Commonwealth Bank of Australia (ASX: CBA) shares went floppy on Wednesday following the release of its half-year results.

Here are the key highlights from Commonwealth Bank of Australia’s half-year report (compared to the same period from a year earlier):

- Revenue up 2% to $21.3 billion

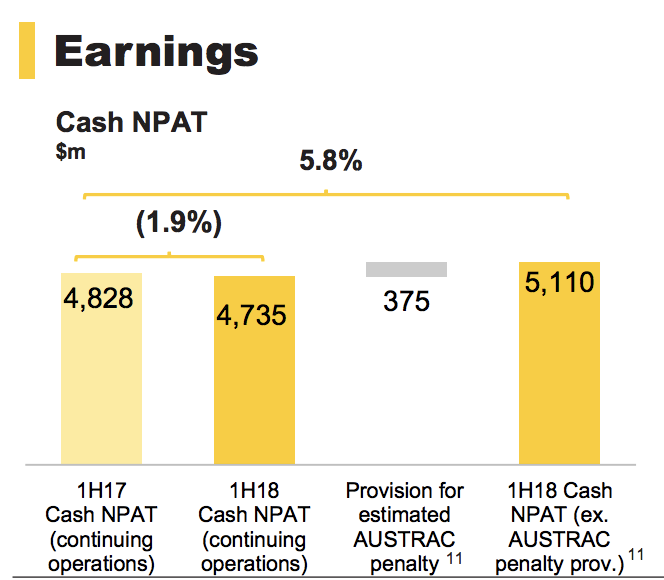

- Profit flat at $4.9 billion (cash profit of $4.7 billion, down 2%)

- A dividend of 200 cents per share, up one cent

- Net interest margin (NIM) of 2.16%

- APRA Capital ratio of 10.4%, up 0.5%

- A $375 million provision was incurred in relation to money laundering allegations

- A $200 million provision for the Royal Commission

Outgoing Commonwealth Bank of Australia CEO, Ian Narev, said the bank spent much of half focusing on fixing its mistakes.

“During this period, we have focused a great deal of effort on fixing our mistakes, and becoming a better bank,” Narev said. “The pride and dedication of our people have also enabled continuing business momentum across CBA.”

During the half, allegations of money laundering conducted through Commonwealth Bank of Australia ATMs caught the attention of the media following a report from AUSTRAC. In addition, Commonwealth Bank of Australia has been caught up in scandals involving poor financial advice and market manipulation and a Royal Commission into the financial system.

“We have taken a significant provision for regulatory and compliance costs, consistent with accounting standards,” Narev noted.

“We have also taken a $375 million expense provision which we believe to be a reliable estimate of the civil penalty a Court may impose in the AUSTRAC proceedings. We recognise, and regret, that these costs arise from our failure to meet some standards that we should have. We will continue to work hard to do better.”

Adjusting for the provision for money laundering, Commonwealth Bank of Australia, Australia’s largest company by market capitalisation, said its ‘underlying cash’ profit would have been up 5.8%.

“…we have been able to increase our dividend, even whilst providing for these costs, and strengthening all aspects of our balance sheet so that we can support customers and deliver returns for our shareholders into the future,” Narev said.

Commonwealth Bank of Australia’s Net Interest Margin (“NIM”) rose 0.06% to 2.16%. A bank’s NIM represents the difference between what it costs a bank to borrow money (e.g. from depositors) and what it collects for its loans (e.g. mortgages).

Commonwealth Bank of Australia improved its NIM and its APRA capital ratio, which rose to 10.4%. The bank will pay a dividend of $2 per share on March 28th, 2018.

“Global growth trends are positive overall,” Mr Narev commented. “However, market volatility remains a risk given ongoing global uncertainty as to the pace and extent of rate rises.”

He said the bank remains positive about the long-term outlook for the Australian economy, but it is wary of risks associated with slow wages growth, underemployment and job creation.

Under Narev’s leadership, Commonwealth Bank of Australia has transformed and enhanced its digital offering and presence online, a trend which is likely to continue under its new CEO, Matt Comyn.

“…we will continue to focus on the long term so we can serve and innovate for our customers, provide stable returns for our shareholders, support our community, and remain strong into the future,” Mr Narev concluded.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

- Key Highlights From Magellan’s HY Report

- The Best Investors Are Dead or Female

- Is Bitcoin Going To Zero?

Disclaimer: This article contains general information only. It is no substitute for licenced financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.