Happy New Year from all of us here at Rask. I hope 2019 is everything you want it to be — and more.

Usually, I’m not one to set resolutions or goals.

Nonetheless, here are my three investing goals for 2019 — we’ll check back on them in 12 months. Hopefully, you can use them as a basis for your financial goals in 2019.

1. Beat the Market.

Every investor wants to ‘beat the market’ (i.e. outperform the ASX 200) — if they didn’t want to do better, it’s easier to simply buy a low-cost index fund.

Unfortunately, none of us can control what the sharemarket or property market does or doesn’t do. Fortunately, we can control what we buy and sell, and when we do it. Doing that will help you sleep easy at night.

As you know, I only ever buy shares in companies that:

- I can understand

- have a competitive advantage or moat

- are run by excellent and aligned management, and

- trade at a reasonable price.

If I can get enough of these shares in my long-term portfolio, I believe time will take care of the rest.

2. Grow my portfolio to 15 of my best share ideas.

Currently, I have just 8 investments in my portfolio. Most of them are fast-growing tech shares. I own one ETF.

In my opinion, when you know what you are doing — and you have a thick skin — a good investor need only have 10-20 shares in his or her portfolio. Less experienced investors might target 30 individual shares.

You: “Why do you want to get to 15?”

Firstly, it narrows my focus. I think it makes complete sense to buymore of my best investment idea than to buy my 30th best idea.

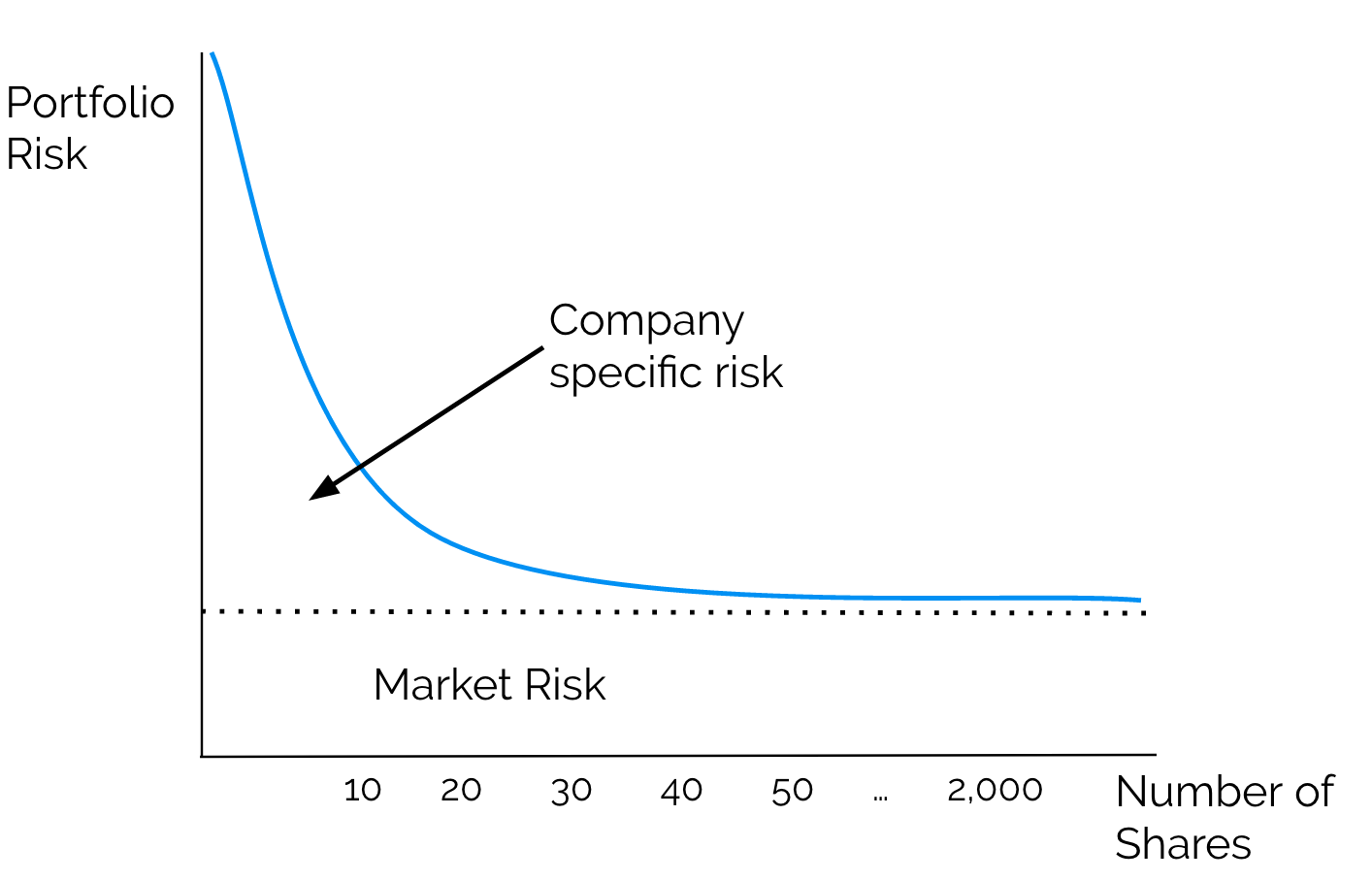

Secondly, Evans and Archer (1968) showed that owning 10 diverse shares was enough to remove most of the ‘risk’ in a share portfolio. Other studies have shown that holding 20 diverse stocks lowers the portfolio risk by 70%!

More than 30 shares and you’ll lose your focus. Therefore, your portfolio’s risk may even increase!

