In last week’s Investor Club Newsletter

, I wrote:

“While some might argue that investing success comes in many different flavours, strategies, styles and opinions, I don’t know of any long-term returns that come close to [Warren] Buffett’s.”

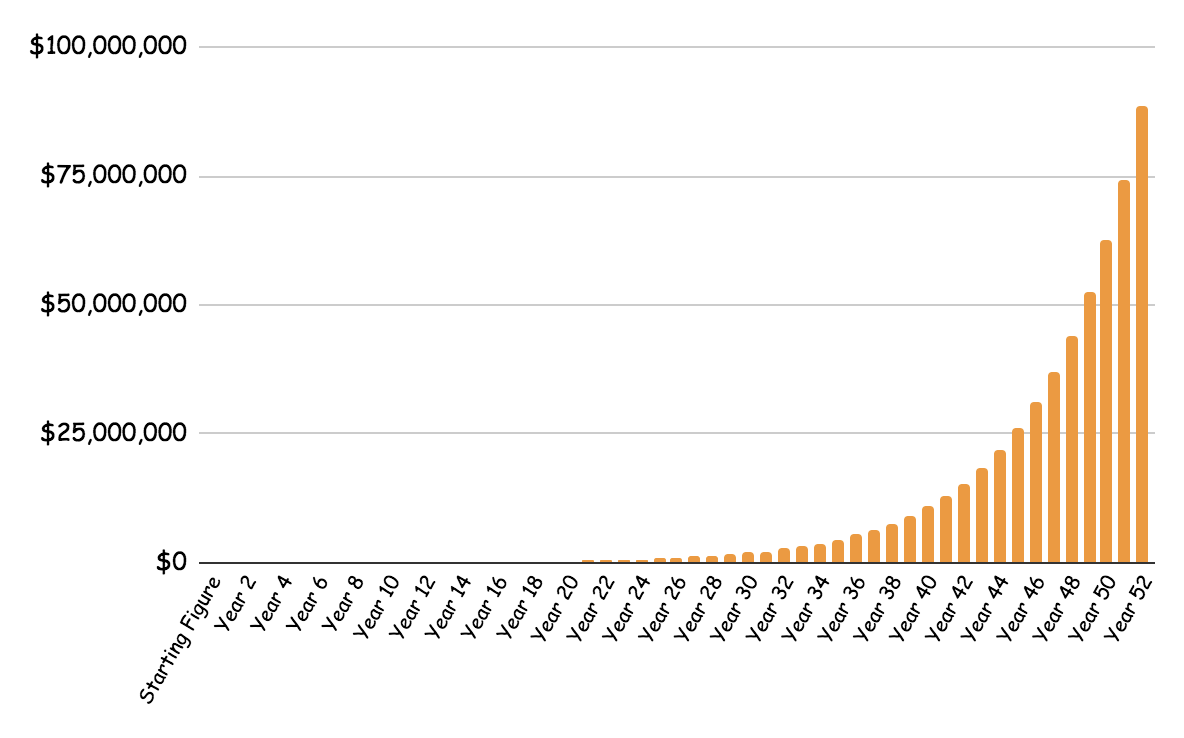

With 19.1% per year investing returns since 1965 — over 1 million percent in total gains — Buffett is, in my mind, the world’s greatest living fundamental investor.

$1 invested with Buffett in 1965 would have been worth more than $9,000 by 2017. $10,000 (which was a lot of money back in the swinging 60’s) would have totalled more than $88 million by 2017.

However.

While Buffett is often regarded as the best investor, what you’re about to read could change your mind.

Does It Get Better Than Buffett?

In 2016, I spent five months interviewing some of Australia’s best professional investors whose focus was global shares.

I jetted off around Australia and met some interesting and unique investors.

Until that time, all of the best investors I knew of I found in books. Buffett, Munger, Lynch, Greenblatt… the ‘usual suspects’.

These ‘anti-Wall Street’ types executed their strategies differently but they used a similar set of principles.

