Since 2006 New Zealand’s XERO FPO (ASX: XRO) has grown from four people with an idea into a global accounting software heavyweight with 2,000 people in eight different countries.

With the CEO baton now passing from its founder, Rod Drury, to Steve Vamos, I thought it would be a good opportunity to look at some of the key trends in Xero’s success. And what better way to do that than with three simple charts.

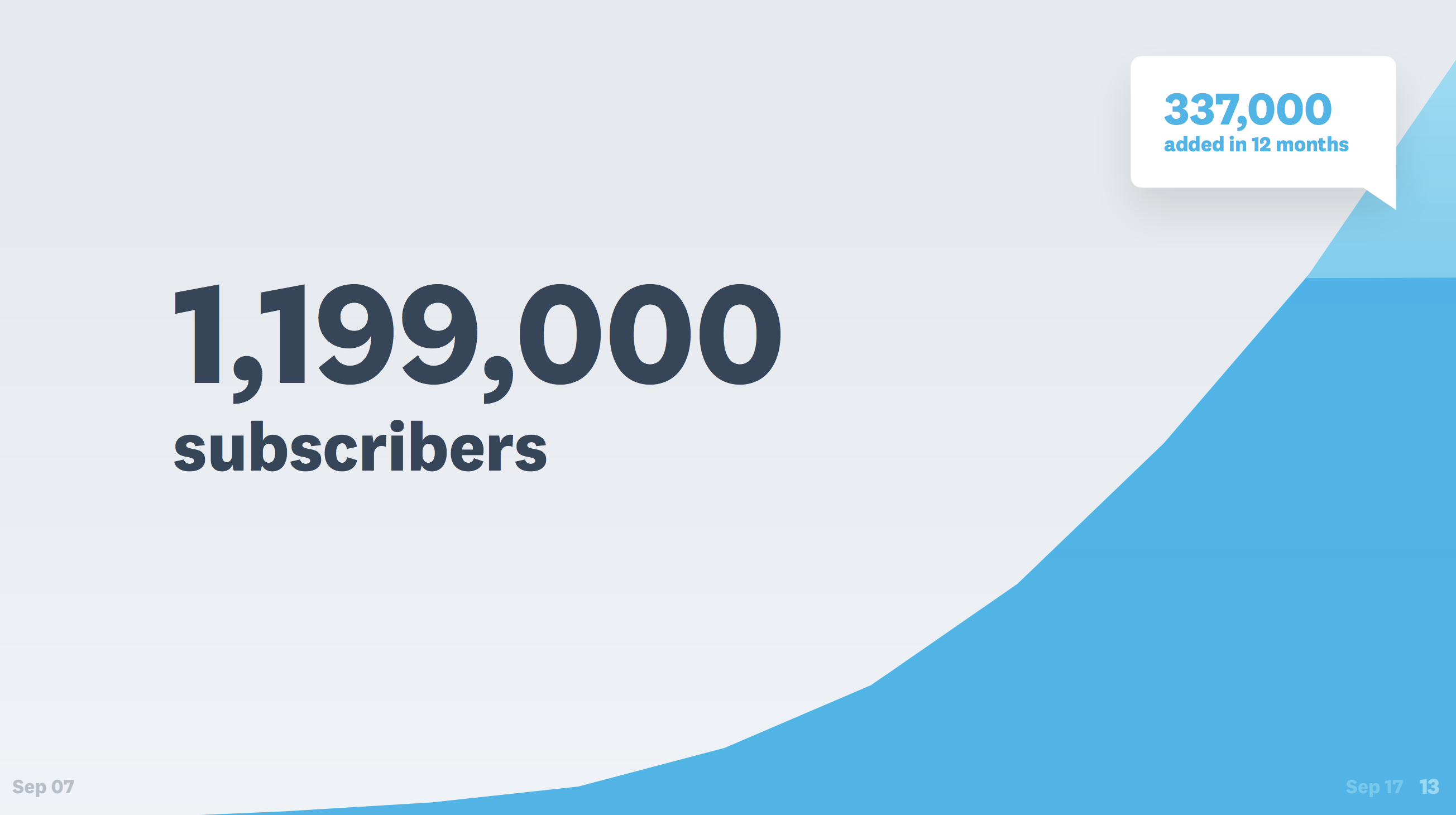

Xero Subscribers

Here’s a shot from a recent presentation showing Xero subscribers as at 30 September 2017. Keep in mind it’s from a few months ago. Xero’s tagline is “beautiful accounting software”. Small business owners, accountants and bookkeepers appear to agree.

