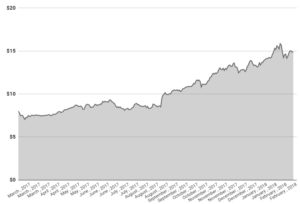

Shares in printed circuit board (PCB) manufacturer Altium Limited (ASX: ALU) ripped 26.7% higher to close at $18.88 today, an all-time high. The Altium share price is up 126% in the past 12 months, and up 1,676% in the past 5 years, according to Google Finance.

Altium’s strong rise today was due to record profit results, with revenue rising 30% to $63.2 million, and earnings per share rising 50% to 11.48 cents per share. EBITDA margins (what the heck is EBITDA?) widened from 25.8% to 30%. This means that Altium is generating more profit from every $1 of sales than it previously was.

When sales are growing and profit margins are widening, it can do wonderful things for a company’s share price, as Altium has shown. According to Thomson Reuters consensus estimates, Altium is expected to earn 34.3 cents per share for the full year 2018. This means the company is priced at approximately 55x full year earnings.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.