Commonwealth Bank of Australia (ASX: CBA) shares were trading lower today as the broader market or S&P/ASX 200 (^AXJO) trended lower.

Commonwealth Bank of Australia or CBA is Australia’s largest bank, with commanding market share of the mortgages (24%), credit cards (27%) and personal lending markets. It has 16.1 million customers, 14.1 million are in Australia. It is entrenched in the Australian payments ecosystem and financial marketplace.

Dividends + Growth

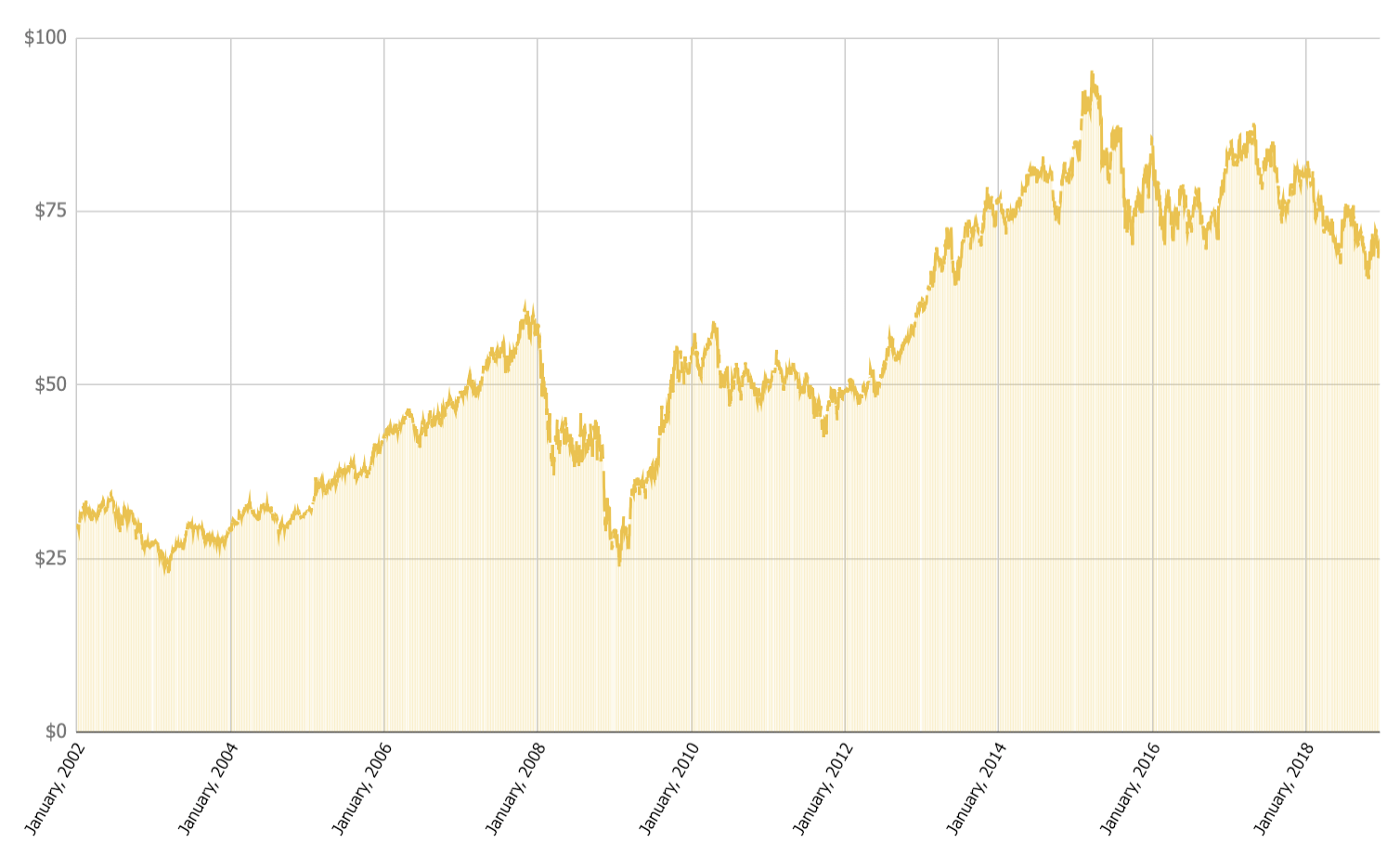

Since the early ’90s Commonwealth Bank shares have ridden the wave of rising household debt, lower interest rates and overall economic prosperity. They’ve proven to be a fantastic way to invest in Australia’s strong economic engine.

For example, did you know Commonwealth Bank shareholders who held shares from the initial public offering (IPO) in the early ’90s would have received almost 80% of their original purchase price ($5.40) in dividends ($4.31) this year alone?

Unfortunately, good things can’t last forever.

Is This As Good As It Gets?

In 2018, as news of a potential fall in property prices began to undermine confidence in bank shares and news that franking credits could be cut emerged, CBA shares continued to fall.

Recently, Commbank shares changed hands at prices not seen for more than five years.

Are They Good Value?