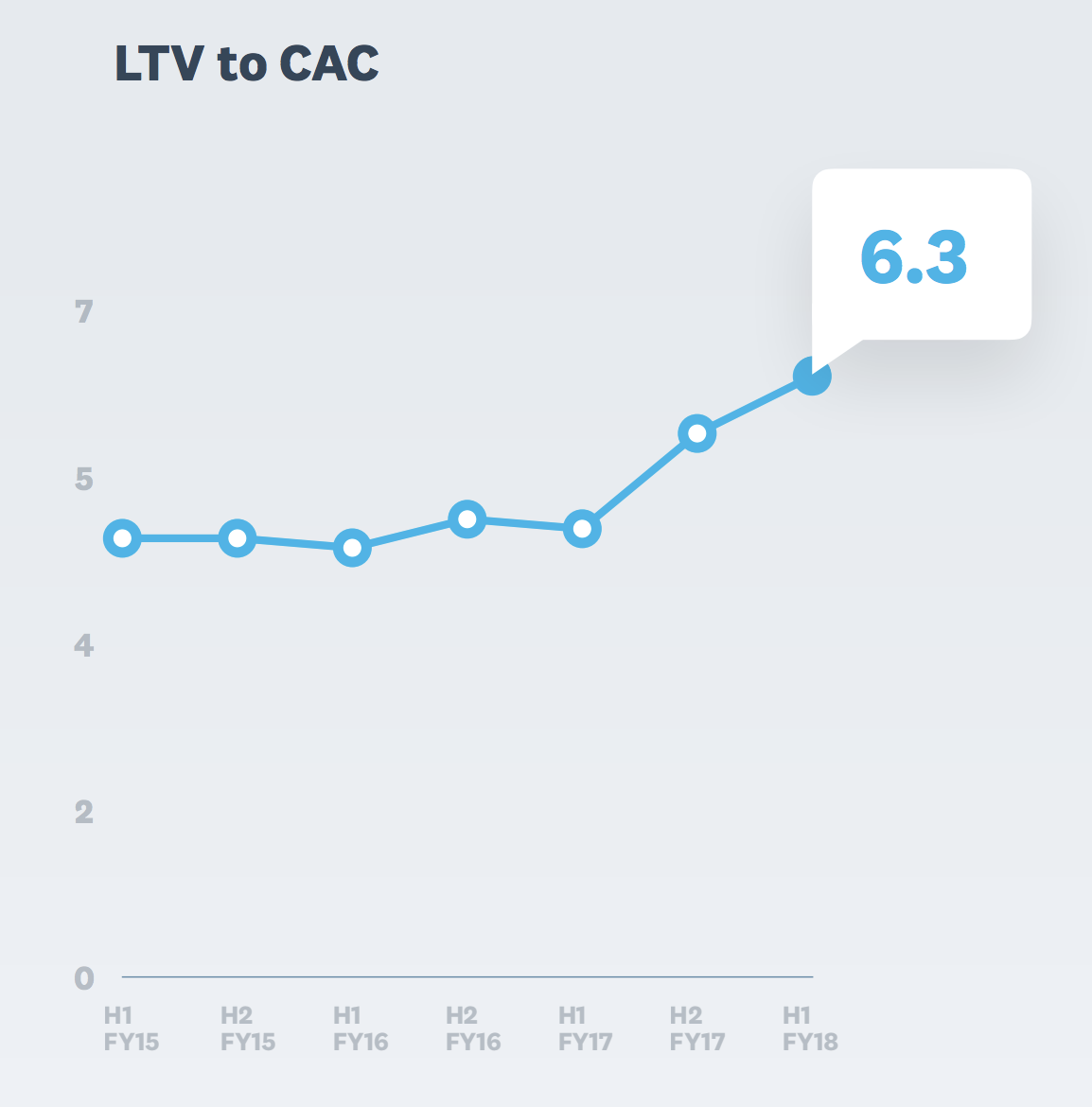

LTV to CAC

“LTV to CAC” might sound like some weird finance jibberish, but it’s very important. LTV means Lifetime Value or the amount of gross profit that a tech company expects to earn from an average customer. CAC means Customer Acquisition Cost or the amount of money which companies like Xero have to spend to get the customer using their product.

If you combine those two, the amount you’ll make from a customer versus what it costs to get them to buy your product, you have your most important equation. It tells you if its worth spending money to acquire more customers.

As Xero explained in its September 2017 Half Year report, “e.g. the gross margin derived from a subscriber in ANZ is currently on average 12.2 times the cost of acquiring that subscriber.”

So why is the LTV to CAC ratio so good? As you can imagine, it might be a big pain for a busy small business owner to change accounting software once they have learned how to use it and adapted all of their systems. That makes software like Xero’s quite ‘sticky’ — meaning customers tend to hang around.

