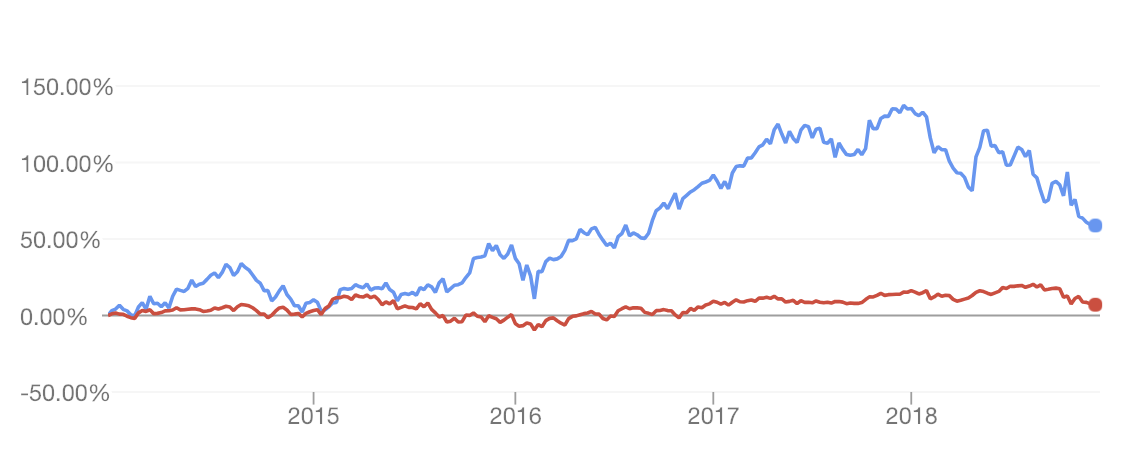

Challenger Ltd (ASX: CGF) shares have substantially outperformed the Australian sharemarket or S&P/ASX 200 (^AXJO) (INDEXASX: XJO) over the past five years.

I want to start off by saying: I won’t be buying Challenger shares in the foreseeable future, for the reasons I’m about to discuss. Having said that, I could be completely wrong about the shares (it wouldn’t be the first time!).

Challenger Shares (blue) Versus ASX 200 (red)

Past performance is absolutely not guaranteed.

Past performance is absolutely not guaranteed.

Who Is Challenger?

Challenger is Australia’s largest provider of ‘annuities’, which are financial products typically sold to retirees who seek reliable income. Challenger was established in the mid-80’s and listed on the ASX in 1987.

In 2018, Challenger managed more than $90 billion between its investment portfolio, which is the sum of the money invested by retirees who buy annuities, and its fund management business.

It’s different to QBE Insurance Group Ltd (ASX: QBE), Magellan Financial Group Ltd (ASX: MFG) and a bank, but it’s similar to each of them.

Why 99% of Investors Own Challenger Shares

Here’s where my concerns start to emerge…

It seems to me that no ordinary shareholder can tell me exactly how Challenger makes money, the risks facing the business and how to evaluate it. Here’s what shareholders tell me:

- “It pays a dividend”

- “Australia’s superannuation system is worth trillions”

- “Challenger is the number-one annuities provider”

To be sure, I’m not suggesting shareholders need to know the ins-and-outs of derivatives, annuity pricing or need to be mathematicians.

However, I believe understanding what a business does is the single most important factor that determines success in investing.

For example, I couldn’t tell you which PayPal algorithm is most secure but I owned Paypal (NASDAQ: PYPL) shares after it was split from eBay Inc (EBY).

Compared to Challenger’s business I find PayPal’s operations to be very transparent and relatively easy to scrutinise. For example, if fraud goes up, competition increases or bad debts rise, chances are you’re going to lose money if you own PayPal shares. You don’t need to ‘take management’s word for it’ to know that.

