Shares of the $1 billion debt collection and financial services business, Credit Corp Group Limited (ASX: CCP), fell 8% on Tuesday following the release of its half-year financial results.

Credit Corp is a debt collection and lending business with operations in Australia, New Zealand and the USA.

Debt collection companies will buy a customer’s debt from the likes of utilities, banks or telecommunications businesses for cents in the dollar and hope to recover them for more than they paid to purchase the debt.

This morning, Credit Corp reported the following results for its half-year to 31 December 2017:

- Net profit up 18%

- Australia/NZ lending business on track for 30% earnings growth

- US debt buying is profitable and set to achieve a full-year turnaround of up to $3 million

- Solid core Australian/NZ debt buying

“It is pleasing that close to 30 per cent of earnings in 2018 will be derived from the lending and US debt purchasing businesses we have established from scratch over the last five years,” Credit Corp CEO Thomas Beregi said.

“To grow collections with significantly reduced purchasing demonstrates the strength and sustainability of our collection operation, in particular, the merit of our emphasis on building and maintaining a large bank of recurring payment arrangements.”

Credit Corp grew its 2018 contracted debt ledger pipeline from $75 million to $190 million. However, Mr Beregi said it is a competitive market. “Competitors continue to enjoy access to debt and equity capital to support increased investment,” he noted.

Shares of one of Credit Corp’s rivals, Collection House Limited (ASX: CLH), have failed to recover to their peak of $2.39, which it achieved in 2015, and currently, trade at $1.30.

Looking ahead, Credit Corp confirmed its 2018 profit growth guidance of between 12% and 16%.

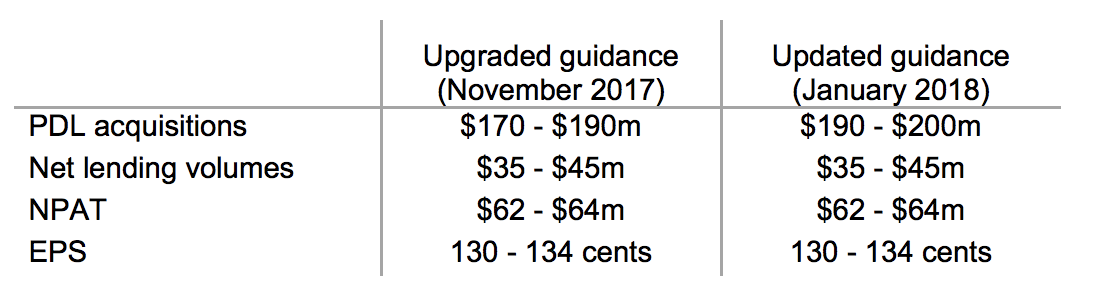

However, it said, “The increased Purchased Debt Ledger (PDL) purchasing pipeline of $190 million has necessitated a revision of the 2018 PDL investment guidance.”

Shares of Credit Corp closed 8% lower at $21.77 on Tuesday.

Want To Join An Investor’s Club Newsletter?

You can join Rask’s FREE investor’s club newsletter today for all of the latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.