Last night, the Australian Government handed down Budget 2018.

With an election on the horizon and around 30 news polls in a row showing the opposition as the preferred Government, Budget 2018 was fairly tame.

Having said that, there are some winners and losers from yesterday’s announcement.

Here are my 5 takeaways.

1. The Aussie Budget is in Good Shape

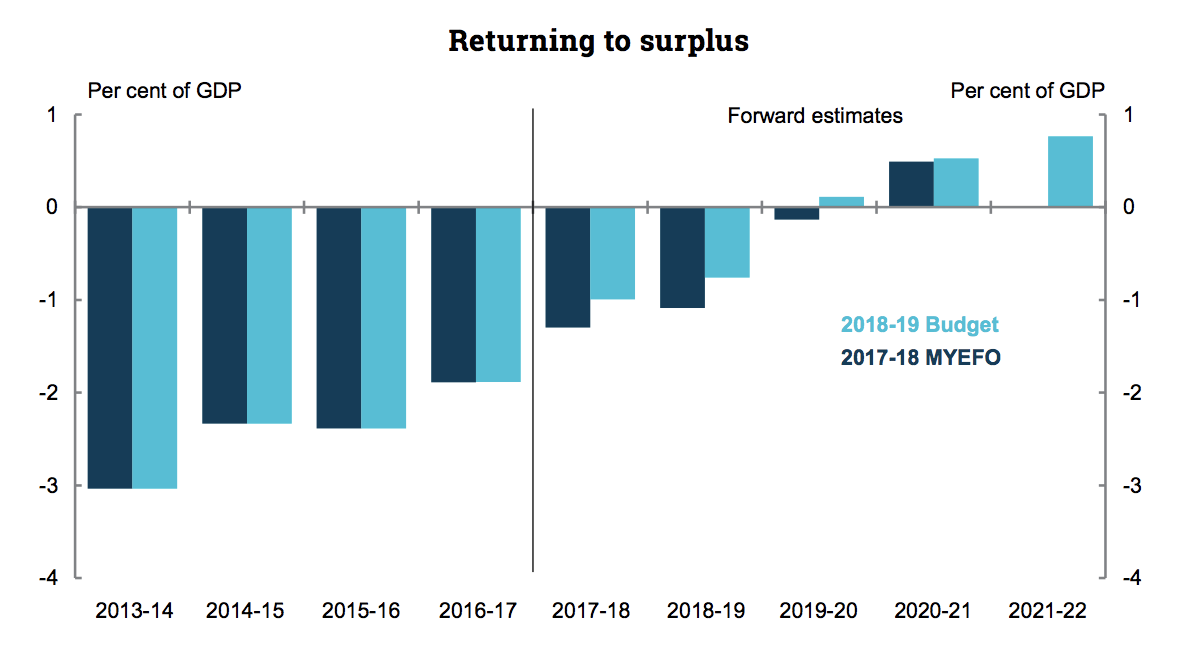

By 2020/2021, the Government thinks Australia will be in a surplus. Meaning, our country earns more than it spends.

Some might argue that a surplus is not always a good thing. However, it is vital we live within our means and, especially when the economy is firing on nearly all of its cylinders, we push towards a balanced budget.

Australia has enjoyed a record-breaking 28 years without a recession. Times won’t always be this good.

2. Tax Cuts…

The Government’s plan to get more cash back in the pockets of Australians starts with lower income earners from July 2018 and extends to higher income earners ($200k+) in 2024.

In addition to the low-income tax offset (LITO), the Government plans to introduce a new offset which will provide tax beneifts of up $10.19 per week ($530 per year) in 2018/2019. The LITO will be increased slightly in 2022/2023 and the 19% tax bracket will rise from a maximum income of $37k to $41k.

For middle-income earners, the 32.5% tax range will be extended to $90k from its current $87k, meaning less tax for the ‘average’ full-time worker, starting July 2018. In 2022, the 32.5% tax bracket will rise again to include people earning up to $120k. In 2024 the 37% tax rate will be removed.

Finally, the highest income tax bracket threshold, paying tax at 45%, will be increased from $180k+ to $200k+ by 2024.

3. More Super

Young people with a low Super fund balance will have to elect to receive insurance cover rather than it being provided by default. Holding multiple insurances can eat away at Super balances, especially if they have a few different funds.

Other changes include:

- The ATO will have the power to consolidate inactive or lost Super accounts

- Fees will be capped at 3% for balances up to $6,000

- Exit fees will be banned

4. Pensioners Eligible For Bonus

The work bonus is an incentive allowing recipients of the Government pension to work a few hours each week, fortnight or month and earn an income. The amount they can earn before it affects the pension will increase slightly from $250 per fortnight to $300 per fortnight. It will also include the self-employed.

The pension loans scheme, which allows pensioners to boost their pension by using their home as security for a ‘loan’ to the Government, will change. Full pensioners will be able to increase their income by up to 50% of the pension.

5. Small Business Breaks

There were a few changes and investments in the small business space, including lower taxes for businesses with up to $50 million in turnover, starting July 2018. The standard corporate tax rate is 30%. However, eligible small businesses will pay the reduced rate of 27.5%. Previously, the turnover rate was capped at $25 million.

Also for small business, the instant asset write-off will be extended a further 12 months, encouraging small businesses to spend up to $20,000 on new or upgraded assets.

Summary

The Australian

called it a “‘no harm’ budget” while the ABC said it reflects a “transformation of Australian politics since the election”. I tend to agree.

I’m happy there were no immediate and sweeping changes to corporate taxes. And my highlight was seeing some relief for pensioners following years of changes — or proposed changes — to their welfare from both sides of Government.

Until next year it seems Australians can expect ‘more of the same’.

Did you know it’s free to join The Rask Group’s Investor Club Newsletter? It’s a regular (usually weekly) news and educational update on financial markets, investing and unique strategies. Join today and get ready to laugh and learn.

Click here to join The Rask Group’s Investor Club Newsletter Today