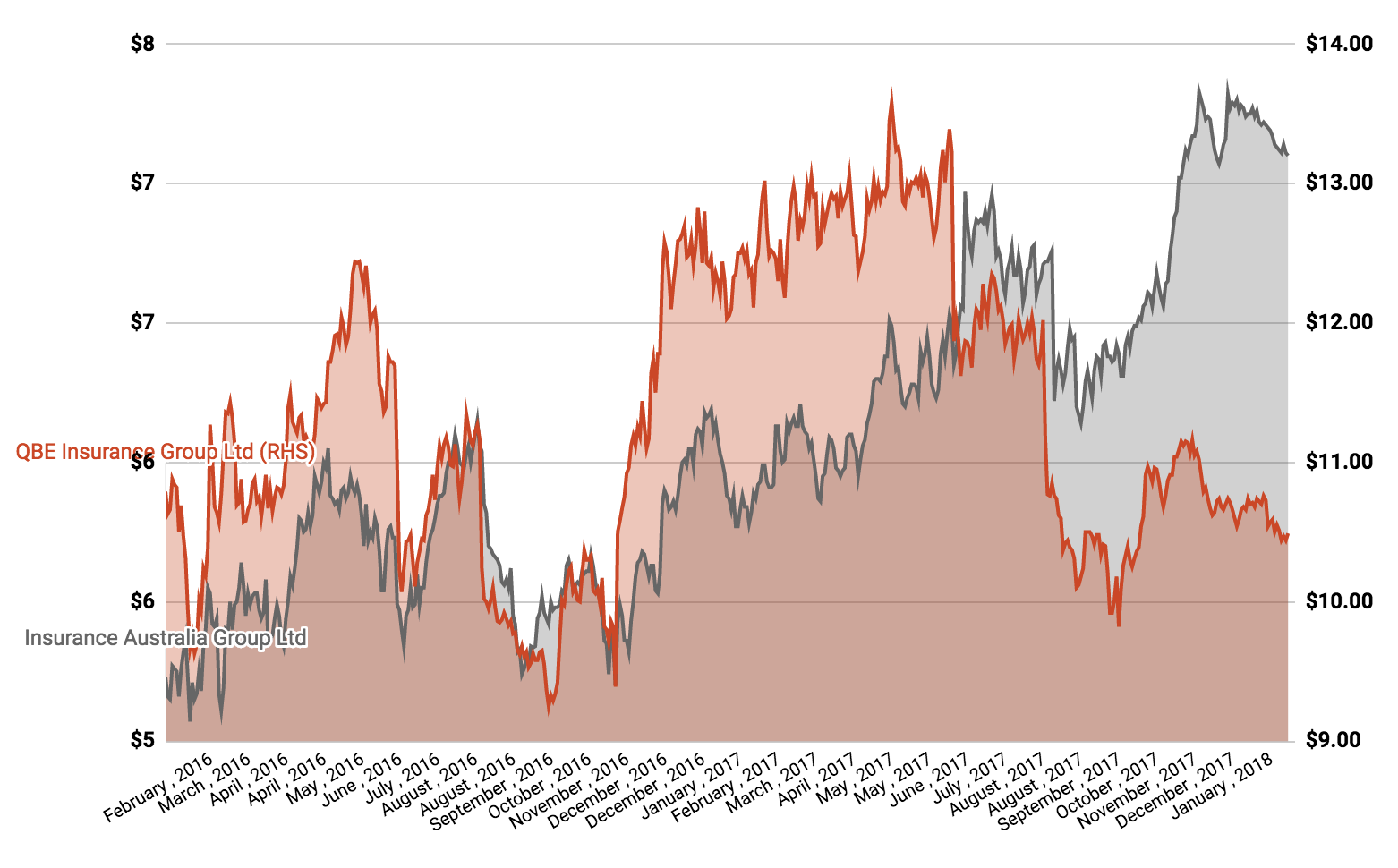

QBE Shares

QBE’s Trading Update

This morning, QBE filed a trading update with the ASX ahead of its formal 2017 financial results, which are due to be released on February 26th.

The insurer said its combined operating ratio (COR) will be 104%, above the targeted range of 100% to 102%. The combined operating ratio measures how much money an insurer pays out (for claims, commissions, expenses etc.) versus how much money it receives for selling insurance cover.

According to the QBE website, a combined operating ratio below 100% means an insurer is making an insurance profit.

QBE said weather events such as California’s wildfires, storms in Australia, and Hurricane Maria; a detailed review of claims; and other smaller items contributed to a poor result.

In addition, “two significant one-off” items will tip QBE’s 2017 financial year result into a loss of $1.2 billion. That compares to a profit of $1.16 billion a year earlier, according to Morningstar data.

“This has been a challenging year for QBE, reflecting an unprecedented cost of catastrophes as well as the particularly disappointing deterioration in our emerging markets businesses,” CEO Pat Regan said.

“Over the last few months, I have been conducting a detailed review of our operations. We have some businesses with strong market positions that are performing well but we also have businesses that are underperforming.”

Fortunately, the outlook for its 2018 financial year is more upbeat. QBE is targeting a combined operating ratio of 95% to 97.5% and a return from investments of 2.5% to 3%.

QBE is conducting a strategic review of its Latin American operations in a bid to simplify its business and reduce risk, Mr Regan said. “I will give you more detail on these plans in conjunction with the release of our FY17 result detail on 26 February 2018.”

“The Board will consider the quantum of the final dividend and buy-back expectations in conjunction with the finalisation of the FY17 results on 26 February 2018,” QBE added.

QBE Insurance shares were trading 4.96% lower at $9.97 Tuesday morning.

Our Most Popular Stories:

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.