Shares of Netflix, Inc. (NASDAQ: NFLX) are tipped to jump on Tuesday when US trade reopens following yet another strong quarter from the world’s leading online streaming service.

Netflix

Netflix is the world’s leading online movie streaming service, with around 118 million total subscribers throughout the United States and internationally.

Netflix described the fourth quarter of its 2017 financial year as “beautiful”. In 2017, streaming revenue grew 36% to $11 billion and the company added a further 24 million new memberships.

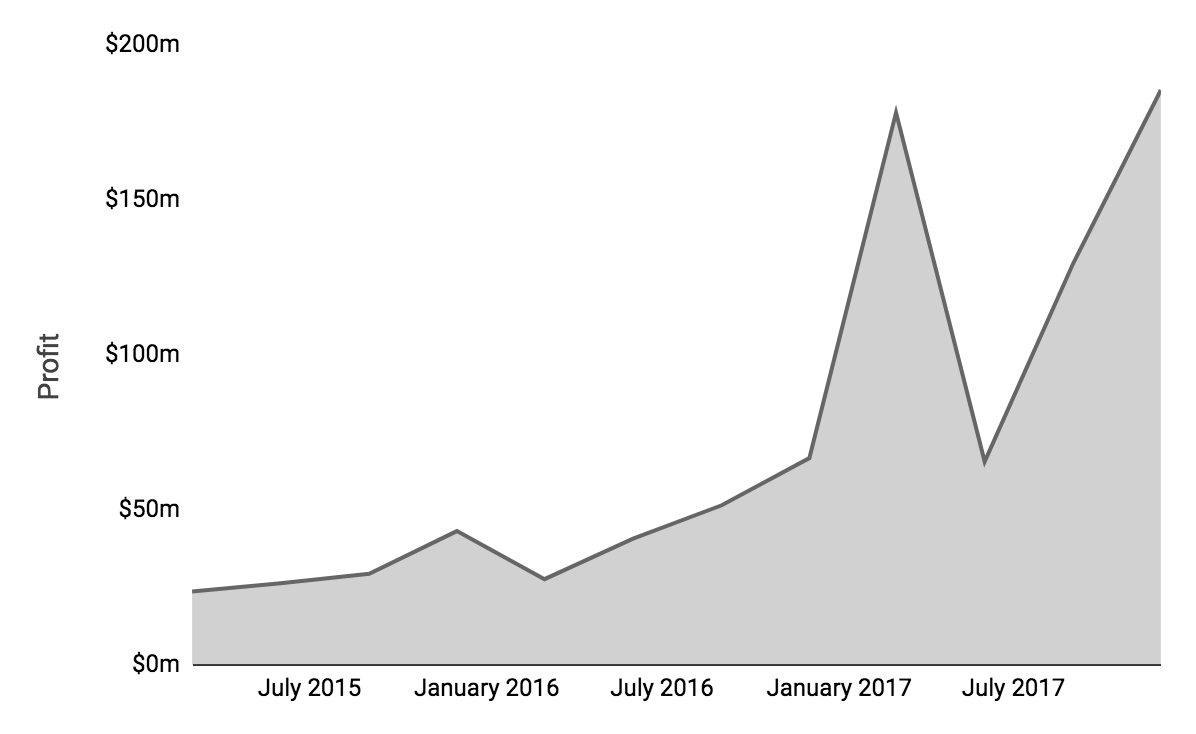

Netflix posted a net profit of $186 million during the quarter, its highest yet. Diluted profit per share was $0.41 with Netflix’s management setting next quarter’s guidance at an impressive $0.63 — 51% higher.

