Retail Food Group Limited (ASX: RFG) shares were frozen in a trading halt on the ASX today as more wrinkles begin to appear.

Retail Food Group is the corporate name behind popular fast food chains like Crust Pizza, Pizza Capers, Gloria Jeans, Donut King and more.

In recent months, Retail Food Group has found itself in the media’s spotlight following scathing allegations of mistreatment towards its franchisees. Meaning, the people who ‘buy’ the right to start a business using one of the company’s brands.

In 2017, Fairfax reported that many small business owners suffered financial hardship while trying to run their outlets under Retail Food Group’s oversight.

Retail Food Group initially responded to the news by saying: “it does not accurately reflect its current business, its proactive efforts to better assure employee entitlement compliance and the levels of support it provides to franchisees.”

The next day Retail Food Group said its half year profit would be 34% lower as a result of negative media coverage and lower franchise revenues.

“The retail market is expected to remain challenging for the near future and we remain focused on responding to this challenge through delivering franchisee support initiatives and reducing corporate costs,” CEO Andre Nell said at the time.

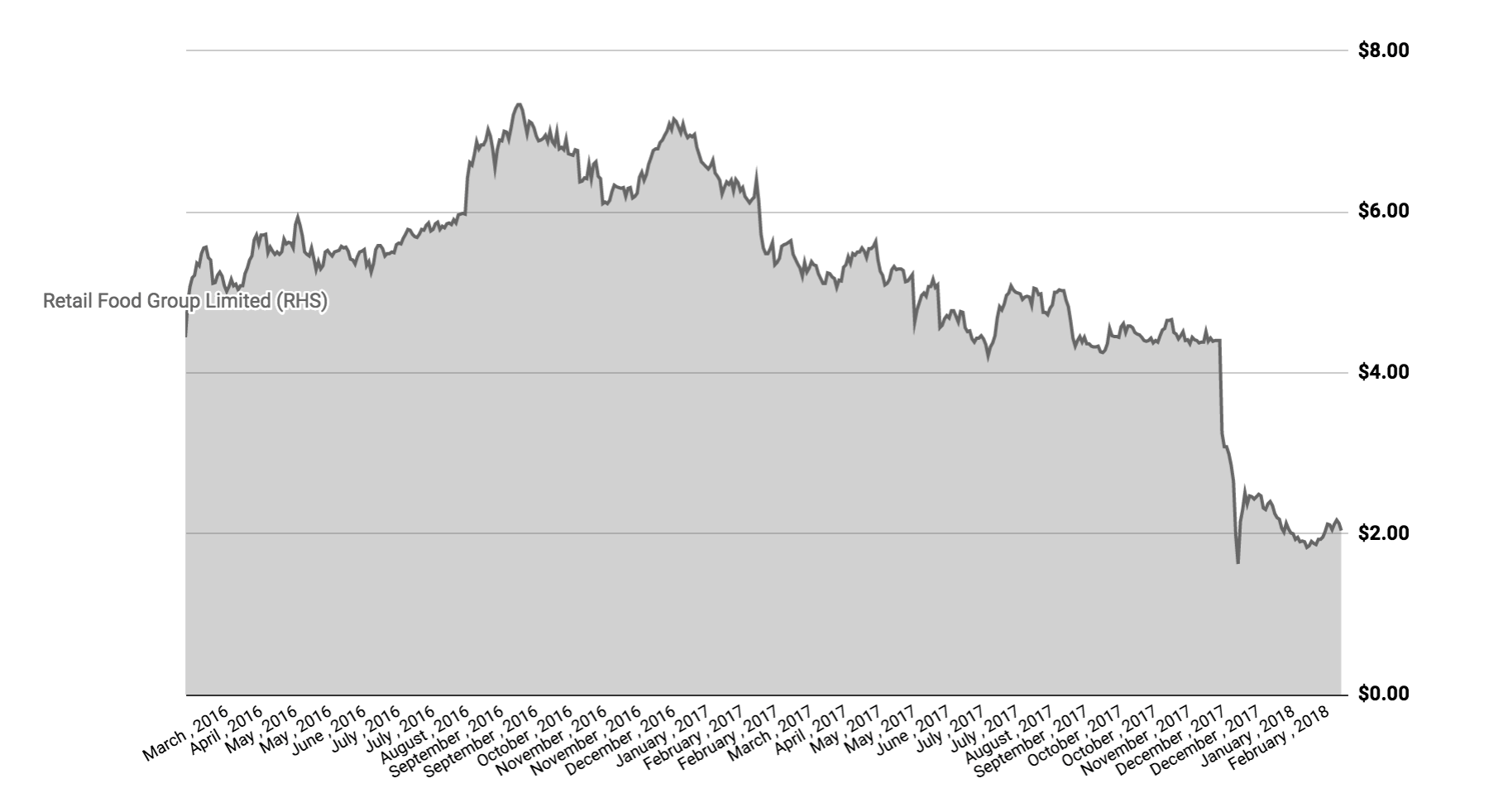

RFG Share Price

This morning, Retail Food Group shares entered a voluntary trading halt: “pending the receipt by RFG of the auditor’s report on RFG’s financial report for the half year ended 31 December 2017.”

“As foreshadowed in the release made on 9 January 2018, RFG expects its statutory NPAT for 1H18 to be materially less than the result for the equivalent prior period,” Retail Food Group’s announcement read.

“These results can only be finalised and released to the ASX once RFG’s financial statements for the period have been finalised. That can only occur once the auditor’s report has been issued which may not, RFG currently understands, be available to RFG until Friday 2 March 2018.”

The company may not get the auditor’s tick of approval until March 2nd. However, the ASX said: “If the Company fails to lodge its half year results for the period ended 31 December 2017, its securities will be suspended from the commencement of trading on Thursday, 1 March 2018, in accordance with listing rule 17.5. ”

Today, February 28th, is considered to the be last day of ‘reporting season’, the time of year when most ASX-listed companies reported either half or full year results to investors.

“Retail Food Group was originally due to release its interim results last Thursday and the week-long delay suggests that the auditors may have significant concerns about the accounts,” The Australia Financial Review‘s Sue Mitchell wrote.

Whatever happens from here, in light of the recent negative commentary surrounding its business practices, lodging results later than expected is not a good look for the embattled retailer.

Join Rask’s Investor Club Newsletter Today

You can join Rask’s FREE investor’s club newsletter today for all of the latest news and education on investing. Join today – it doesn’t cost a thing. BUT, you’ll need a good sense of humour and a willingness to learn.

Keep Reading

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.