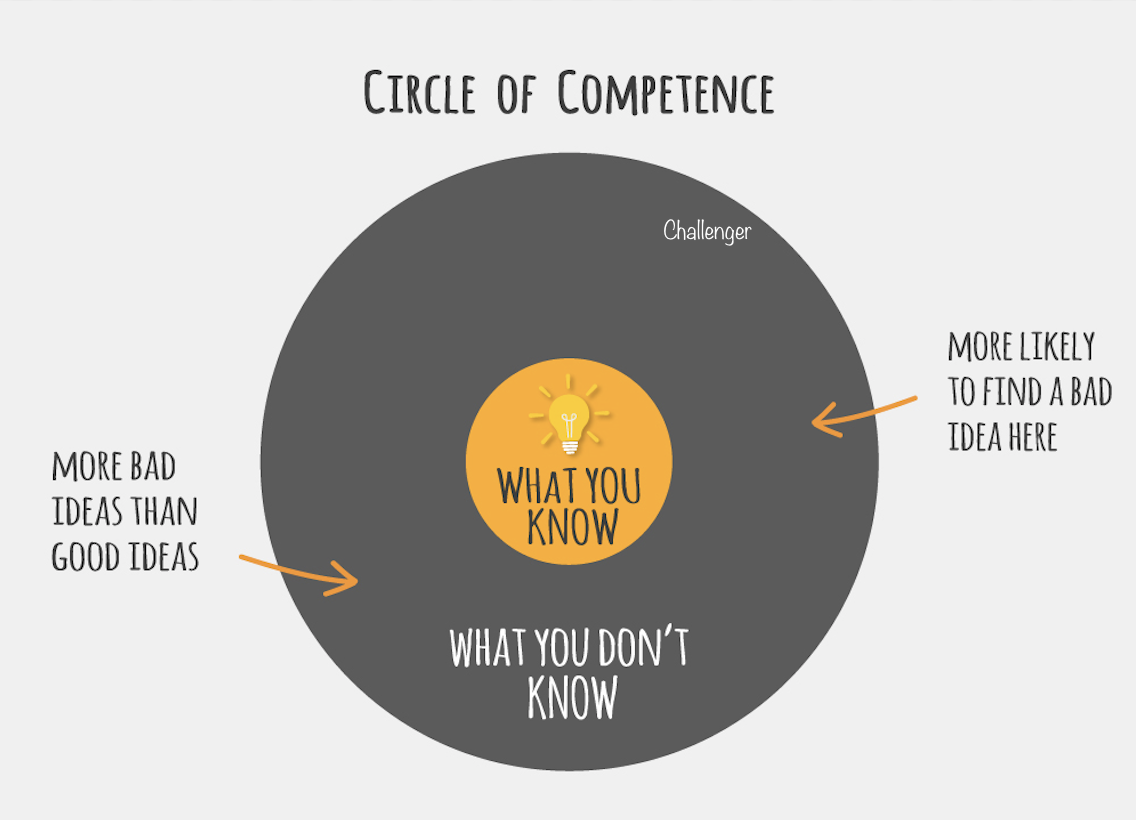

Warren Buffett and Charlie Munger refer to an investor’s “circle of competence”.

Ultimately, knowing what’s inside your circle of competence is difficult to determine, and every investor is different because your inner circle is based upon experience, hard work and technical skill.

A circle of competence can probably be best summed up by the phrase, ‘know what you own and why you own it’. I believe investing in what you know is a much more effective and less stressful way to manage my money.

So if the reason you own Challenger shares is due to its growing annuities portfolio, I think it’s important you understand how those work and the risks associated with them.

What is an Annuity?

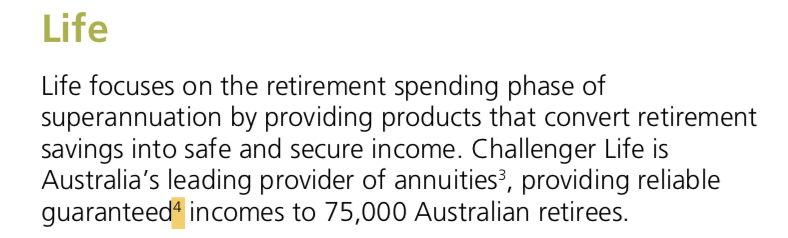

In the simplest terms, an annuity is something a retiree would buy from Challenger. Challenger takes that money and invests it in a way that it believes it can generate a “Guaranteed” income stream.

The TV advertisements for annuities make it look and sound better: “…a Challenger annuity pays a guaranteed income safe from market crashes”.

Here’s a snippet from the Challenger 2018 Annual Report:

How does Challenger guarantee returns?

When it takes money from retirees, Challenger ‘matches’ the money coming in against investments which should sustain the payments back to the retiree. As you would expect, Challenger pools client money, invests for the long-term (don’t we all), pays its staff, tax, a dividend and hopes to grow.

