Shares of New Zealand’s XERO FPO (ASX: XRO) jumped 7% on Thursday as National Australia Bank Ltd. (ASX: NAB) embraces the software company’s accounting platform.

Xero is a $4.3 billion Kiwi tech heavyweight specialising in software for accountants. Clients, which include small business owners, accountants and bookkeepers, can access Xero’s “beautiful accounting software” from almost any device because it is hosted in the cloud.

In 2014 and 2015, Xero was ranked #1 by Forbes as the world’s most innovative growth company.

Xero has 1.2 million subscribers.

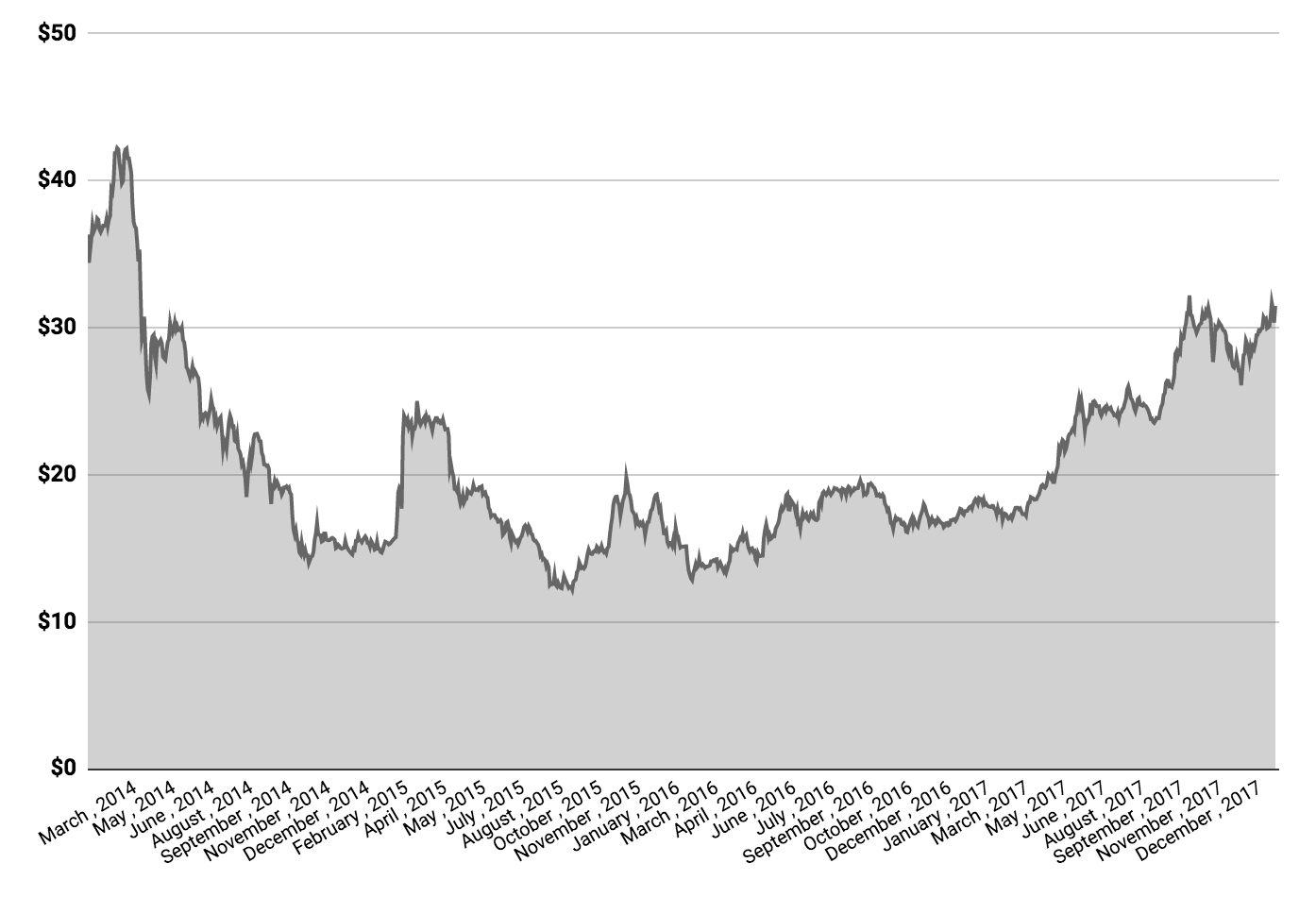

Xero Share Price

Despite having a number of strategic investors in the USA and being run from Wellington, New Zealand, Xero is transiting to a sole listing on Australia’s ASX.

Xero Teams Up With National Australia Bank

In recent years, Australia’s major banks have attempted to embrace technology and innovation in a bid to lower costs and keep a competitive edge.

Following NAB’s alliance with REA Group Ltd’s (ASX: REA) realestate.com.au, Fairfax Media is reporting that Xero and NAB have moved to enhance their integration.

NAB customers using Xero will be able to make payments within Xero rather than using its online banking.

“I think we will look back one day and say ‘I can’t believe we used to take payment information from our desktop and import it manually into banking software’,” Xero Australia’s Managing Director, Trent Innes, said.

In exchange for the ability to transact through Xero, the deal will enable NAB to assess the banking needs of Xero’s customers.

“If the NAB customer is operating in the Xero ecosystem and we can provide value to that customer by making it easier for them, I can’t see why you wouldn’t do that,” NAB’s Jonathan Davey said. “We are taking some of the data that currently only exists in Xero and providing a dashboard in our internet banking channel.”

While some investors have alluded to potential branding risks associated with the banks opening their doors to third-party software, Australia’s banks are also keeping a watchful eye on the rise of ‘fintech’ solutions and potential disruption by large offshore companies. Apple’s Pay, Google’s Android Pay, Amazon, Alibaba and many other tech giants are making inroads for the banking sector.

In late 2016, REA Group announced its deal with NAB to offer its customers access to lending. “Customer preferences are changing and we must be prepared to adapt to the growing demand for digital services,” NAB’s Anthony Waldron said at the time.

Xero has experienced significant growth in its number of users over the past five years thanks to its international expansion, product enhancements and ease-of-use. It will be hoping that the deal with NAB is the first of many.

In November, Xero said it had more than 600 connected apps for businesses.

Want To Join An Investor’s Club Newsletter?

You can join Rask’s FREE investor’s club newsletter today for all of the latest analysis and education on investing. Join today – it doesn’t cost a thing.

Keep Reading

- The Best Investors Are Dead or Female

- Points of Reference & Investing

- Sirtex Shares Visit The International Space Station

Disclaimer: This article contains general information only. It is no substitute for licenced financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use

and Privacy Policy.