In Australia, it would be fair to say that a job most aspiring finance professionals and students dream of doing is working in the investment team of a funds management business. Specifically, working as an analyst in an active equity manager.

Should I do the CFA Institute’s Chartered Financial Analyst (CFA®) program or the Master’s of Applied Finance (MAppFin)?

That’s a question many would-be stock pickers ask themselves to improve their chances of landing one of these analyst roles offering $100,000, $200,000 or $300,000 per year.

Asking yourself these tough education questions is more important ever. In addition to regulation, the active investment management industry is under serious fee pressure from the ongoing transition to index funds and passive investments.

Should you undertake the world-renowned CFA® Program or try your hand with a Master’s of Applied Finance from a local university?

The CFA® Designation

Having been enrolled in the CFA® program I believe it will find new and demanding ways to challenge even the brightest and most experienced professionals and students. With three gruelling exams — levels 1, 2 and 3 — and a related work experience requirement, you can begin to see why it is the prestigious program.

According to the CFA® Program website, it is, “the most respected and recognised investment management designation in the world.”

Master’s of Applied Finance

The Master’s of Applied Finance or MAppFin, for short, is a post-graduate level course for finance professionals. I did mine through Kaplan Professional, the global online financial education specialist. Like the CFA®, many post-graduate finance courses are delivered online. There are pros and cons to that, of course. Convenience is the number-one factor for most time-strapped professionals. The quality of learning can be the biggest ‘con’, especially if you don’t have the motivation to get as much as possible from the online instructors.

However, many online courses have come a long way over the past few years. Online learning environments have gone from the equivalent of a part-time teacher using crayons to write course notes to senior lecturers and industry professionals using great software tools available in the cloud.

Personally, I find it hard to believe that an online learning environment will ever be as rich and fulfilling as that delivered in face-to-face classes (this, coming from the guy who creates free online finance courses).

But I did my two Master’s degrees through Kaplan because the standard of learning is high, it’s convenient and the case studies are very practical. For example, one of the units required us to do a proper spreadsheet valuation of an ASX-listed company — exactly the type of thing I wanted to learn. Kaplan also does the best notes for CFA exams.

One of the most highly regarded MAppFin’s that I have come across is the course provided by Macquarie University via Finsia. It’s a face-to-face program and might be ideal for those with work experience. The Master’s course takes a minimum of two years to complete.

One of the benefits of some postgraduate courses is the ability to articulate from lesser qualifications (e.g. Graduate Diploma) to the MAppFin over time. So, if you’re like me, you can start with a certificate which could be a good ‘proof of intent’ for some entry-level jobs, then you can slowly push along with one or two units at a time until you have the Master’s.

What the stats say

To make this assessment as objective as possible, the team at Rask Finance undertook a survey of leading active fund managers in Australia, which have Australian and/or international equities strategies. (note: if you’re a hardcore statistics junkie don’t bother sending us an email — we’ll be the first to admit that our survey was hardly scientific).

We took note of the undergraduate, postgraduate and other courses/designations held by analysts (graduate, research analyst, senior analyst, etc.) and portfolio managers.

Our survey included everyone in the investment team from a collection of major investment management companies. A “partial MAppFin” includes professionals who have graduated with at least a Graduate Diploma of Applied Finance.

Here’s what we found:

