Virtually every ASX investor has had some association with Telstra Corporation Ltd (ASX: TLS) shares at one stage or another and, for the most part, it’s been an unpleasant experience. Shares are today below what they first listed for all-the-way back in 1997.

Of course, that tells only half the story. When you factor in the telco’s much-coveted dividends — which total $5.41 per share since listing — the return looks better (but still not great).

If you acquired your stake in Telstra anytime since 2015, you’re almost certainly well into the red — dividends or not.

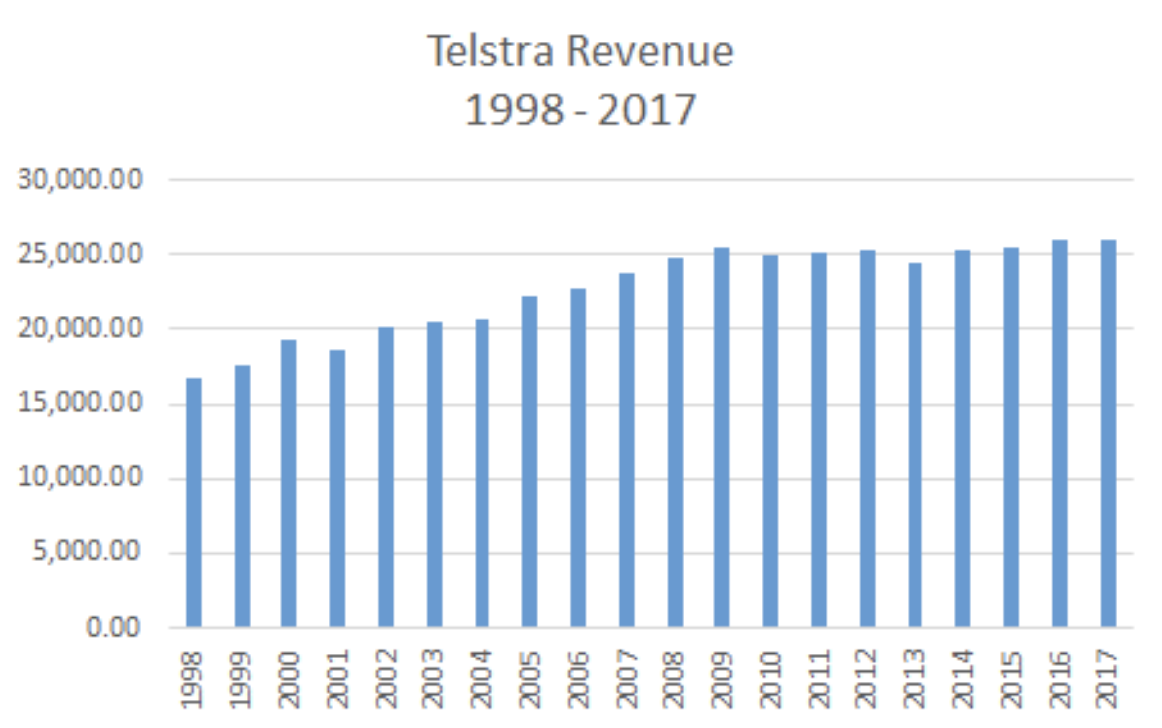

Looking at Telstra’s top line, which has steadily improved since listing, and is on track to hit a record of over $26 billion in the current year, such a woeful share-price performance may, at first, seem a little unreasonable.

Well, at least until you put that growth into perspective. Despite the massive surge in demand for telecommunications services since the turn of the century, Telstra’s revenues have averaged a rather lacklustre pace of 2.3% annual growth. In the past five years, sales have essentially been flat.

