If you’re a die-hard investor like me, you’ll no doubt know that Warren Buffett, Chairman of Berkshire Hathaway, worth an estimated $75.6 billion according to Forbes, releases a shareholder letter to investors each year.

You can find the PDF here.

Warren Buffett Wisdom

While some might argue that investing success comes in many different flavours, strategies, styles and opinions, I don’t know of any long-term track records that rival Buffett’s.

Using his preferred measure of book value, Berkshire achieved an average annual gain of 19.1% between 1965 and 2017 — that’s a total return of more than one million percent. (you read that right: “one million”).

How does Buffett do it?

Primarily, Buffett says, Berkshire owns a collection of private companies (e.g. a large insurance company) and public companies (e.g. shares). Along with his partner, Charlie Munger, Buffett uses a simple investment strategy. As Buffett wrote in the letter, they buy businesses that:

- Have durable competitive strengths

- Have capable and talented management

- Produce good returns on their assets

- Have room for internal growth (note: ‘internal’ is the opposite of acquisitions), and

- Can be bought at a “sensible purchase price”

It’s a strategy which has barely changed over many years.

In 2009, in an interview with the BBC, Charlie Munger was asked why more investors didn’t use the strategy.

Source: YouTube.com

“It’s a very simple set of ideas. The reason our ideas have not spread faster is they’re too simple…the professional classes can’t justify their existence if that’s all they have to say.”

He goes on, “it’s so obvious and simple, what would they have to do with the rest of the semester.”

If a professional investor is earning a six (or seven!) figure salary just to say to their client, “we buy shares of great businesses at good prices”, their clients would likely demand more. “After all”, they would say, “I’m not paying you to do what I could do myself!”

But, successful investing is, as Morgan Housel once said, ‘99% doing nothing’, yet, ‘it’s the other 1% that will change your life.’

Here are some gold nuggets of investing wisdom from Buffett’s 2017 letter to shareholders.

3 Gold Nuggets From Buffett’s 2017 Letter

1. “Charlie and I sleep well. Both of us believe it is insane to risk what you have and need in order to obtain what you don’t need.”

Leverage, otherwise known as debt, might magnify our returns when times are good, but it increases risk when times are tough, Buffett says.

As investors, we are constantly on the lookout for situations which allow us to make more money than we risk losing.

I don’t have a crystal ball. I know what I don’t know. So like Charlie and Warren, I avoid debt.

It’s also worth noting that if you buy shares in companies with little to no debt, the company could decide to borrow money (likely at cheaper rates than you or I can get) and leverage their business.

2. “Charlie and I view the marketable common stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their “chart” patterns, the “target” prices of analysts or the opinions of media pundits. Instead, we simply believe that if the businesses of the investees are successful (as we believe most will be) our investments will be successful as well.”

There are reasons many would-be investors are scared of investing in shares and say, “it’s like gambling”. To those people, the sharemarket is random guesswork.

While you and I know different, it would seem like gambling if we didn’t understand how the sharemarket works.

If you have a choice, keep it simple.

As Charlie says, “The reason our ideas have not spread faster is they’re too simple“ (my emphasis added).

3. “I want to quickly acknowledge that in any upcoming day, week or even year, stocks will be riskier – far riskier – than short-term U.S. bonds. As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.”

Shares are undoubtedly riskier than some other investments, such as U.S. bonds. However, Buffett is saying that the longer you hold a good portfolio of shares, the lower that risk becomes.

Investors still experience the random ups and downs in the short-term (which is part and parcel of the stockmarket and called “volatility”). However, something extraordinary happens…

Here’s an extract from Morgan Housel’s investing presentation to MicroCapClub which he titled, “What Other Industries Teach Us About Investing.”

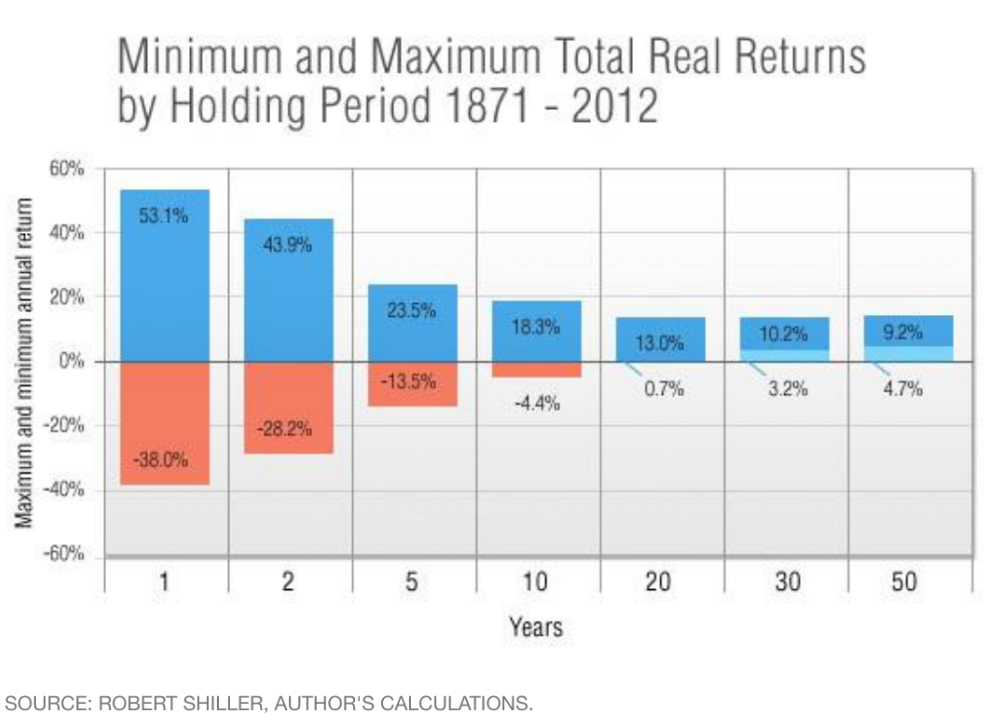

This chart shows the worst (orange) and best (blue) returns from holding an S&P 500 index fund over rolling periods from as little as 1 year to 50 years.

Consistent with Buffett’s earlier point, the chart shows that the longer an investor owns a diverse basket of shares the better their chances of success. As can be seen, the ‘worst’ performances start out being very large but get smaller over time.

As Morgan says, “It’s not until 10, or 20, or 30 years that the odds of success have fallen truly in your favour.”

Takeaways

While investing might sound simple, it’s not easy.

It requires a willingness to learn, the ability to change your mind when the facts change, a long-term mindset, and lots of work.

Cheers to our financial future!

Owen Raszkiewicz

Twitter: @owenrask

P.S. If you want to join my free investing club newsletter, go here.

P.P.S. If you’re looking for Buffett’s other letters, try this link.

P.P.P.S. What does “P.S.” even mean?

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.