In an announcement to the ASX, Retail Food Group Limited (ASX: RFG) released its half-year report to investors.

Despite being late to report its results due to an issue between RFG and its auditor, the owner of fast food chains like Gloria Jeans, Pizza Capers and Donut King served up a lemon.

As a reminder, RFG was the company embroiled in scathing allegations of franchisee mistreatment put forward by Fairfax Media Limited (ASX: FXJ).

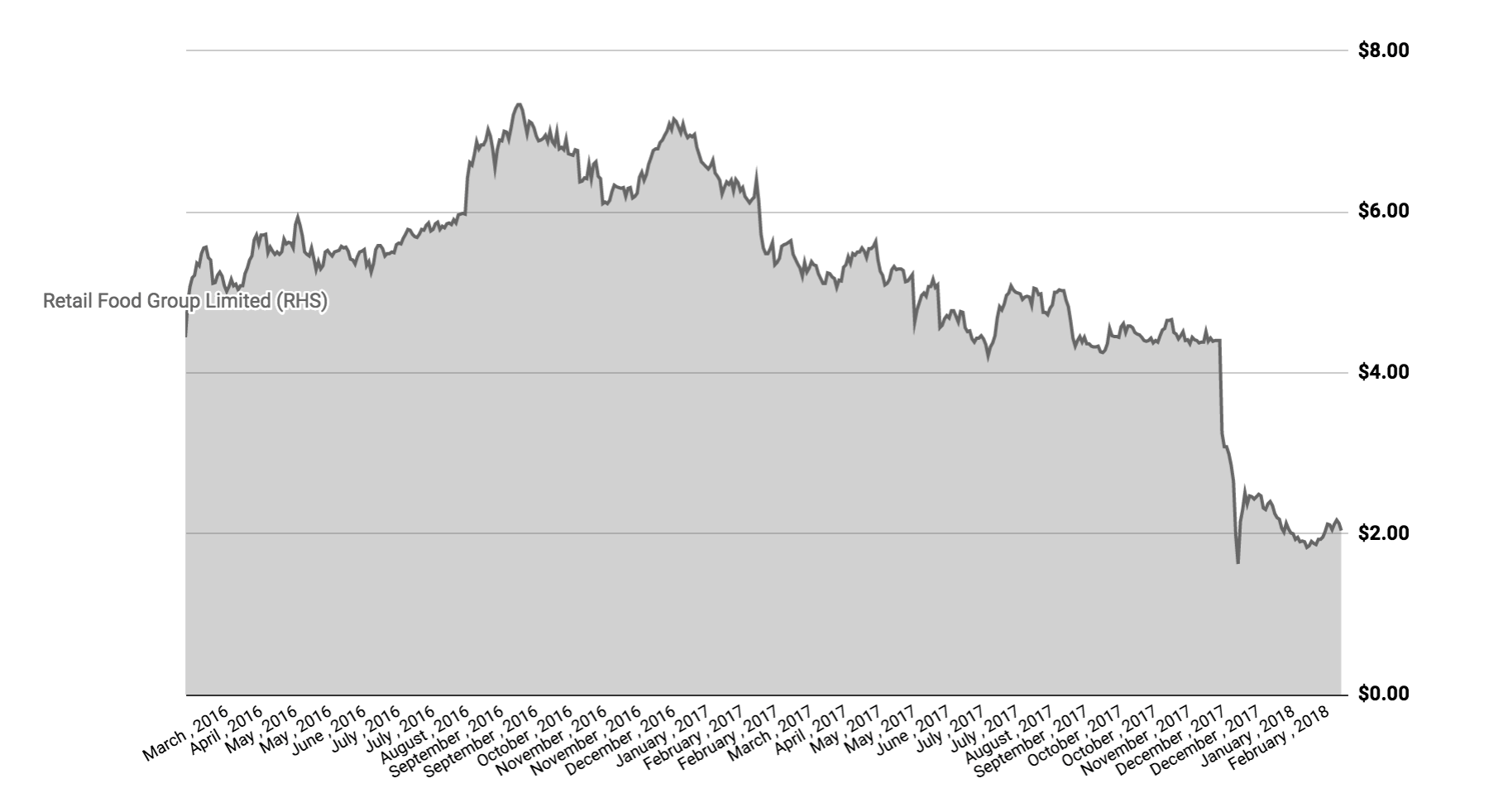

RFG Falls on Allegations

The Retail Food Group Limited HY Report

Here are the key news headlines from the RFG 2018 half year report:

- Revenue of $195.5 million, up from $161.9

- Underlying EBITDA (watch: what the heck does EBITDA mean?) went from positive $56.6 million to negative $100.8 million

- A net profit of $33.5 million in the same period last year turned into a loss of $87.8 million

- The dividend was cut from 14.75 cents per share last year to nothing

- RFG’s ASX shares are set to resume trading Monday, March 5th

- 160-200 Australian outlets will be closed by the end of FY19

“We have had to make some tough decisions about our business model, our franchise network and the value of some of our assets,” RFG CEO, Andre Nell said. “The key to improving our performance is to simplify what we do. We have all the assets we need to deliver our diversified business strategy – now we need to make sure we make the best use of those assets.”

“The actions we are taking now will secure a sustainable long-term future for the Company and our franchisees’ businesses, and drive future value for our shareholders” – Nell

As part of a business-wide review, RFG said it will close between 160 and 200 stores by the end of FY19, “predominantly due to unsustainable rent and declining shopping centre performance.”

A re-assessment of its trading performance and planned store closures resulted in an impairment charge which forced RFG to report its financial loss.

RFG said its net debt stood at $259.7 million at 31 December 2017 and the decision to cut the dividend was due to a “strategic reset”. Retail Food Group’s senior lenders will also reset the financial covenants on RFG’s debt.

“As the Company progresses its business-wide review, consideration will be given to further structural improvement to better ensure RFG is applying resources more effectively,” Mr Nell added. “This includes further review of our broader brand strategy and portfolio.”

In light of the recent profit downgrades and changes, RFG said making a full year profit outlook is difficult but the company will keep investors informed of any developments.

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.