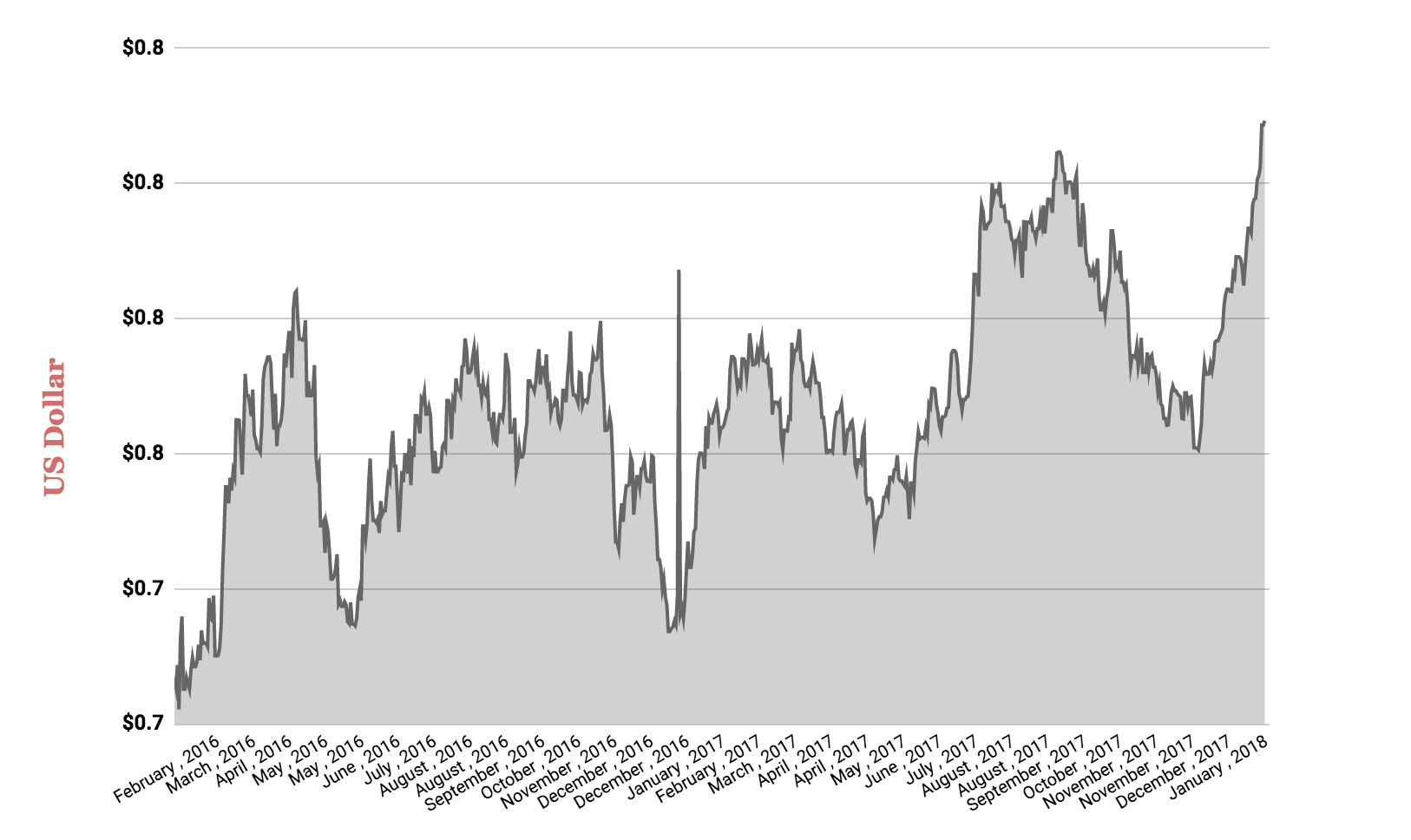

In less than two months the Australian Dollar (A$) (AUDUSD) has risen from 75 US cents to nearly 81 US cents. The Aussie Dollar’s rise has baffled some experts.

Aussie Dollar Rises

What’s Going On With the Australian Dollar?

According to Paresh Upadhyaya from Amundi Pioneer, the Australian Dollar faces three key headwinds: falling iron ore prices, slowing growth in China and widening interest rates.

Iron ore

Along with many other resource-focused countries, rises and falls in commodity prices can have a large impact on Australia’s trade and economic growth.

Overnight, iron ore prices closed down 0.9% to $US74.40 a tonne, according to IG Markets. Iron ore is one of Australia’s major export commodities and a key driver of the West Australian economy.

Earlier this month, iron ore hit fresh six month highs as investors grew positive about the short-term market environment.

Shares of BHP Billiton Limited (ASX: BHP) and Rio Tinto Limited (ASX: RIO) also enjoyed the price rise of major commodities such as oil, copper and coal.

According to indexmundi.com, the commodity metals index, which includes copper, aluminium, tin and iron ore (amongst other things), was up 18% in the second half of 2017.

“…in the medium term, the Australian economy does not welcome a stronger Australian dollar,” James Athey of Aberdeen Standard Investments was reported as saying on Bloomberg. “Plus, I expect commodity prices to moderate.”

China

According to Forbes, China could stand to lose its ’emerging market’ tagline as its economic growth continues to moderate. “China’s growth rate is slowing, for sure, but the official statistics overstate real growth,” Forbes contributor Sara Hsu recently wrote.

According to Trading Economics, the Asian super economy’s official rate of growth has slowed from over 12% in 2010 to below 7%. The economy has grown immensely over this period.

Interest Rates

Australian interest rates are being tipped to rise by some economists. However, few economists expect Australia’s RBA to act quickly given the recent signs of a slowing local property market.

Nevertheless, in the US, the Federal Reserve’s interest rates are already on the rise. Compared to Australian markets, North America could become more appealing to large institutional investors, such as those who invest in bond markets.

“When we last produced our forecasts in mid-December we expected that the Federal Funds rate would be increased by 25 basis points in June and December in 2018 to reach 1.875% by year’s end,” Westpac Banking Corp (ASX: WBC) Chief Economist Bill Evans said.

Mr Evans expects the difference between US and Australian interest rates will have a downwards effect on the Aussie dollar (AUD).

“Associated with that higher Federal Funds rate would be a rising bond rate and rising US dollar with targets of a rise of around 5.5% in the USD Index (DXY) and an increase in the US 10 year bond rate to 3% from 2.35% at the time,” Mr Evans wrote. “Associated with that expected increase in the USD; an expected fall in Australia’s Commodity Price Index of around 20%; and a deteriorating yield differential as the RBA remains on hold in 2018 we expected a fall in the AUD from around USD 0.765 to USD 0.70.”

That’s finance for: the Australian dollar was expected to fall to 70 US cents, according to Westpac.

“However with the starting point much higher (USD0.807 vs USD 0.765) our revised target for AUD/USD by end 2018 is now USD 0.72.”

Mr Evans expects the USA’s Federal Reserve to increase interest rates three times in 2018.

A word of warning about financial forecasts: identifying and predicting the measures which cause short-term movements in currencies is very difficult — some say it’s impossible. Therefore, Rask Media believes it is important to read widely before forming a view of economic events.

Join Our Free Investor’s Club Newsletter

You can join our FREE investor’s club newsletter today for all of his latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

- 75% of Big Bank Financial Planners Failed Best Interest Duty

- S&P/ASX 200 Tipped To Open higher

- The Bank Royal Commission Wants YOU

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.