Westpac Banking Corp (ASX: WBC) shares have trickled lower and lower throughout 2018 – they currently trade around $26 but started the year around $31.

Westpac Banking Corporation, more commonly known as Westpac, is one of Australia’s ‘Big Four’ banks along with Commonwealth Bank (ASX: CBA), National Australia Bank (ASX: NAB) and ANZ Banking Group (ASX: ANZ). Westpac is one of Australia’s largest lenders to homeowners, investors, individuals (via credit cards and personal loans) and businesses.

3 Reasons I’d Consider Selling

For the record, I don’t own Westpac shares, nor any of the other Big Banks. I think they are great businesses with strong moats and fierce competitive strengths. However, like all businesses they do have their limits.

Nonetheless, if I did own Westpac I might consider selling at least some of my holding. Here’s why…

1. Investor Lending

There’s been a lot of talk about the ‘interest only cliff’.

Meaning, a few years ago people were falling over themselves to sign up for loans which allowed them to repay only the interest component of the borrowing. For example, a $500,000 loan taken out 3 years ago would still be worth $500,000 today – the borrower was only on the hook for the interest (e.g. 5% per year). That is, until the loan needed to be refinanced a few years later (now).

There are some spooky stats about “I/O” lending swirling around in the financial media’s cauldrons. Most likely, it’s overblown to make you click. But like all of the big ‘tail risks’ it’s a low-probability-high-impact issue that must be factored in when you position your portfolio.

According to APRA banking stats, 37% of Westpac’s household lending goes to investors. That compares to 31% at Commbank.

Around a year ago 45% of Westpac’s mortgages were interest-only. In September 2018 it was 34.8%. Commbank’s level of interest-only loans was 30% as at June 2018.

What this means is Westpac’s lending appears more exposed to a retraction in investor lending and the supposed interest-only cliff.

2. Property Prices

Property prices are being squeezed for a few reasons but I’m not convinced we’ll see a major crash anytime soon.

Nevertheless, slower property price growth will have a negative effect on the demand for credit/loans from banks. In the simplest terms possible, all banks need to grow their assets (loans) and widen their net interest margin (the amount earned from each loan) to be successful.

I have strong reason to believe that investors — especially those invested in apartments or ‘income’ properties — are typically the first out the door when times get tough. If that’s true, Westpac could find it even harder than others to grow its assets/loans — without sacrificing on quality.

As a business Westpac can ‘cost out’ its way to profit growth. Meaning, it can cut costs to grow its profit.

Bottom line, I expect slower — or no — growth in property prices will make it much harder for the bank to grow its revenue in coming years.

3. Valuation

A simple back-of-the-envelope valuation anyone can do to value bank shares is something called a dividend discount model (DDM). I explain all the major valuation techniques (and provide a template) in Rask’s free valuation courses.

Here’s how it works… let’s say Westpac’s annual dividends are sustainable. It has paid $1.88 per share in dividends for three years running, but keep in mind that’s been during a great bull market.

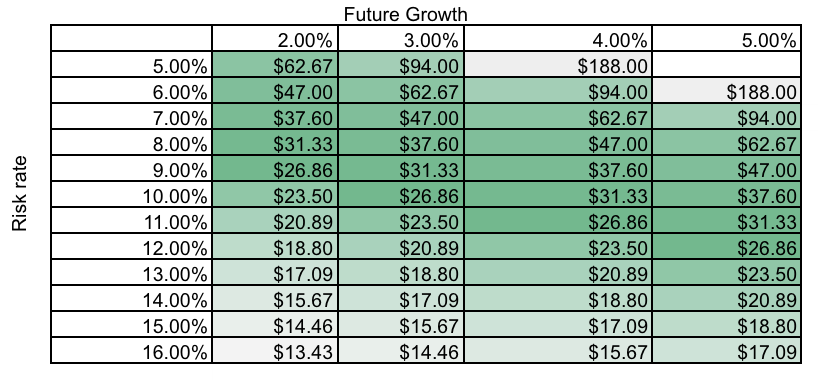

The following table shows the valuation of Westpac shares under different assumptions of risk (left-hand side) and long-term growth (top row).

Of course, the garbage-in-garbage-out rule applies to this valuation. For example, expecting long-term future growth of 5% forever is a very tall order. Further, run away from any analyst who uses a risk rate below 7% to value shares.

In my opinion, a back-of-the-envelope fair value for Westpac shares is below $25. Some might argue that franking credits are worth something and that would boost the valuation.

For example, a tax-adjusted dividend might mean the appropriate dividend in the model should be north of $2 per share. Having said that, I could labor on the reasons why franking credits shouldn’t be your focus in the coming years.

Bottom line Westpac shares do not appear to be great value at today’s prices.

Buy, Hold Or Sell

I have some strongly held views when it comes to investing in shares. These have guided me well for many years.

The first is making sure you don’t get wiped out. For most investors that means having 6 months of cash for living expenses and avoiding letting your portfolio become overly concentrated to one sector or theme.

Second, if you’re a long-term investor you can afford to be choosy. Don’t just accept the status quo. Go for companies with great (not ‘good’ but great) long-term prospects, with defensive features, run by excellent management. If you’re a genuine long-term investor, feel free to pay up.

In my opinion, with over 2,000 companies on the ASX and many thousands more overseas, Westpac is not a company I need to buy at today’s prices. And if a relative I didn’t know suddenly passed away and left me some shares I’d probably sell them.

If you’re looking for 3 ASX dividend + growth shares I would buy for the right price, keep reading below…

[ls_content_block id=”14945″ para=”paragraphs”]