They would:

- Read annual reports

- Study financial statements

- Find good management, and

- Wait for the market to offer them a compelling price

This is frequently referred to as “fundamental analysis” because you, the analyst and investor, should work to understand the fundamental drivers of a business.

For years, I had thought this was the only way to invest — the other stuff was nonsense.

But after I began researching and interviewing the real-life investing professionals I realised there was a lot more to investing than most books care to let on.

Indeed, to coin a phrase, there were more ways to skin an investing cat.

What’s Your Investing Edge?

Broadly, there are three commonly accepted investing ‘edges’:

- Informational – your access to and use of information

- Analytical – your ability to interpret information better

- Behavioural – your ability to remain impartial and keep a cool head.

All of us have some degree of strength across each of the edges.

Some of us have a cooler temperament under pressure.

Some of us have better sources of information.

And some of us can apply our analytical ability for superior returns.

It was the same with the professionals I interviewed. Some had strengths and weaknesses in each of the areas.

The Best Investor You’ve Never Heard Of

‘Fundamental’ analysis is undoubtedly one of the most common styles of investment. But there is another field that could be even more lucrative for the right people. And there is one person, from overseas, who is revered by everyone in this field.

Fund managers would talk about this person in a way that was almost joking but suspect. It was as if they didn’t truly know if what they heard was fact or fiction.

This person — and their team — are almost never spoken about because they are hidden away from the mass media and their leading investment fund closed its doors to outside investors in 2005.

No-one really knew what was going on.

That was… until 2016.

In 2016, Bloomberg aired a story “Inside a Moneymaking Machine Like No Other“.

The topic was New York-based Renaissance Technologies. Known in the biz as “RenTec“.

The person was Jim Simons, who retired in 2009. Forbes currently estimates Simons’ wealth at $US 20 billion (that’s $25 billion, to you and I).

Jim Simons’ TED Talk

Despite Bloomberg’s best efforts, the investigative reporters concluded:

“We know very very very little about [RenTec]”, but “it’s a fountain of money like no other”.

Renaissance Technologies is a quantitative investment company. Meaning, it uses statistics and computer power to buy and sell shares around the world.

The ‘signals’ to buy and sell could be minuscule and unnoticeable to us mere mortals. For example, the effect of weather in Paris on daily share prices.

Renaissance Technologies is believed to have 300 employees, 90 of whom have PhDs. Astrophysicists and mathematicians are some of its preferred employees.

Launched by mathematicians, its systems are believed to house around 7 million lines of computer coding.

Investing: Employees Only

RenTec employees are exclusively able to invest in what’s called the ‘Medallion Fund‘.

But it doesn’t come for free.

Investing in the Medallion Fund is believed to incur a fee of ‘5-and-44’.

That means, the employees (who are the investors in the Fund) pay a 5% management fee back to Renaissance each year, plus they forgo 44% of the gains as ‘performance fees’.

The Medallion Fund is not the only Renaissance fund but it’s considered ‘the’ Fund.

Why?

According to AFR, the Medallion Fund produced about $US74 billion in profit over 28 years.

At first, I thought that sounded insane. $74 billion dollars!

Here are some of the perks of working at Renaissance, taken from its website:

- “an investment allocation to Renaissance funds for qualified employees and their families”

- “a flexible spending account (up to federal limits)”

- “a charitable gift matching program”

- “an annual company trip to a luxury resort for all employees and their families”

And for the real scientists out there, “state of the art computational facilities”.

“Renaissance’s computers are some of the world’s most powerful,” wrote the AFR in 2016.

Who cares?

