We’ve all heard of the ASX small-cap superstar success stories like Afterpay Touch Group Ltd (ASX: APT).

So far, Afterpay’s sharemarket success has some investors thinking it’s the next Amazon.com Ltd (NASDAQ: AMZN) or Netflix Inc (NASDAQ: NFLX).

While the jury is out on Afterpay (I don’t own Afterpay – at this time), there are a few things all investors need to know

before they go in search of the elusive ‘multi-bagger’.

The next five investing tips might help you spot the next big thing before it hits the front pages of the AFR, but they’re more likely to save you money.

1. What Cash Flow?

Most small companies talk a big game when it comes to potential yet they don’t have the cash flow to save themselves.

Specifically, I’d be a very rich man if I had a dollar for every time I heard a CEO say ‘look at the market opportunity!’ but have $0 in cash flow.

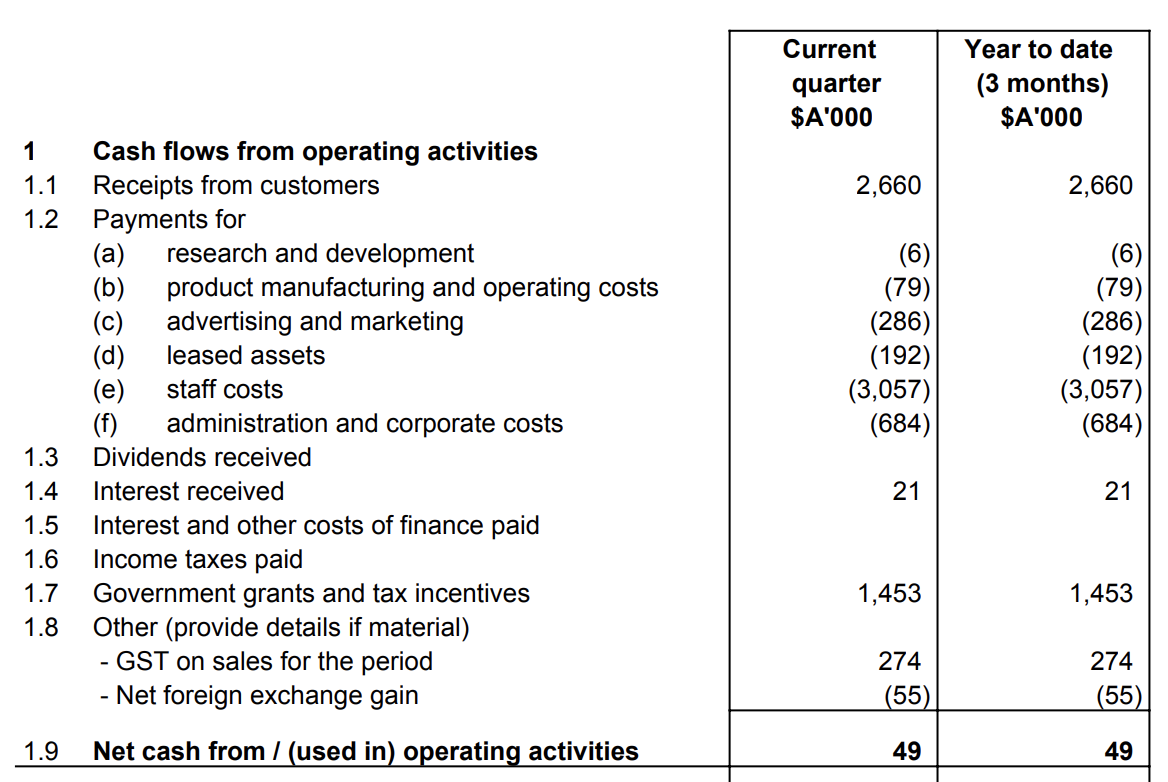

Cash flow is the single most important ingredient in any business. Specifically, you’re looking for cash flow from customers. Here’s a screenshot from HR and recruitment software company Xref Ltd (ASX: XF1).

As you can see, in the three months to September 30th 2018, Xref generated $2.66 million of cash flow from customers.