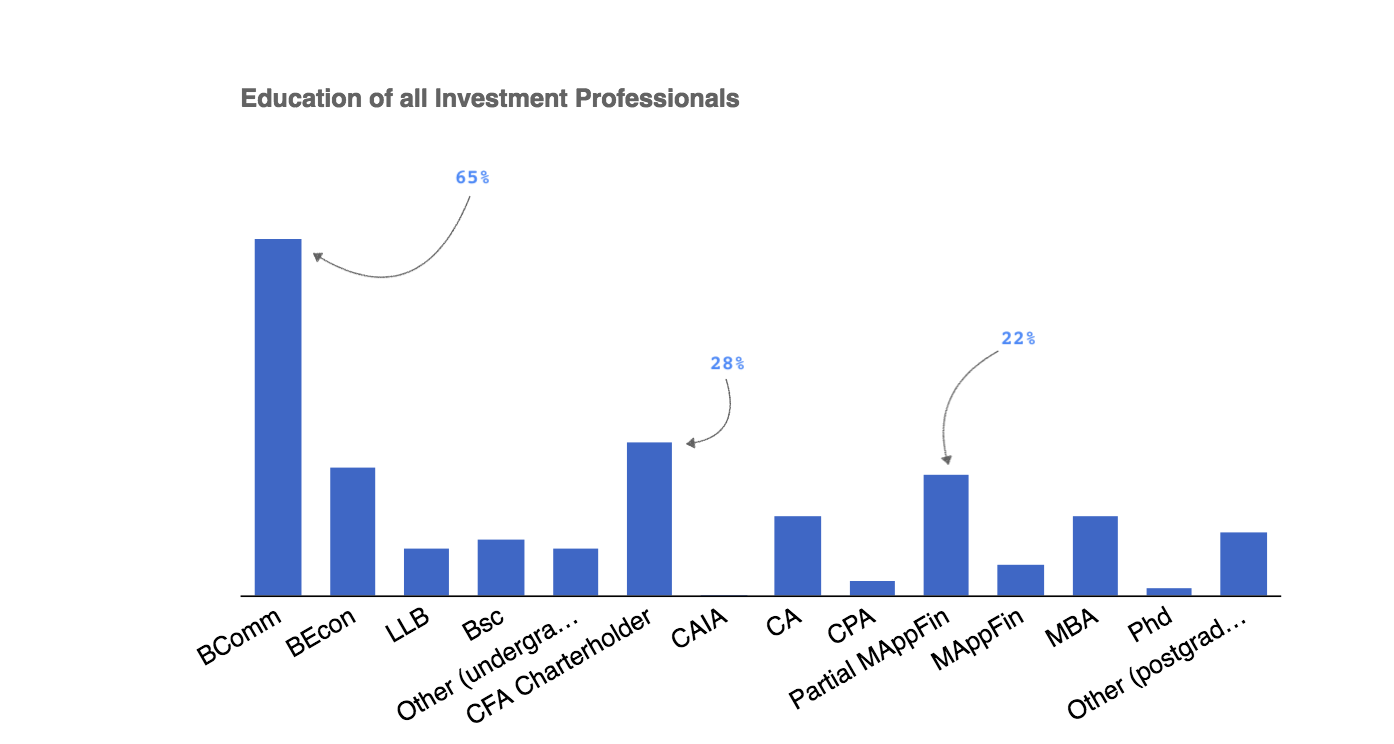

This graph shows the education of all professionals included in the anonymous examination.

For undergraduate degrees, the Bachelor of Commerce (BCom) is by far the most popular choice, with 65% of all professionals having completed the degree. Around 28% of individuals were CFA® Charterholders, 15% were Chartered Accountants (CA), 22% had a partial completion of the MAppFin, and 6% held the MAppFin.

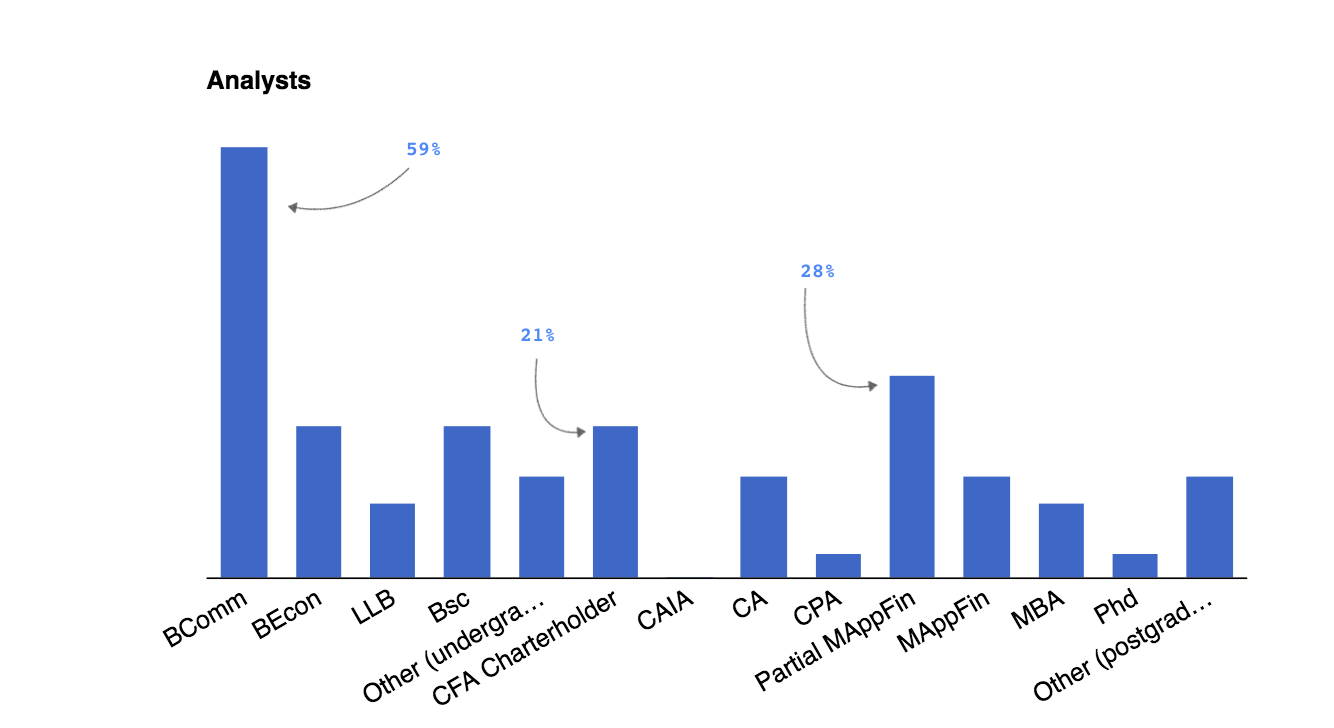

In the analyst community, 21% were CFA® Charterholders while 42% of professionals had either completed or were on their way (“Partial MAppFin”) to finishing the MAppFin.