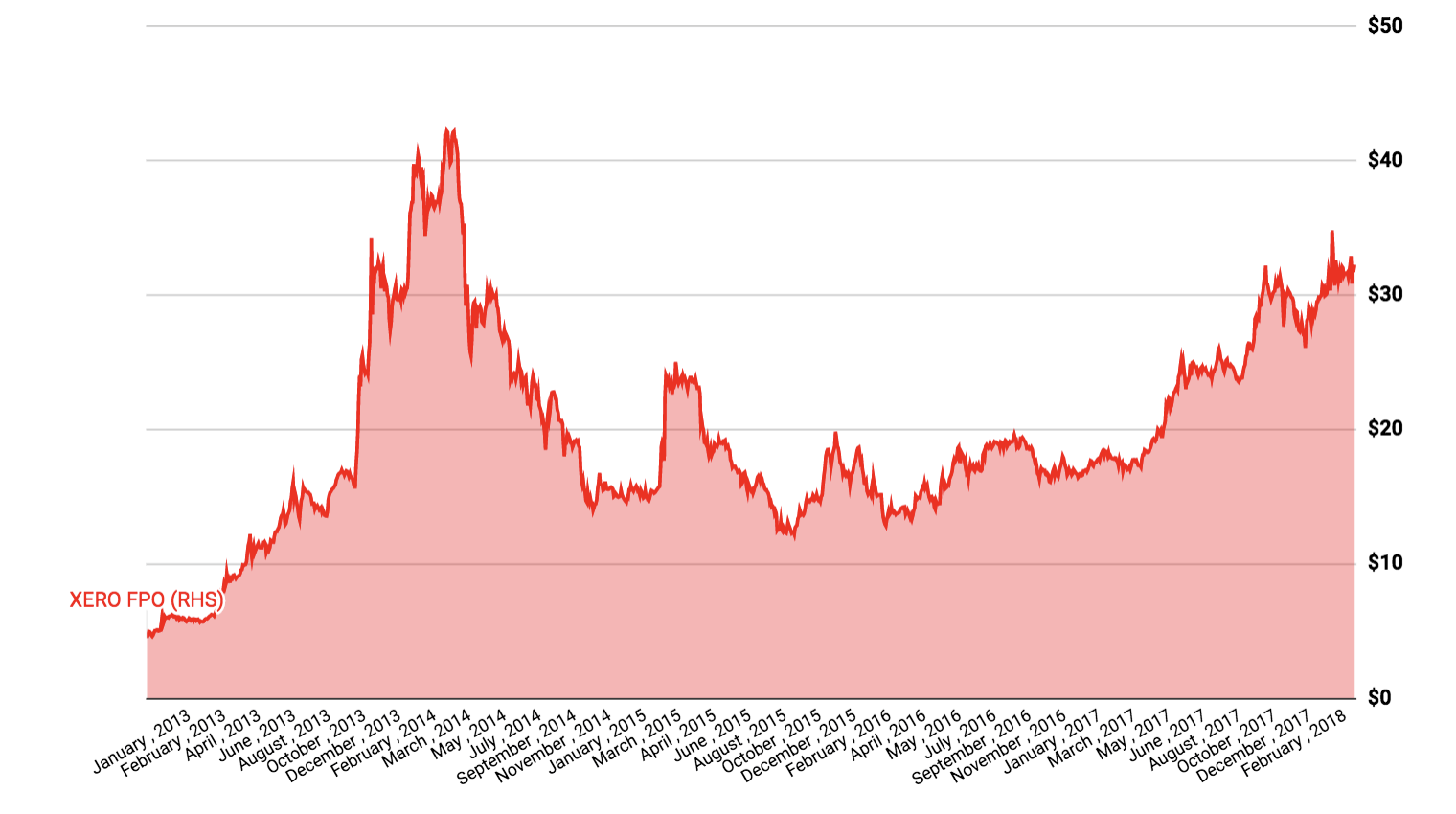

Share Price

Finally, it seems the share market has been impressed by Xero’s performance in recent times.

As the outgoing Drury said in an ASX announcement this week, “Xero has recently passed a number of key milestones: we’ve achieved positive EBITDA and operating cash flows, consolidated our listing on the Australian Securities Exchange (ASX) and developed a high performing leadership team.”

Outside of the sharemarket, Xero’s success in the NZ tech scene has made it a poster boy for other companies pursuing similar strategies. Here’s what Pushpay Holdings Ltd’s (ASX: PPH) CEO, Chris Heaslip, said on Twitter:

Congrats on building an incredible business @roddrury – An inspiration for all Kiwis looking to export to the world from NZ! https://t.co/xI3ZSodKue

— Chris Heaslip (@ChrisHeaslip) March 5, 2018

“The next chapter for Xero is focussed on scaling internationally,” Drury said this week. “I’m looking forward to continuing my focus on product innovation while working with Steve as a non-executive director.”

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.

Disclaimer: This article contains general information only. It is no substitute for licensed financial advice and should not be relied upon. By using our website you agree to our Disclaimer & Terms of Use and Privacy Policy.