The Yancoal Australia Ltd (ASX: YAL) share price jumped 3% on Monday following a bumper quarterly production report.

Yancoal is Australia’s largest pure-coal producer, with operations in NSW, Queensland and Western Australia. It is majority owned by Yanzhou Coal Mining Company (65.46%) and Cinda International HGB Investments (16.7%).

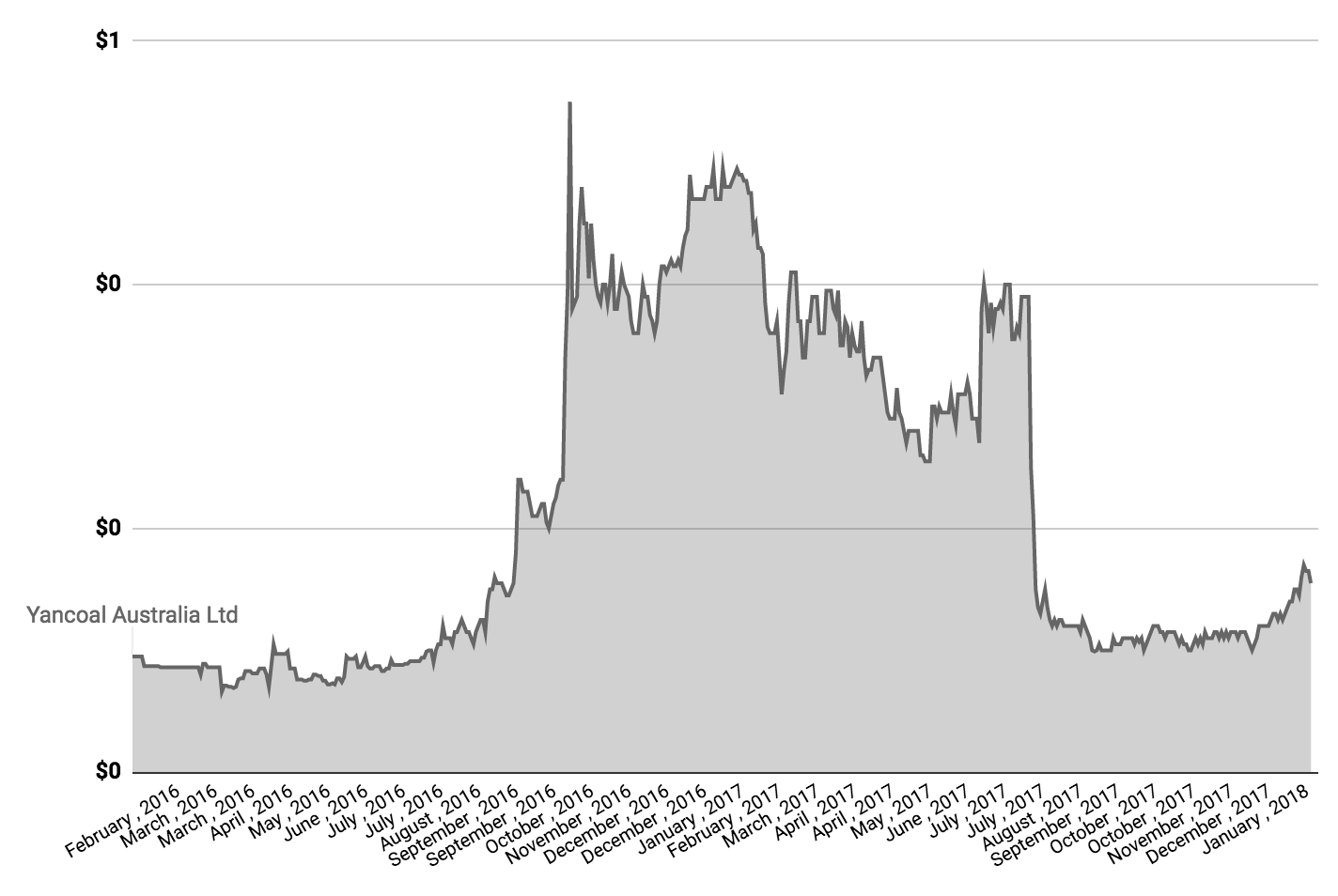

Yancoal Shares

On Friday evening after the ASX’s close, Yancoal released its quarterly report to investors.

Here are some of the key stats:

- 8.65 million tonnes of saleable coal produced, up 92% on the prior year

- Quarterly sales of 11.3 million tonnes, up 83%

- Commenced longwall production at the Moolarben underground mine

According to a recent management presentation, Yancoal and its partners have more coal in reserve than Whitehaven Coal Ltd (ASX: WHC) and New Hope Group (ASX: NHC). It’s third only to BHP Billiton Limited (ASX: BHP) and Glencore.

In December, Yancoal announced plans to boost coal production to between 20 and 30 million tonnes and will consider making debt repayments and dividends.

Yancoal shares closed up 3% at $0.16 on Monday.

Our Most Popular Stories:

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.