Being a first home buyer is always a challenge. Sydney and Melbourne property prices, in particular, seem to be very expensive.

But it’s not all bad. Below, I explain why it’s important to remember that property prices are cyclical and why a better time to buy your first home could be just around the corner.

First Home Buyers: Don’t Sweat It

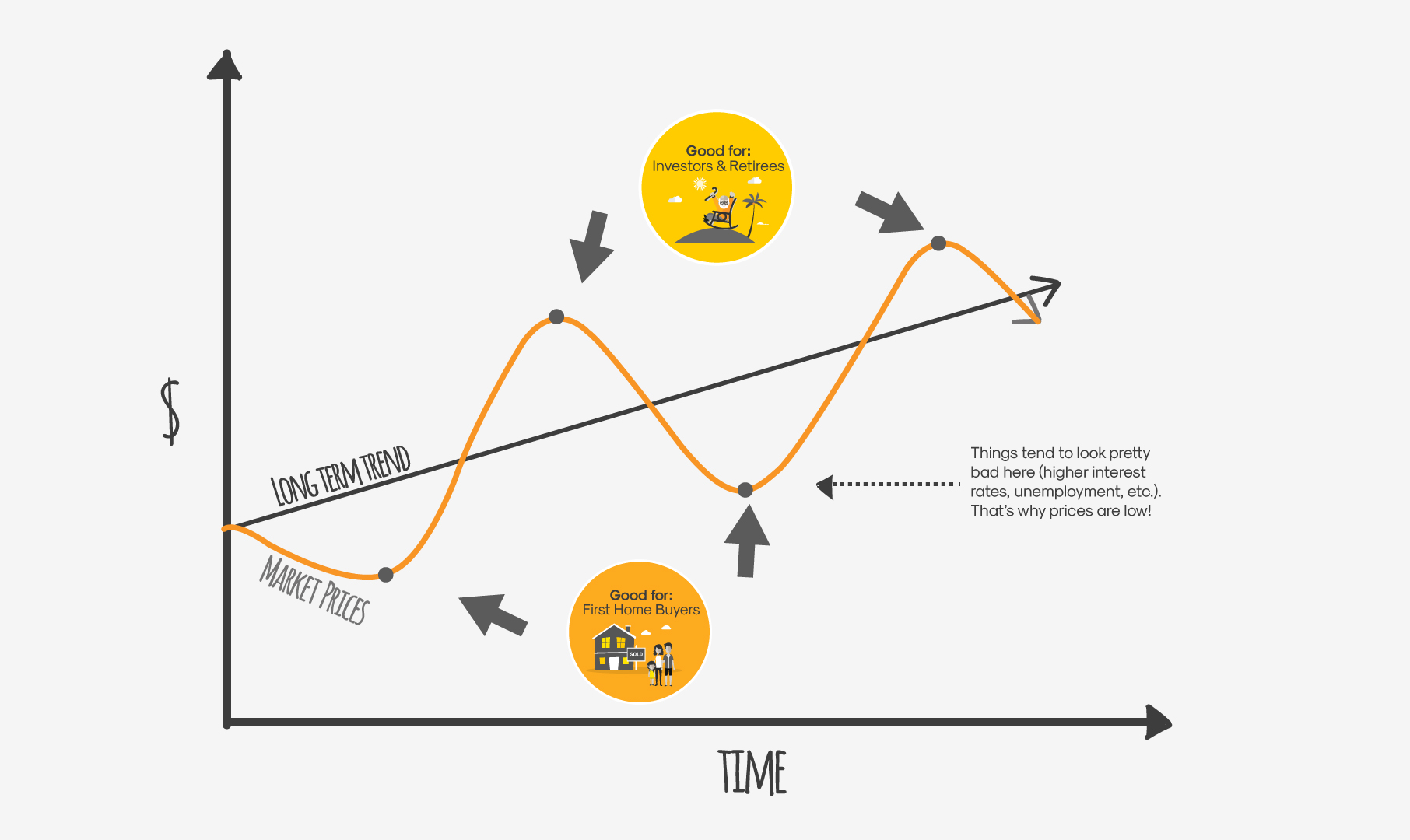

Here’s a helpful — and reassuring — property chart I put together for Rask Invest.

Ask yourself where we might be on the orange line of property prices?

You’ll probably hear people tell you, “property prices always go up over time” or “prices double every 7 years”.

Yeah, nah…

I’ll admit prices tend to rise over the long term or, at least, they have over the past 30 years.

But let’s not forget that since the early 90’s, interest rates have fallen from 17% to 1.5%, our population has risen from 17 million to 24 million — a 47% increase — and average wages have increased from $450 per week to $1,179 per week — a 260% increase!

Can that continue?

I’m not so sure it can.

Remember One Thing…

I know that buying a first house seems like a massive financial headache. It’s your financial Everest.

However, if you follow the 7 steps I outlined in this article (7 Simple Money Tips For First Home Buyers) and remember that property markets are cyclical your headache will be no more.

Don’t underestimate the savings you can make in one, two or three years. Chip away at it. There will come a time when it’s great to be a first home buyer with a healthy deposit.

And it could be closer than you think…

According to the Australian Bureau of Statistics (ABS) house prices in Melbourne and Sydney fell in the three months to March 2018 — the first quarterly decline in more than 5 years.

Analysts from Australia and New Zealand Banking Group (ASX: ANZ) now expect further falls in house prices, according to Business Insider.

Summary

A few years ago I was over in Calgary (Canada) and a friend told my wife and I that he had bought a two-bedroom apartment with two friends back in 2007 (property prices were riding high but they had a bad case of FOMO). It was their first place and they had to split the property three ways to afford the big deposit needed to get a loan. They rented it out.

Fast-forward 9 years and they sold the property for a loss despite spending tens of thousands of dollars in upkeep. Canada was a great place to invest in until 2008.

If you are in a rush to buy when property prices are high, the deposit alone could be a killer, your stress levels will be through the roof and you could end up buying a place you hate or lose money on.

Remember, you could be owning this place for decades — and it could be the biggest purchase you ever make.

So don’t sweat about missing out. Remember, property prices will rise and fall. Save your cash — and enjoy being mortgage free!

Personally, I’m not worried about house prices because I invest my money in other places. I follow a very simple four-step strategy. I recently outlined my step-by-step process in this free ebook.

You can download the free Aussie investing ebook

, “What Buffett’s Investing Checklist Can Teach Aussie Investors“ when you join the free Rask Group Investor Club Newsletter. I’ll email it to you.

Click here to join The Rask Group’s Investor Club Newsletter and Download The Ebook!