60 Minutes call it “Bricks and Slaughter”.

Channel 9 wrote: “We’re all to blame for [the] looming housing market crash”.

The medium to the truth, news.com.au, says, “60 minutes reveals you could lose 40% of your home’s value”.

Lucky for me, the Rask family household is fully locked and loaded with tins of SPC’s baked beans (salt reduced, of course).

On second thoughts, who am I kidding, we’re renters!

What is Going On?

There’s been lots of speculation about falling property prices this week.

So let’s block out the noise and focus on the facts of Aussie property…

For the most part, Australian property prices have risen strongly over the past few decades.

Indeed, since the most recent Aussie recession (in the early 90’s), which almost saw the collapse of Westpac Banking Corp (ASX: WBC), homeowners and investors in capital cities have enjoyed a tremendous run-up in prices.

In 2018, however, it appears the non-stop growth in property prices has — at least — slowed. According to Corelogic, property prices fell for the 11 months through August.

I’m acutely aware of the cyclical nature of property prices, as all Rask Investor Club readers would be. However, it’s the longer term trends and expectations that concern me.

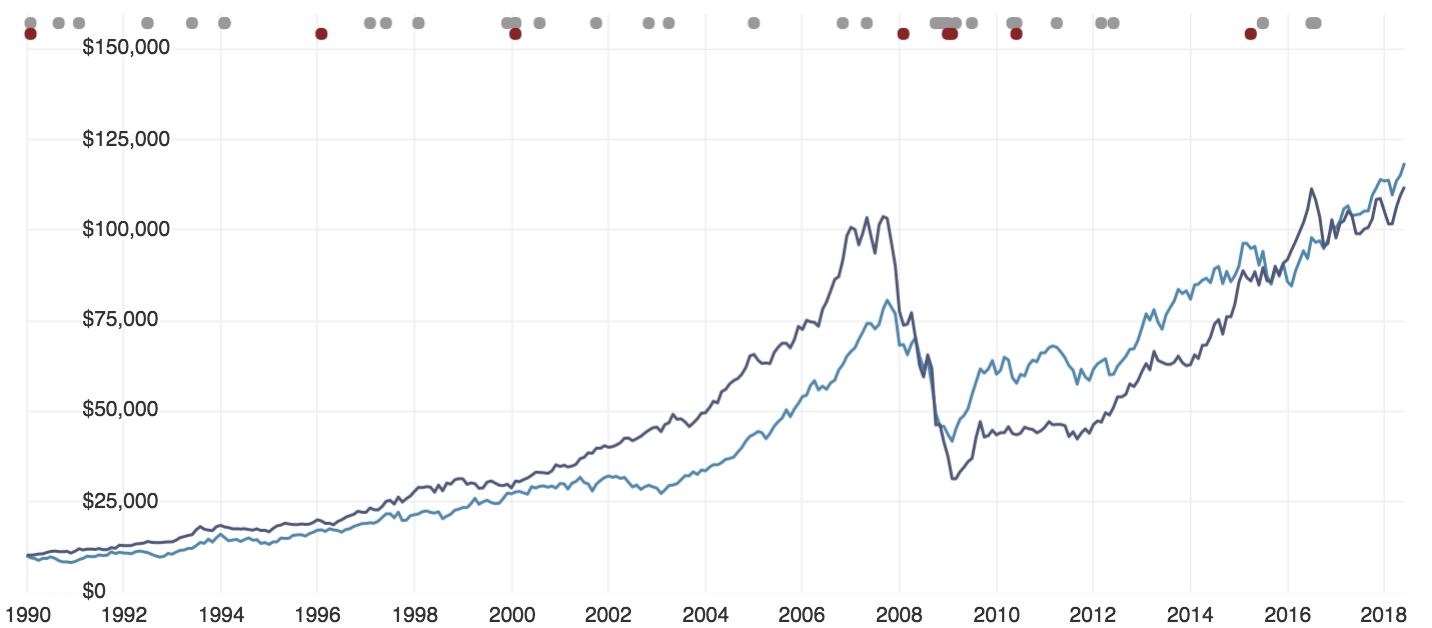

According to the data compiled for Vanguard Australia’s interactive chart, Australian property has returned a touch under 9% annually between January 1990 and September 2018. $10,000 re-invested at an average of 9% would have become more than $100,000 today. That’s impressive.

Of course, that figure excludes the impact of taxes, fees and inflation — each of which is a real thing and must be accounted for.

Drivers of Growth

I would happily settle for a 9% yearly return from property going forward.