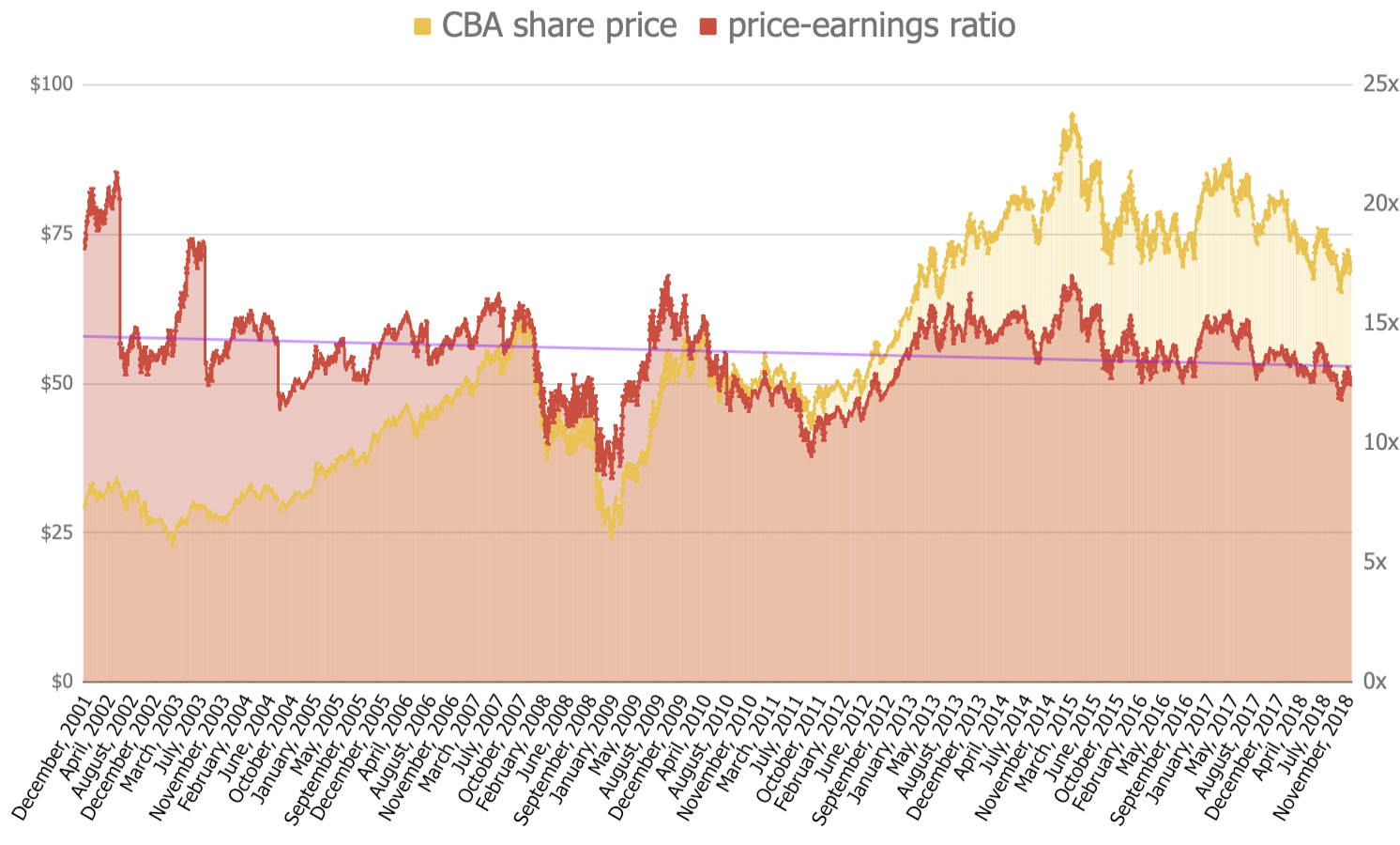

As all good investors know, focusing on the share price tells only part of the picture. Some analysts will compare the share price to profit per share, known as the price-earnings ratio, and analyse it over time.