Netflix Quarterly Profit

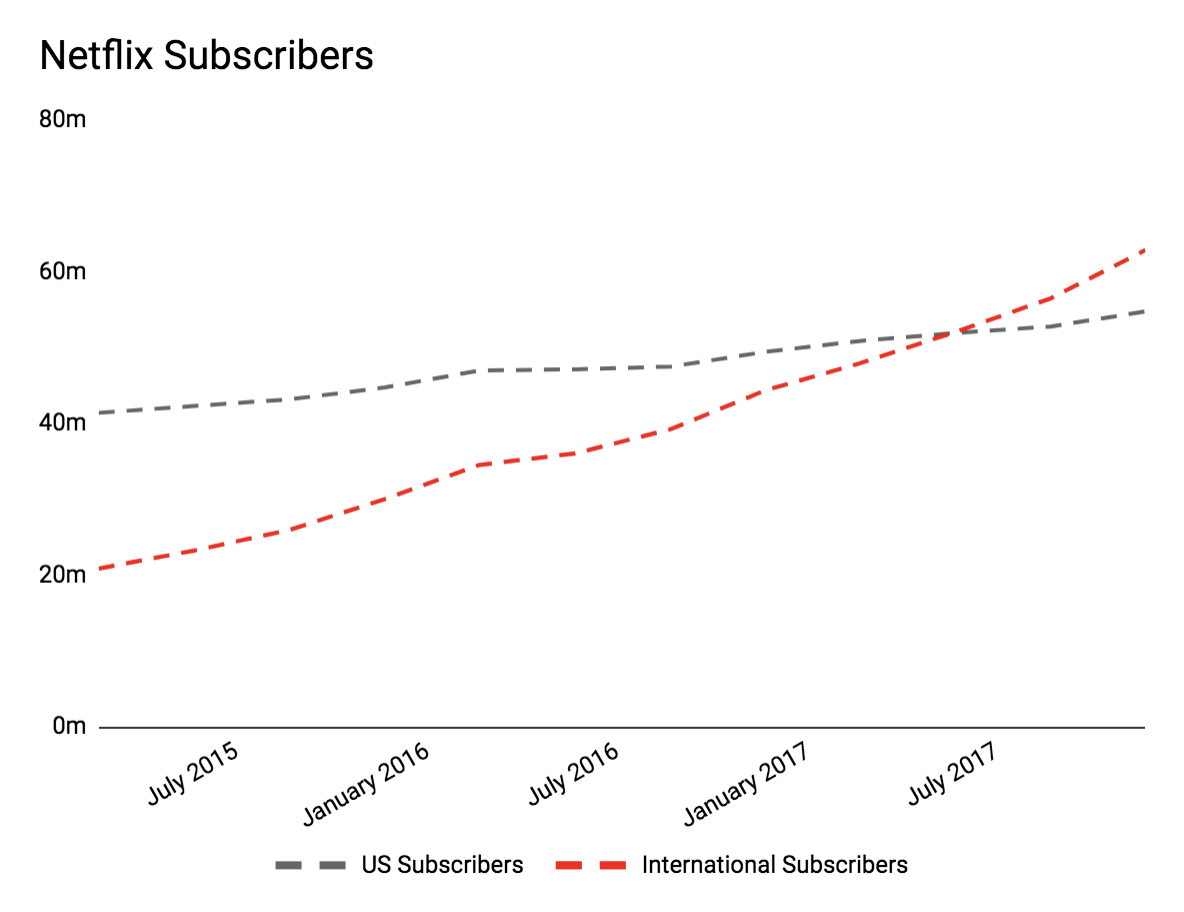

Netflix’s total number of International Streaming memberships now exceeds that of its domestic US memberships. However, 2017 was the first year that the International business returned a positive contribution profit for the tech company.

“our primary profit metric is operating margin and we are targeting a full year 2018 target of 10%, up about 300 basis points year over year, as in the prior year,” Netflix noted. “We believe our big investments in content are paying off.”

Titles such as 13 Reasons Why, Stranger Things and Bright were Netflix’s key success stories last year. On the back of their performance, Netflix will be increasing its marketing spend from $1.3 billion to $2 billion, “because our testing results indicate this is wise,” it said.

“We want great content, and we want the budget to make the hits we have really big, to drive our membership growth.”

Netflix had three of the top five most searched TV shows internationally for the second-straight year. Netflix’s punt on higher budget self-produced series, in particular, is paying dividends both in terms of viewership and the bottom line. Bright, starring Will Smith, is Netflix’s most expensive production thus far.

“In its first month, Bright has become one of our most viewed original titles ever.”

Despite its success, Netflix knows it is not alone with Amazon.com Inc (NASDAQ: AMZN) and Apple Inc (NASDAQ: AAPL) nipping at its heels.

“On the commercial-free tech side, Amazon Studios is likely to bring in a strong new leader given their large content budgets, and Apple is growing its programming, which we presume will either be bundled with Apple Music or with iOS.” The software ecosystems and value proposition of Amazon and Apple have proven to be formidable forces.

Then there’s Google’s (NASDAQ: GOOGL) YouTube and Facebook Inc’s (NASDAQ: FB) push into ad-free video content.

“With their multi-billion global audiences, free ad-supported internet video is a big force in the market for entertainment time, as well as a great advertising vehicle for Netflix,” Netflix noted.

Finally, Netflix took the opportunity to announce the appointment of Rodolphe Belmer to its board of directors. Mr Belmer is the former CEO of Canal+ Group and CEO of Eutelsat.

Our Most Popular Stories:

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.