But before anyone pawns a kidney to buy property let’s remember that during the period from 1990 to today we’ve seen, according to data from ABS viaTrading Economics:

- Interest rates fall from almost 17% to 1.5%

- A population explosion, from 17 million Aussies to over 25 million – that’s a 47% increase in beds!

- Average wages rising from $450 per week to around $1,200 (a 160% increase)

In simple terms, that means the debt used to buy property got a lot cheaper, demand for space has never been higher and most Aussies received a massive pay rise. In addition, various reports appear to suggest that urban density (more people fitting into the same spaces) and overseas investment have played a part.

Can house prices keep growing by almost 9% per year for the next 10 years?

Forecasts are — at best — educated guesses. No-one knows for certain what will happen in the future. Past performance is not a good indicator of future performance, the important disclaimer reads. But in my opinion, we’re unlikely to see 9% p.a. returns from Australian property over the coming decade. From these levels anyhow.

Why?

Well, let’s think about the drivers of historical growth and stare into our crystal ball towards the future:

- Interest rates are already at record lows. Dropping interest rates from 17% to 1.5% has a bigger impact on affordability than dropping rates from 1.5% to 0%. And let’s not forget the banks don’t have to pass on lower rates to borrowers. As we’ve witnessed recently, banks can raise rates to protect their profits — regardless of what the central bank (RBA) is doing.

- Population growth is likely to continue. Australia is still the best country on earth, so I think our population will keep rising thanks to organic growth (more babies) and acquisitions (migrants).

- Average wages growth could remain lower for longer. At a touch over 2% per year, wages are growing at a slower clip than during the last boom and bust (i.e. the lead-up to 2008). Wages should grow over time — some states are showing positive signs — but there are many factors to consider.

Supply & Demand

One factor I have neglected to mention thus far is supply and demand. Apartments in some major cities are widely believed to be in a state of oversupply. More supply with the same or less demand equals lower prices. That’s economics 101.

However, good quality properties are almost always in demand because they either can’t be built fast enough or cannot be replicated (e.g. homes in a good location). Meaning, new supply shouldn’t have as much of an impact on prices.

Ultimately, these types of properties should remain in favour throughout the cycle. That’s not to say they won’t fall in price, they will likely follow the market lower, but to a lesser extent.

Will Prices Really Fall By 40%?

Unlike the 60 Minutes crew, I’m not predicting a 10%, 20% or 40% fall in prices. At the end of the day, those numbers are simply the guesswork pushed by media outlets to sell papers and advertising space.

In my opinion, property will continue to be one of the core investments for many Australians, and rightly so. However, as with all investments, there will be good, bad and ugly times to own property. The key to success is surviving — and thriving — in a market downturn, in my opinion.

I think anyone can do that by being prepared for the worst and hoping for the best. In other words, don’t get wiped out.

It’s not about timing the market, it’s about time in the market.

Ways To Weather A Downturn

Looking at property markets now, I think it’s more important than ever to avoid being stuck with high amounts of debt and reassess growth expectations.

Moreover, think strongly about diversification (click here for a video explainer of diversification). Don’t be the guy (or girl) who bets his job (e.g. as a construction worker), the family home and investment portfolio on the idea that ‘property prices can’t go backward’ or that ‘prices double every seven years’. Neither of those things is true.

As always, I believe the keys to surviving and thriving a market downturn include:

- Keeping 6 months’ worth of living expenses set aside in a low-cost high-interest savings account (for emergencies)

- Never buying off the plan — let the builders fund their own projects!

- Having adequate insurance protection inside and/or outside of Super

- Investing in property and Australian and international shares for the long run (that is, diversify outside of Australia!)

- Understanding that most financial markets move in 7 to 10-year cycles, and

- Seeing the forest (the market) from the trees (the individual property you own).

Again, no-one knows exactly what the future holds — even the big wigs on current affairs programs.

Nonetheless, I believe it pays to think long-term, always have a cash buffer and be honest with yourself about the risks of investing. Only then should the potential rewards of any investments be considered.

See How I Do It

If you want to see how I have structured my budgets, the bank accounts and insurers I use, and the investments I’m making click here.

Cheers to our financial futures!

Owen Raszkiewicz

Lead Adviser, Rask Invest

Twitter: @owenrask

Disclaimer: This blog post first appeared on The Rask Group’s website, www.raskfinance.com/blog. The information included here is general information only and should not be considered as personal financial advice. The information does not take into account your needs, goals or objectives, so don’t rely on the information to make a financial, taxation or legal decision. Please read The Rask Group’s full disclaimer on the Rask Finance website.