Commonwealth Bank of Australia (ASX: CBA) shares are owned by more than 800,000 Australians with millions more inside Super.

Many of those shareholders probably had or got their home mortgage through the bank. Some of whom are probably employees of the bank. Many of whom might also invest in property with the help of the bank.

Before I go any further, I have little to do with Commbank or CBA — our business banks with NAB (ASX: NAB) and I bank with another bank — the one I’m about to introduce you to. We have no commercial interest in any of them.

As I was saying…

From the outside looking in, I’m constantly concerned that many Aussies have a substantial portion of their investment portfolio, livelihood (house) and potentially their income and investment properties dependent on one economy and even one institution. That’s my motivation for writing this article.

Here’s a name that’s probably familiar to you, ING Groep NV (NYSE: ING). I’m guessing almost all of you don’t own shares in it (at least directly).

Commbank Versus ING Bank

What do they do?

Commbank: Commonwealth Bank of Australia or CBA is Australia’s largest bank, with commanding market share of the mortgages (24%), credit cards (27%) and personal lending. It has 16.1 million customers, 14.1 million are in Australia. It is entrenched in the Australian payments ecosystem and financial marketplace.

ING: ING Groep is a Dutch company with market-leading positions in the Netherlands, Belgium and Luxembourg. With 37 million customers it operates in 40 countries. It considers itself a challenger bank in Australia, despite having 1.5 million customers and growing. In 2017, Global Finance Magazine ranked ING the number-one bank in the world.

Profits & Dividends

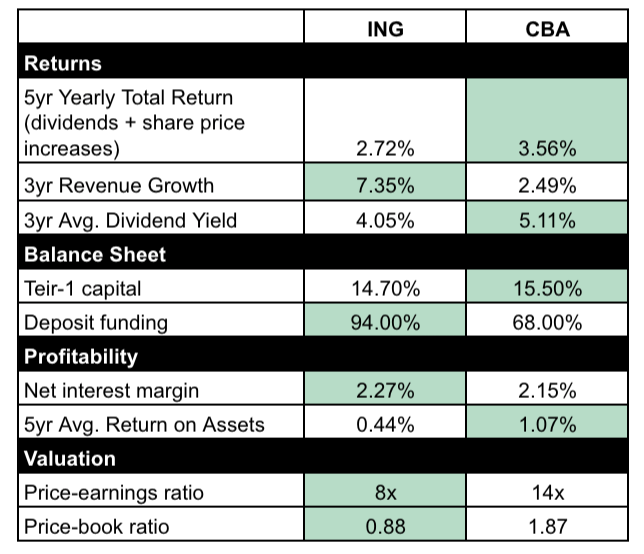

Here are the key stats you might want to know before digging in a little deeper:

Contrary to what many people believe, European banks have come back a long way since the GFC.

Indeed, ING has fully paid back all stimulus lent to it by the Government (with EUR3.5 billion in interest!) and significantly restructured its business. All-the-while, it has paid a respectable dividend to shareholders.

What am I trying to say? Aussie banks aren’t the only banks that pay generous dividends.

