Bank of Queensland Limited (ASX:BOQ) has reported its annual result ended 31 August 2018.

Bank of Queensland is one of Australia’s largest regional banks with 44% of its loan book based in the sunshine state.

3 Key Facts:

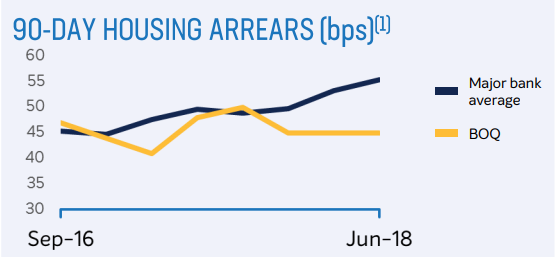

1: Bank of Queensland’s said its loan arrears are stable compared to worsening numbers for its big bank peers.

A key talking point for bank investors has been that the major banks are reporting rising loan arrears, such as in the recent Commonwealth Bank of Australia (ASX: CBA) FY18 report.

Bank of Queensland attributed the stable arrears as a direct consequence of “clear risk appetite and responsible lending practices”.

[emaillocker]

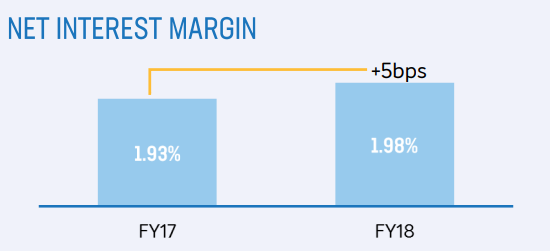

2: Bank of Queensland noted an improved net interest margin (NIM), unlike some other banks.

The ‘NIM’ is a key profitability figure for banking analysts because it is the margin the bank is making on the loans given customers compared to its own costs to lend the money. An improving NIM may be seen as a surprise because of rising funding costs for the industry.

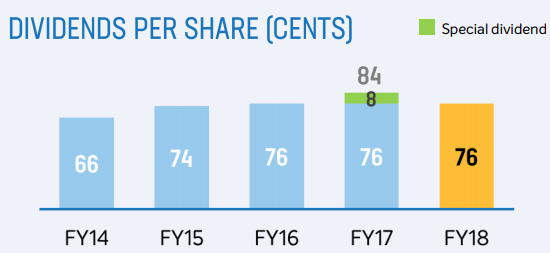

3: The bank revealed its ordinary dividend was maintained.

A special dividend was declared last year due to the sale of a vendor finance entity. However, the bank said its normal dividend was maintained at 76 cents per share. Meaning, it will pay a final

dividend of 38 cents per share.

Some of the other headlines from the report included:

- Total income grew by 1% to $1.1 billion

- Underlying profit before tax down 1% to $583 million

- Cash profit down 2% to $372 million

- Cash profit per share (EPS) down 3% to 94.7 cents

Bank of Queensland CEO Jon Sutton said: “BOQ has transformed into a resilient, multi-channel business that is geographically diverse and serves a broader range of customers.

We have continued to manage the business for the long term, investing in the digitisation of our operations and modernising our technology infrastructure.”

Outlook

Mr Sutton said that although the industry faces a “number of headwinds”, the bank is focused on its strategy.

He was particularly pleased with the acceleration of growth in the business segments and Virgin Money Australia.

CEO Sutton believes the bank is in good health, saying: “Our asset quality remains sound and signals the enhanced resilience that has been built into the Group’s balance sheet.”

The Bank of Queensland share price has risen by nearly 3% in early trade.

[/emaillocker]

Like Finance? Listen To The Best* Finance Podcast On Earth

The Rask Group’s Australian Investors Podcast is fast becoming Australia’s #1 podcast for serious investors. It provides unique insights from Australia’s best investors, entrepreneurs, authors and financial thinkers. Download the latest episode free on iTunes, Castbox, YouTube or wherever you choose to listen.

Here’s a timeless interview with former stockbroker, Charlie Aitken.

*As voted by us