I’ve saved the best thing about the Medallion Fund, for last:

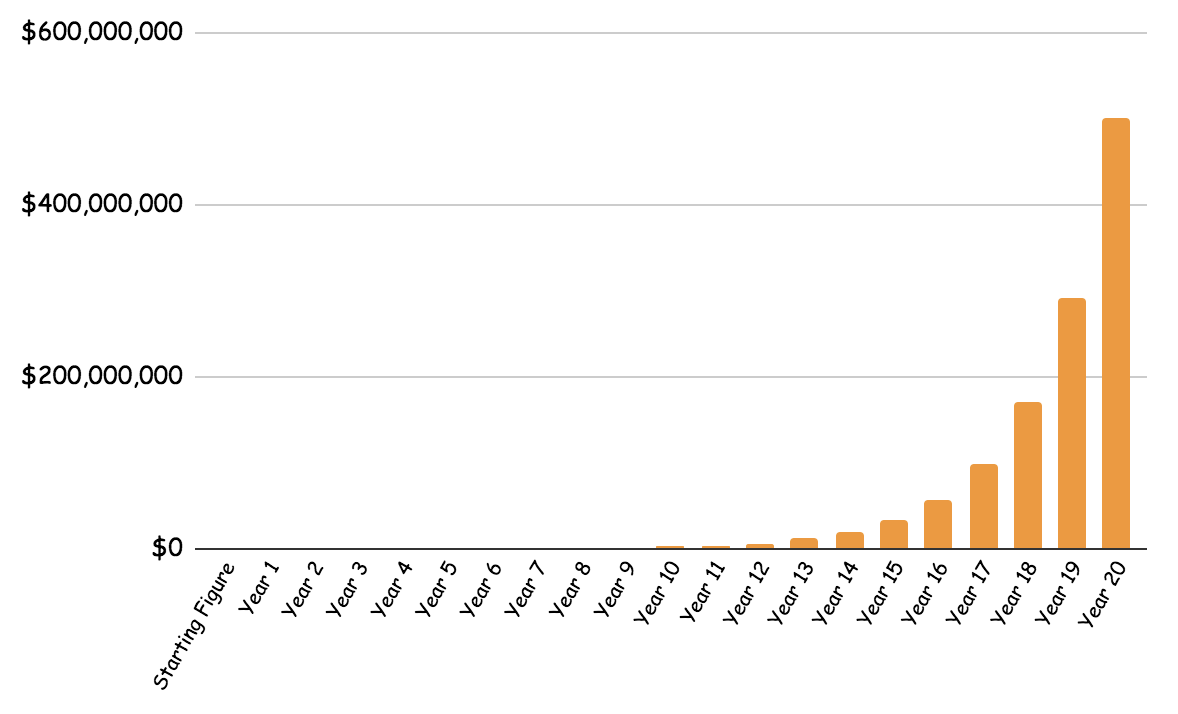

Bloomberg reported in 2015 that between 1994 and 2014 the RenTec Medallion Fund averaged 71.8% annual returns. During the GFC it achieved a return of more than 90%.

$1 invested at 71.8% for 20 years turns into $50,172.

$10,000 turns into more than $500 million…

The Medallion Fund is believed to have achieved average yearly returns of over 30% since its inception in 1988.

As Simons said in this speech, “it made an awful amount of money.”

In 2015 and 2016, the Medallion Fund’s returns are believed to have fallen to ‘just’ 21% and 18%, respectively.

Takeaway

Hearing the story about the Medallion Fund made me question if the track record is real; if it can last; and, if Buffett is the best investor alive.

I think it’s worth noting that Renaissance has other open funds which have not performed as well as the Medallion Fund.

At the very least, reading about Simons, Renaissance and the Medallion Fund opened my mind to the idea that there are many other ways to make money by investing in shares.

As for key takeaways, I put in a lot of effort to know what I don’t know and playing to my strengths. For me personally, using statistics to find investing signals like changes in the weather is well outside my circle of competence.

In contrast, finding great companies trading at good prices to hold for the long run seems a lot more achievable and sustainable.

Cheers to our financial future!

Owen Raszkiewicz

Founder & Managing Director

The Rask Group

Get my newsletter by joining The Rask Group’s free Investor Club!

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today

Hey, you, read this disclaimer: This article contains information only. It is not financial advice. It is no substitute for trusted and licensed financial advice and should not be relied upon. By using our website you agree to our Code of Ethics, Disclaimer & Terms of Use and Privacy Policy. Also, don’t forget, past performance is not a reliable indicator of future performance.