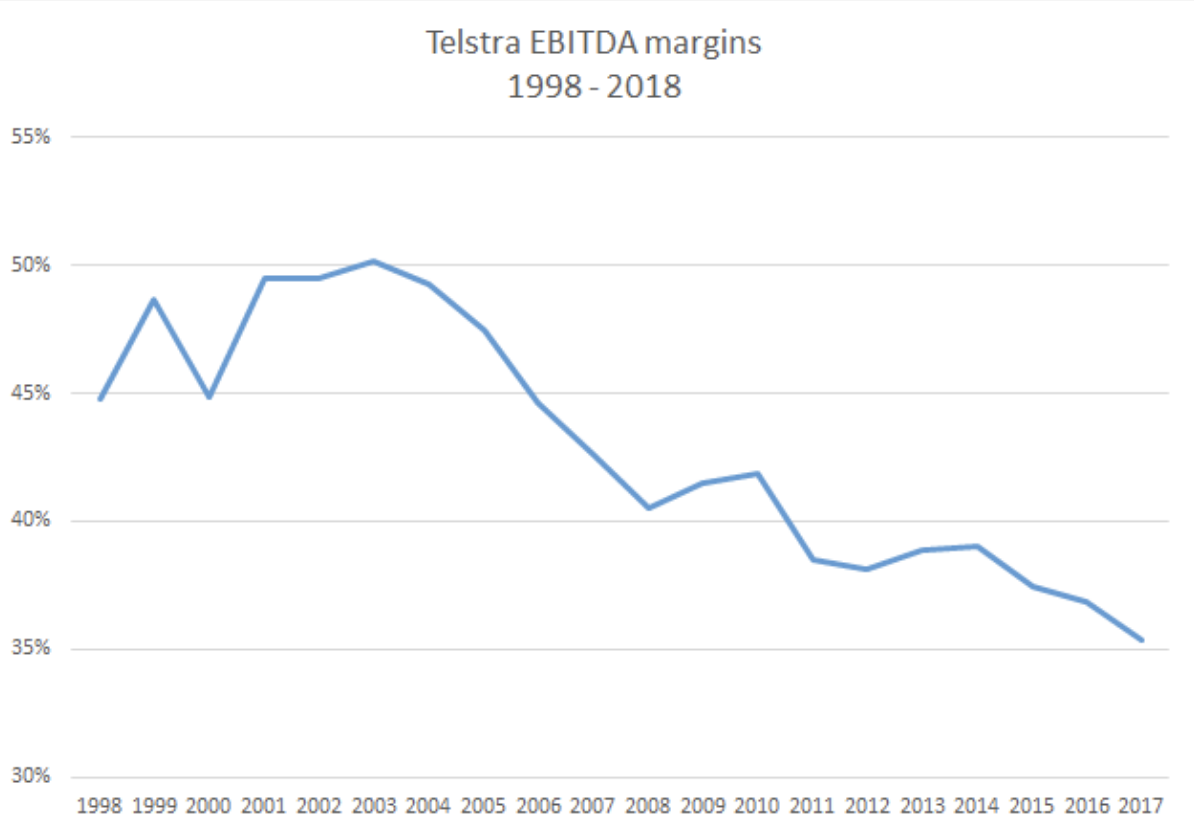

Combine that with falling margins, and things start to look a little bleak at the bottom line.

A key culprit is, of course, the National Broadband Network (NBN), and the shift in competitive dynamics it has unleashed.

Telstra signed an agreement with NBN Co. in June 2011 which would see it progressively disconnect customers from its network, and transfer much of the network infrastructure to NBN Co.

In return, Telstra gets a one-off payment for every customer disconnected from its network, a figure approaching $2 billion this year and next. Payments will progressively wind down until the end of the migration period in 2020. Telstra also receives recurring payments for use of its ducts, backhaul and exchange racks, which is anticipated to be close to $1 billion annually by the next decade.

While that’s a good chunk of change — stated at $9 billion in net present value back in 2010 — it means that Telstra no longer enjoys a wholesale monopoly status and the pricing power that imparts.

It also creates a ‘churn event’, whereby typically lazy consumers are far more likely to consider alternative providers when forced to use the NBN. Not every customer that switches to the NBN stays with Telstra, and new accounts are increasingly being won by competitors. Moreover, all this competition is driving prices — and margins — much lower.

It’s a similar story in the mobile space. There are now around 180 mobile providers in Australia operating off three wholesale networks. More than half of new contracts sold in 2017 went to smaller resellers, and I believe things will get even more competitive when TPG finishes its mobile network roll out.

Mobiles are 40% of Telstra’s total operating profit. With a high fixed cost base, it wouldn’t take too take much of a squeeze on margins to really hurt the bottom line.