Trouble spots

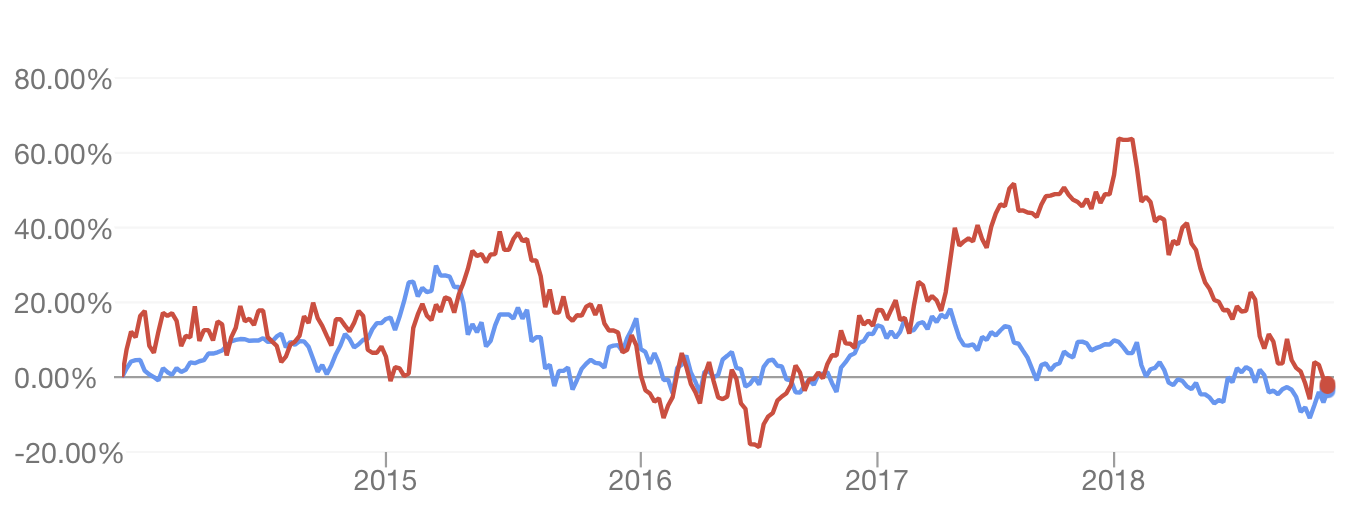

As you can see in the chart above, it was only recently that ING shareholders began to significantly underperform CBA shareholders on a relative basis.

The reasons behind the vicious sell-off appear to be two-fold (as far as I can tell).

Firstly, money-laundering scandals. ING recently reported a drop in profit due to charges brought forward over money laundering.

Secondly, ING has exposure to Turkey. Its economy is in the doldrums. Turkey accounted for around 1.6% of bank assets in 2017, but it is a tail risk.

CBA is not immune to risks either.

The Australian housing market needs to cool down over the next five years and in my humble opinion, we should see defaults from homeowners pick up considerably, especially if we see a return to normal levels of interest rates.

That’s not a prediction of doom and gloom, more an economic reality that house prices can’t go up forever; millions of Aussie households are also in a precarious position and government folly following the next election could send our target of an economic surplus down the dunny.

Better Buy: ING or Commbank

In my opinion, it’s too early to act on ING’s recent share price fall.

Value investors have an issue with knowing the difference between being wrong and early. And unless you have done a substantial (and I mean substantial) amount of research into ING’s strategy and modelled outcomes appropriately you could end up being both wrong and early.

Commbank shares are still too expensive.

Sure, you could buy some shares for dividend income, but in the absence of cost-outs from its investments in tech, growth could be hard to come by. In my view, there are 2,000 other companies on the ASX and (as I hope you have seen in this article) many thousands more overseas that are at least comparable and arguably serve to diversify your exposure to the Australian economy. I own a company that I think could one day be a much bigger money manager than CBA.

Coming full circle: given the Aussie economic outlook for the next five years, I think it’s worth considering where your overall finances are allocated (not just your share portfolio!).

P.S. I’ve just released a free report which reveals 3 ASX shares I would buy for the right price. They’ve proven themselves to be reliable dividend + growth shares. Of course, past performance is not indicative of future performance but as I say in my free report, there are many reasons to keep a close watch on these 3 shares in 2019 and beyond.

Click here to access my free report. No credit card details or payment required.

Disclaimer: Any information contained in this article is limited to general financial/investment advice only. The information has not taken into account your specific needs, goals or objectives, so please consider consulting a licenced and trusted adviser before acting on the information. Please read The Rask Group’s Financial Services Guide (FSG) for more information. This article is authorised by Owen Raszkiewicz of The Rask Group, which is a corporate authorised representative No. 1264179 of Strawman Pty Ltd (ACN: 610 908 211) (AFSL: 501 223). Owen Raszkiewicz does not have a financial or commercial interest in any company mentioned.