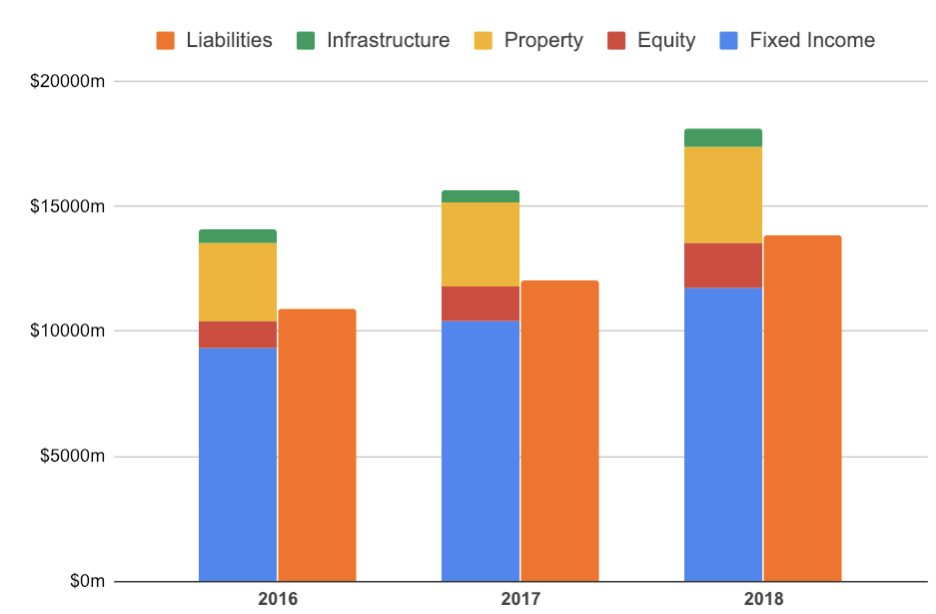

Most of Challenger’s liability to retirees is matched against cash and fixed income / bond investments (85%). The remaining portion is made up by investments in property, infrastructure and exposure to the sharemarket (“equity”).

As you can see above, annuity and guaranteed liabilities (orange) are matched by exposure to various types of investments. Note: I included only the liabilities which appear to me to be guaranteed.

Normalised Cash Earnings

Some people evaluating Challenger shares will point to a ‘low P/E ratio’, otherwise known as the price-earnings ratio. It would make me uneasy for anyone to base a company’s valuation solely on a low P/E but even more so in Challenger’s case.

To get to a sustainable level of profit for Challenger isn’t easy. Even Challenger itself uses ‘normalised’ profits to smooth the “investment experience”. They do this because of the way accounting standards treat the valuation of the investment portfolio and associated liabilities. Here’s what’s written in the 2018 analyst pack:

“Investment experience removes the volatility arising from asset and liability valuation movements so to more accurately reflect the underlying performance of the Life business.”

Challenger assumes things like 4.5% per year returns from shares, 4% returns from infrastructure, 2% from property and so on. That seems conservative right? I mean, shares have returned more than 4% over decades… right?

That’s true.

But let’s not forget the ~600 staff, marketing, dividends and periods of bad returns.

The Powers That Be

Of course, Challenger is regulated.

And the (tongue in cheek) ever-reliable credit ratings agencies and researchers put their stamp of approval on the Life company and its annuities.

According to Challenger’s “analyst pack”, ratings agency S&P upgraded Challenger’s outlook due to its “leadership in the Australian annuities market” and “expanded distribution network”. Make of that what you will.

Serious point: credit ratings agencies do not guarantee shareholders will make a decent return for their investment.

Valuation

I could spend days digging into how Challenger arrives at certain figures. However, the return on my time wouldn’t stack up because I’d never buy shares in a company that I can’t fully understand.

However, one thing I will say is I wouldn’t rely on analyst valuations which use assets, profit or dividends as the inputs. Each of things are volatile and easier for accountants to bend in different ways.

I would focus on the cash flow. Unfortunately, I struggle to get my head around Challenger’s cash flow statement.

Summary

Challenger shares — and its business — are so far outside of my comfort zone I don’t think I could ever buy shares in it.

Having said that I must disclose that I owned a very small parcel of Challenger shares years ago — back when I had no idea what I was doing (I bought shares because it ‘had a low P/E ratio’).

So what’s my take now?

While everything in the accounting statements seems prudent to me on first glance I would caution anyone to stop and consider how comfortable they would be if Challenger’s share price fell 10%, 30% or 60%. I’m not predicting Challenger’s share price to fall, it’s just a test I regularly ask myself.

Indeed, it’s a matter of how comfortable you are in the underlying business that’s important because I’ve found that most people say they understand a business and are comfortable owning its shares right up until the share price takes a bath.

As I always say, there are 2,000 companies on the ASX, hundreds of Aussie ETFs and managed funds, and thousands more investments overseas. You’re not compelled to buy Challenger simply because it’s in front of you. Keep reading below if you want the names of 3 ASX shares I would buy for the right price (hint: they proven to offer dividends and growth)…

[ls_content_block id=”14945″ para=”paragraphs”]