On Monday Perth-based property and apartment developer Finbar Group Limited (ASX: FRI) released a public update to investors forecasting an improved profit performance in its 2018 financial year.

Finbar Group is a $260 million apartment developer with operations in the metro area of Perth and the mining region of Karratha.

Earlier this year, Finbar said it would produce a profit of $12 million in its 2018 financial year, which ends June 30th 2018. However, it now believes profit will be higher, at around $14 million.

“We are pleased to report that we are seeing signs of an improving market and settlements at our Aire and Aurelia projects went smoothly, which has helped improve our guidance numbers,” Managing Director Darren Pateman said.

“More encouraging conditions in the Pilbara have also helped reverse the revaluation impairment cycle which we have experienced for several years,” Pateman added. “As a result we are pleased to provide our updated guidance and announce a final dividend of 3c per share.”

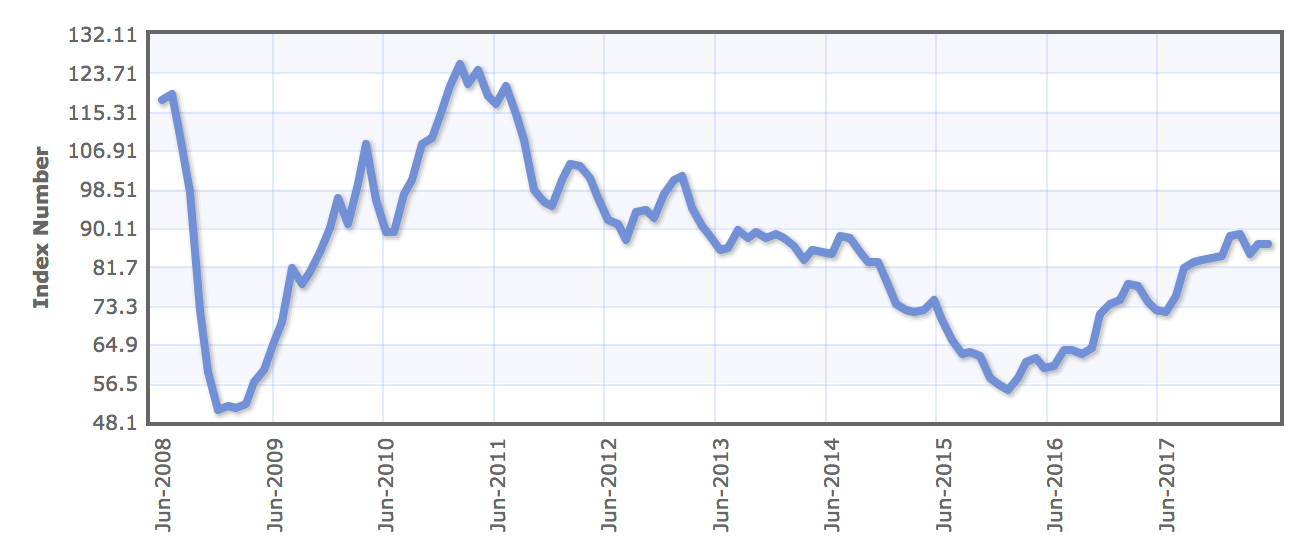

Following the fallout in the prices of commodities like iron ore, copper and aluminium, activity in rural mining towns across the country grounded to a halt as big miners cut their contracting workload.

As can be seen in the chart above, which shows the IMF’s Commodity Metals Price Index, the prices of some commodities had come under pressure in recent years.

West Australian companies will be helping the recent strength in commodities can continue.

Finbar shares traded 5% higher on Monday, according to Yahoo! Finance.