Getswift Limited

(ASX:GSW) lost another 27% of its value today, closing down at $0.95. Today’s fall comes after the company got swiftly dumped and lost 55% on Monday when it returned to trade after a month-long suspension.

Today’s fall may have been accelerated by media reports that law firm Squire Patton Boggs has filed suit in the Federal Court of Australia. Squire Patton Boggs’ lawyer Amanda Banton was quoted as estimating measurable damages could be about $300 million, which is far larger than Getswift’s current cash balance of around $96 million (as of its most recently quarterly report). Ms Banton also stated there might be ‘more to play out’ regarding the Getswift situation.

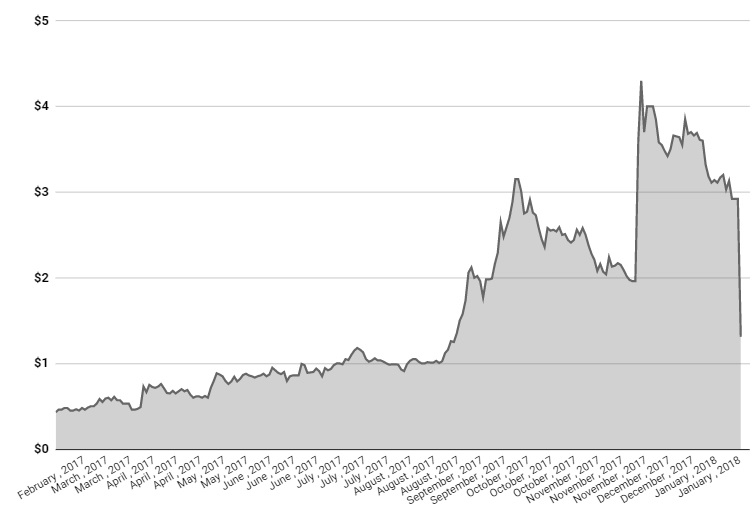

Getswift shares are down 78% from their all-time high of $4.30, although the share price is still up 140% in the past 12 months, according to data from Google Finance. Given the savage falls of the past two days, investors will surely be hoping there isn’t ‘more to play out’ as Ms Banton has suggested.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.