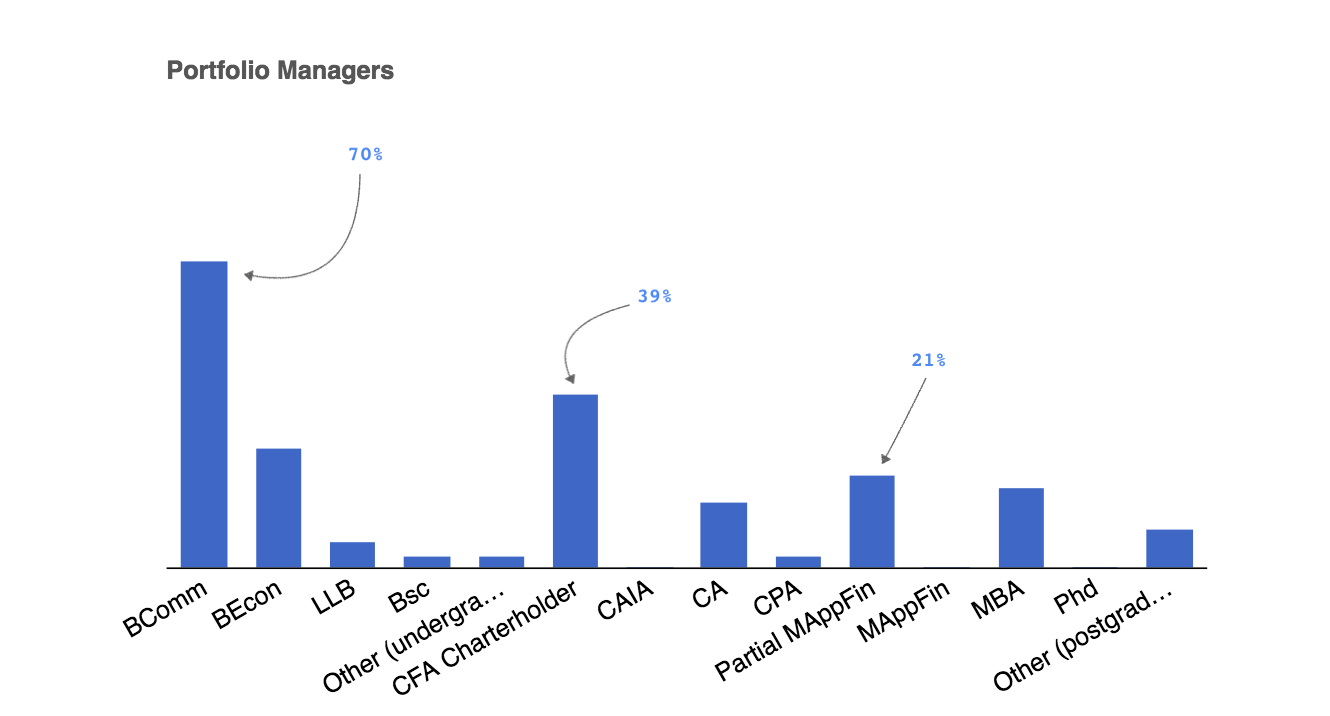

Impressively, 39% of portfolio managers surveyed were CFA® Charterholders. None had completed the entire MAppFin.

Summary

Based on our data, the CFA® Program appears the leading program among portfolio managers in Australia. For analysts, the MAppFin appears to be very popular. Followed by the CFA®, CA and Master’s of Business Administration (MBA).

However, keep in mind, this data is where the industry was last year — not where it will be in, say, 2, 5 or 10 years from today. So if you’re preparing to transition into the active investment industry you might treat these results as your baseline or minimum education hurdle.

Importantly, there are so many other factors you need to nail before landing a job offering the big bucks – which are, admittedly, becoming much harder to find as the industry prepares itself for more headwinds.

When I interviewed portfolio managers and Chief Investment Officers (CIO) they were often more concerned with finding candidates who brought some life experiences and/or technical skills from other areas (e.g. engineering, health, math, and so on.). On top of that, the successful candidates do something special to stand out.

Bottom line, getting some letters behind your name can’t hurt your chances of landing a buy-side analyst role. In fact, I think they are important as proof of your education and motivation to stand out. However, you should also consider where the industry is headed in the next few years, the sacrifice of doing something like the CFA® program, and how relevant your qualification will be to your ideal position.

Want to learn how value businesses and companies using Discounted Cash Flow (DCF), Dividend Discount Models (DDM) and ratio analysis? Try Rask Finance’s Value Investor Program:

Valuation Course: Value Investor Program

It comes with a free downloadable valuation spreadsheet so you can follow along at home.

This article first appeared on www.raskfinance.com.