The simple fact is that stagnating sales combined with lower margins are a toxic combination and one that will be made worse when one-off NBN payments start to roll off.

With a $4 billion-odd annual commitment to capital expenditure, significant one-off restructuring costs, not to mention recent asset write-downs, the balance sheet has little capacity to absorb the expected drop in earnings, which leaves the dividend in a perilous state.

So, things appear rather dire.

Nevertheless, although there’s a very real risk that Telstra ends up becoming a much smaller, less profitable operation, no one is suggesting Telstra is on its way to zero. Logically, then, there’s a price at which it becomes a compelling proposition.

The question is: after a more than 50% drop over the last few years, are Telstra shares now, finally, cheap enough?

Well, that ultimately depends on whether Andy Penn and his team can deliver results with the latest strategy; Telstra2022.

An improved and vastly simplified product offering, underpinned by a market leading network, promises to keep Telstra very much relevant to consumers. And with a solid investment in 5G, I think there’s a lot of value to be captured.

When combined with assets sales (potentially including the newly created InfraCo), Telstra could well end up being a far more focused business, and one with a greatly strengthened balance sheet.

But if earnings are to hold up the company will need to extract every last cent of the announced $2.5 billion in cost savings. There’s undoubtedly a lot of fat to trim, and although major transitions like these almost never run smoothly, it could go a long way to plug the earnings ‘hole’.

So, if Mr Penn’s new strategy bears fruit, and if all cost savings are fully realised, you can make the case for value. Even if the dividend is cut in the meantime.

Such a vision could see Telstra with $9 billion in operating profit (EBITDA) in 2022, about what is expected next year. Without the present uncertainty, that could easily support a share price well above $3. That, combined with even a 14c annual dividend, would be enough to provide a more than 10% average annual return.

There’s certainly a huge amount of execution risk, but I actually like the new strategy and think it’s the right move. It’s certainly doable.

Telstra has great assets and a strong market position. The industry will undoubtedly see the demand for data, voice and IT continue to grow.

Telstra is currently throwing off $4 billion in free cash flow per year, and that should get support as some of the increased capital expenditure tapers off. Finally, barring an irrationally competitive landscape, margins are approaching a point where things will start to get uneconomic for many competitors. Hence, they won’t want margins to compress too much further.

The investment case is even stronger for those that have more of an income focus. If viewed as a “bond”, Telstra’s really not so bad.

That being said, the upside isn’t huge. Even if things go as hoped for Telstra, it’ll likely be a long time before shares have a $4-handle on them. And the downside is certainly not insignificant.

Risk & Reward

It’s far from impossible to imagine a future where cost cuts are not fully realised, market share continues to wane and margins come under increased pressure. Under such a scenario, depending on the extent of the deterioration, shareholders may be looking at a 2022 share price of less than $2.

So, although I tend to think Telstra will prove a worthwhile investment from here, I’d personally need a bigger margin of safety before I was compelled to buy. That’s mainly because I’m trying to weigh this up in terms of opportunity costs, and I believe there are simply better options for my investment capital right now (see my Strawman profile for my current recommendations).

In making your own decision, I think it’s key to ignore, as best you’re able, the 50% plus share price decline suffered since 2015.

That sorry fact doesn’t speak to Telstra’s current prospects, nor does it automatically imply value. In anchoring to this past performance we’re liable to further compound our misery.

That may be by holding firm — or worse, doubling down — on a stock that is set deliver sub-par long-term returns. The market is littered with the broken dreams of #Hodlers.

Or, it may be by capitulating at the worst possible moment. There are plenty of value investors that did very well between 2010 and 2015, where Telstra’s share price more than doubled. (A period, by the way, that saw the telco deliver flat sales and profits. That is, it was pure multiple expansion.)

Whatever your decision, best of luck. It’s not an easy one.

Get More Insights On Strawman – Australia’s Premier Investment Club

This article contains general financial advice or information only (under AFSL: 501 223) and should not be relied upon. This information does not take into consideration your needs, goals or objectives. Therefore, you should consult a licensed financial adviser before acting on any of the information presented here. Past performance is no guarantee of future returns. Andrew Page and Strawman hold no positions in any stocks mentioned.