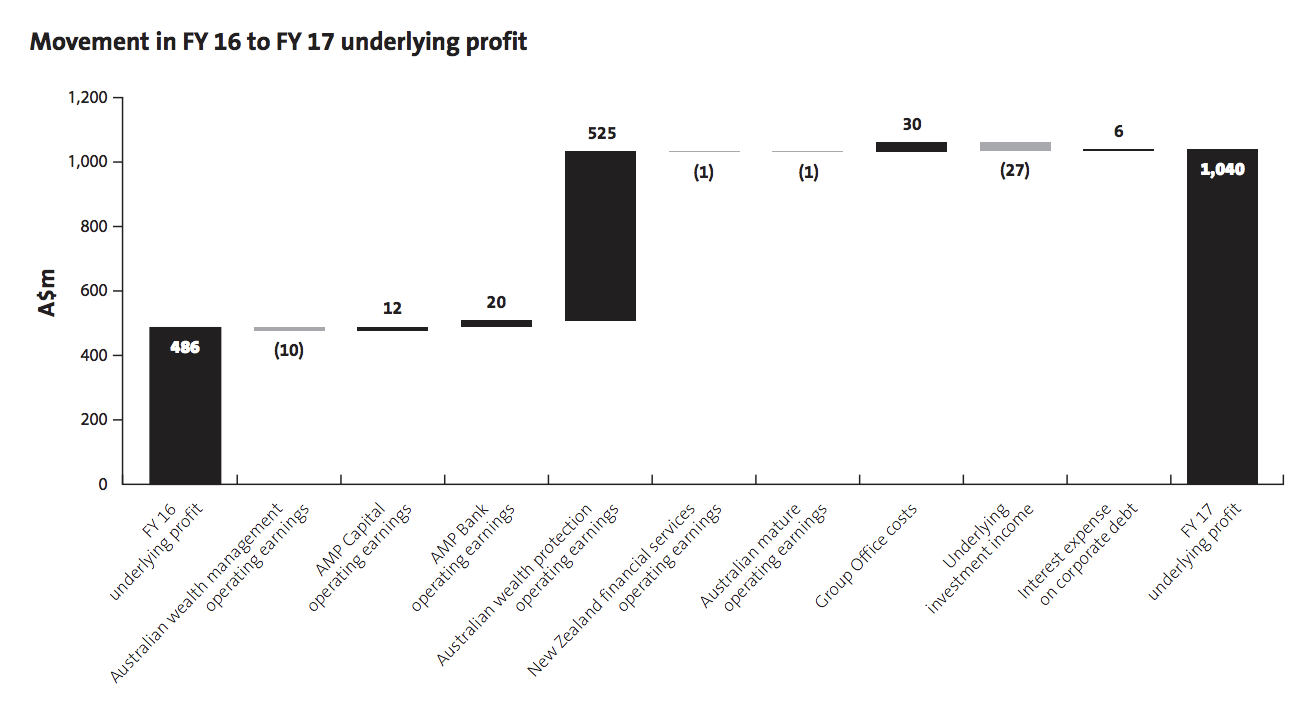

On Thursday, AMP Limited (ASX: AMP) released its 2017 annual results to the ASX, revealing a 347% rise in statutory profit and 114% on an underlying basis.

AMP is the $14.7 billion wealth management business best known for its financial advice network. AMP is divided into six various financial businesses, ranging from Australian wealth management to banking and insurance.

This morning, AMP released its annual report to the ASX. Here are some financial highlights from AMP’s announcement:

- Revenue of $18.4 billion, up 24% compared to a year earlier

- Profit of $848 million, up 347%

- Underlying profit up 114%

- A final dividend of 14.5 cents per share, payable March 28

According to its ASX filing, AMP’s largest unit by profit is its Australian Wealth Management business. It reported a profit of $391 million for the half, compared to $401 million last year. AMP said the fall in profit was a result of lower fees earned inside Superannuation, as Australians transition to MySuper products, as well as a reset in fee agreements with AMP Capital.

AMP Capital, which provides investment management services, upped its profit to $156 million, from $144 million. Money flowing into AMP Capital was driven by demand for fixed income (a.k.a. bonds), infrastructure and real estate asset classes.

AMP Australian Wealth Protection reported a profit of $110 million, up from a $415 million loss a year earlier.

“AMP is positioned to take advantage of positive long-term demographic and market trends, operating in large and growing markets where competition is rational and where AMP has a distinct competitive advantage.” – AMP

AMP said it is focused on four distinct strategies going forward, including:

- Tilting investment towards its higher growth businesses

- Making the business more customer-centric

- Managing costs, and

- Expanding internationally

“AMP is expanding internationally, primarily through AMP Capital, in high-growth regions where its expertise and capabilities are in demand.”

AMP has built partnerships with companies in China and Japan, where there is high demand for its investment and wealth management expertise.

Looking ahead, AMP is targeting a dividend payout ratio between 70% and 90% of underlying profit.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licenced financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.