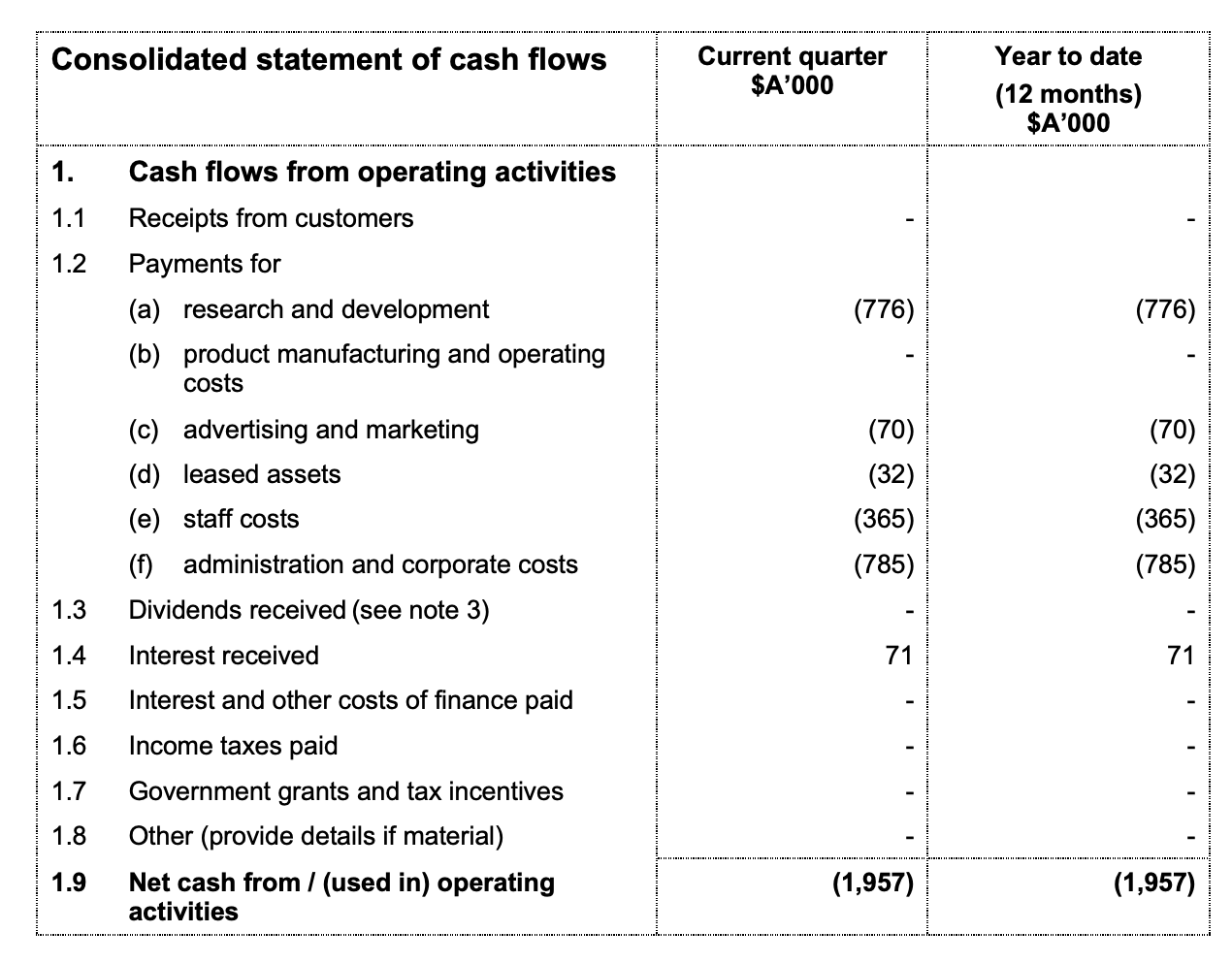

Compare Xref’s cash flow from customers to that of pot stock Auscann Group Holdings Ltd (ASX: AC8):

As you can see, Auscann didn’t earn any cash from customers during the same quarter, yet the company is worth more than Xref (given the current market capitalisation). Some savvy investors may also argue Auscann has far less potential than Xref!

The important thing to remember is that companies which aren’t generating cash flow need to get it from somewhere.

In my opinion, the best sharemarket opportunities already have cash coming in the door. And even if you miss some of the share price growth before the cash flow shows up, I’m willing to wager it’ll be a more prudent strategy over many years to wait for the company to deliver.

2. Management

If you’re the CEO of Commonwealth Bank of Australia (ASX: CBA) you may be able to get through your three-year tenure doing virtually nothing new for shareholders, walk away with millions in your pocket and leave the company in decent shape.

However, if you invest in a company which has just 30 employees and is managed by a CEO who doesn’t have the right alignment with shareholders and the requisite skills to make the correct decisions — your business will be out of business in no time.

Spending some time reading through a company’s annual report and in particular, the section on remuneration and incentives is absolutely vital (tip: if you’re lazy like I am, press CTRL + F to search the PDF for “remuneration”).

I like CEOs and managers with lots of ‘skin in the game’ and long-term incentives based on profit per share.

3. Avoid Crap Businesses

If the business you’re eying up needs lots of cash or debt to grow, or it operates in a market with many competitors of equivalent strength and potential, it’ll be tough for your business to multiply your money.

Companies in the resources sector, biotechnology (hello clinical studies and legal bills) or manufacturing have a tougher time of being a success relative to capital-light companies or businesses which are already operating.

Legend Corporation Ltd (ASX: LGD) is an example of a very small company with an established franchise. It’s not a ‘high flying tech stock’ but it’s a reliable dividend payer which hasn’t had to issue bucket loads of shares to grow profit.

Tip: use a mental tool like Porter’s Five Forces to get the lay of the market environment when you’re sizing up an opportunity.

4. Stick To What You Know

Buffett calls this his ‘Circle of Competence’, others call it common sense.

You’re far more likely to make a mistake and lose money if you don’t put in the work to read about the company, understand the market opportunity, the product and the competitors. Sticking to what you know also helps you sleep easy at night.

For example, if you don’t understand Afterpay’s product, its market potential or how it could go wrong, it’s probably not a good idea to buy its shares. If you do, you’ll panic at the first sign of a sell-off or bad news. Believe me, the bad news is far more common than good news!

5. Debt Free Means ‘Free Kick to You’

Finding companies of any size that do not have loads of debt is a free kick in investing.

Take a look at CSL Ltd (ASX: CSL) a few years ago — before it started taking on debt to improve its returns to shareholders via buybacks and leverage.

Finding a company without debt is just smart. Good businesses grow with debt, sure. But great businesses don’t need it. And debt can be added down the track, should the company wish to boost shareholder returns.

Of course, there are exceptions to the rule but when you’re investing in a risky part of the market (small caps), why not start with companies with an A+ balance sheet?

Summary

These five tips are a good starting point to filter out potential traps when you’re investing on the ASX but they are just the beginning. If you want the names of 1 ASX small cap I bought this year (and another one I might buy soon) keep reading…

[ls_content_block id=”14947″ para=”paragraphs”]

At the time of publishing this report, Owen Raszkiewicz does not own shares in any company mentioned.