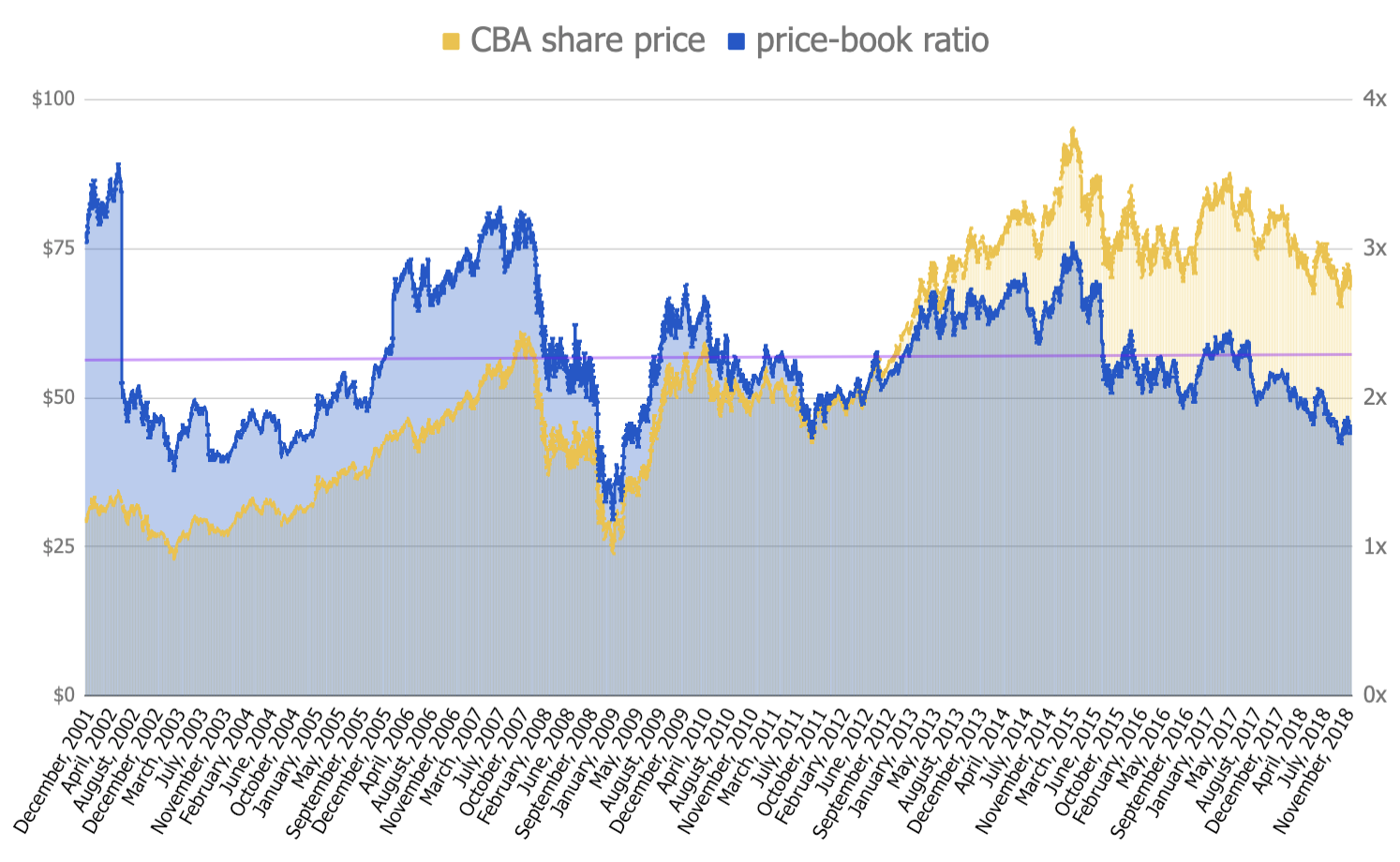

Of course, the earnings or profit of a bank is a derivative of its loan portfolio or ‘book value’. That’s where its true and sustainable value is embedded.

So what does the chart show us?

We can see from the chart that investors are able to pay less for exposure to Commbank’s ~$700 billion loan portfolio than at any time since 2011. Since 2014, we have seen a clear downward trend in the value that investors are willing to place upon Commbank’s loan portfolio.

I’ve been saying it for years but this was a very predictable trend, as the convergence of multiple positive economic factors was never sustainable. The effects of low interest rates and rising property prices were never going to last long and would lead to lacklustre loan growth.

On top of that, regulatory action, increasing prices for wholesale funding and intense competition for loans began to squeeze lending margins. That detracts from the value of the bank’s portfolio.

Are CBA Shares Cheap?

Using the simple charts above we can see that CBA shares have been cheaper in the past, especially in 2008/2009. Buying at those low prices and valuations would have been incredibly shrewd and rewarding.

In my opinion, CBA shares do not deserve to trade at a substantial premium to the valuation of its big bank peers. And when other high-quality banks around the world are trading at more compelling valuations, I see no reason to rush out and buy CBA shares today. For example, I recently compared CBA to ING Groep (NYSE: ING).

When it comes to big macro risks and bank shares I think it’s too hard to know when you’re just early or wrong. Remember, patience won’t lose you money!

P.S. I’ve just released a free report which reveals 3 ASX shares I would buy for the right price. They’ve proven themselves to be reliable dividend + growth shares. Of course, past performance is not indicative of future performance but as I say in my free report, there are many reasons to keep a close watch on these 3 shares in 2019 and beyond.

Click here to access my free report. No credit card details or payment required.

Disclaimer: Any information contained in this article is limited to general financial/investment advice only. The information has not taken into account your specific needs, goals or objectives, so please consider consulting a licenced and trusted adviser before acting on the information. Please read The Rask Group’s Financial Services Guide (FSG) for more information. This article is authorised by Owen Raszkiewicz of The Rask Group, which is a corporate authorised representative No. 1264179 of Strawman Pty Ltd (ACN: 610 908 211) (AFSL: 501 223). Owen Raszkiewicz does not have a financial or commercial interest in any company mentioned.