Keep in mind that I’m talking about an academic’s version of risk (often called ‘volatility’), which isn’t a real risk to me.

To me, risk is losing all of your money when a business goes bankrupt. Meaning, for a long-term investor, risk is not a share price bouncing around from one week to the next.

Also keep in mind that we can’t diversify the ‘market risk’ of a portfolio. If that confuses you (it still gets me), here’s a chart I put together for our Rask Finance education website:

So what’s the point?

My aim with the Rask Invest model portfolio in 2019 is simple:

Buy into only my highest conviction / best share ideas. Then, diversify by holding cash and low-cost ETFs.

I’ll repeat: so far I have 7 shares and 1 ETF. I expect to get to 15 shares in the next 12 months and up to 30 (in total) in coming years.

3. Add AT LEAST $1,000 to my share portfolio per month.

Earlier in 2018, I released a simple and easy-to-follow ‘money plan’. It’s over 100 pages.

I covered all types of things. From paying down debt, setting up a budget that will help our members to invest regularly, choosing a share broking account and all the education I think anyone needs to feel in control of their finances.

The idea behind the plan was simple: turn anyone into an investor.

To do that, I studied the Australian Bureau of Statistics (ABS) data on household spending.

Then I looked at the Superannuation rules and tax brackets.

Then, I asked myself ‘how much should people be saving to achieve financial independence ASAP?’ and ‘what’s the simplest and most effective budget strategy that can make it happen?’.

With Rask Invest I aimed to answer those questions.

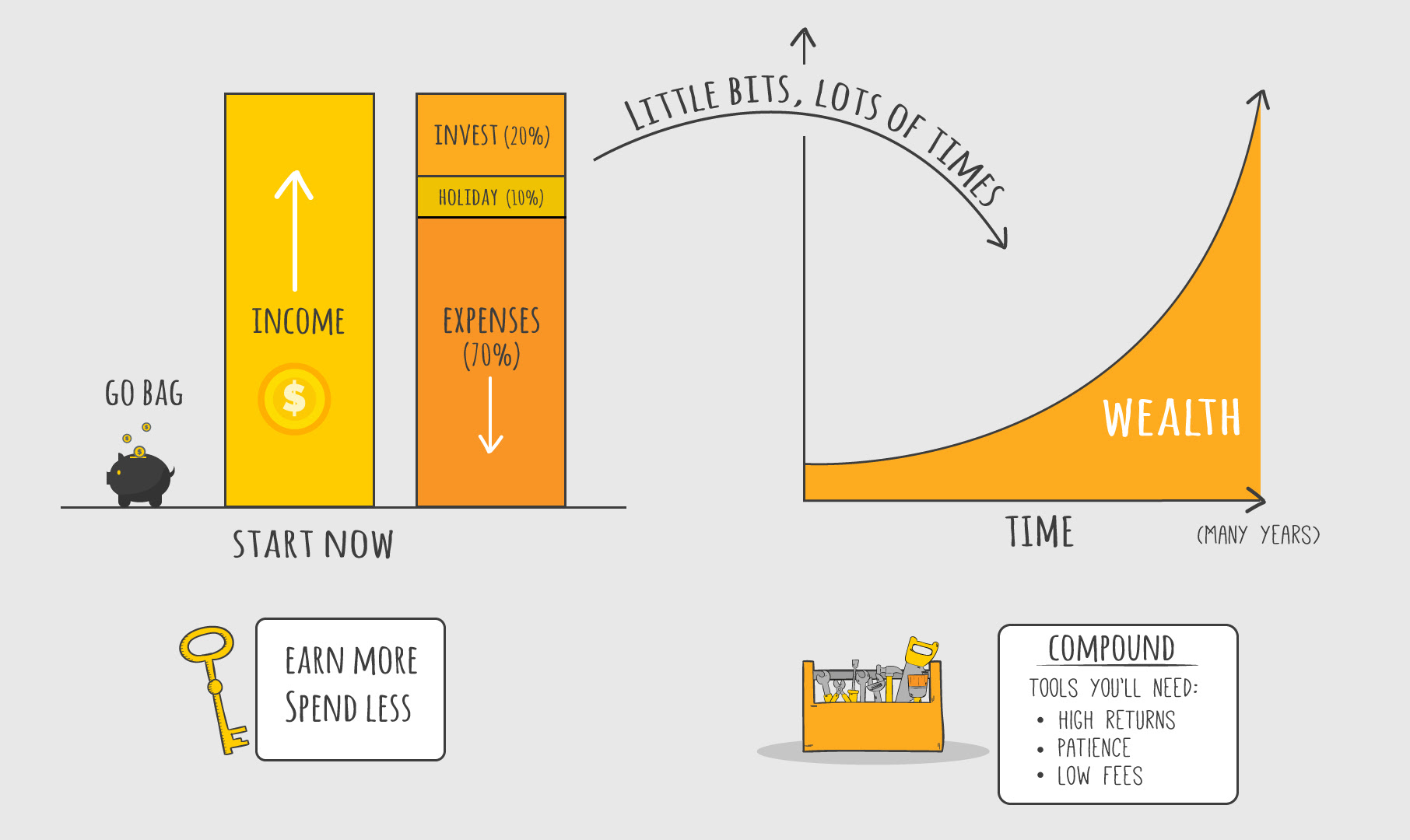

I designed the Rask Invest strategy with a $60,000 wage earner in mind.

I backed the strategy with $20,000 of my own money.

And I add $1,000 per month to my brokerage account to invest for the long run.

Do the math on your finances…

$1,000 is 20% of a $60k take-home income. But $500 (plus $10 for brokerage) is all that’s needed to get started investing.

Here’s the big picture:

Together with regular Super contributions, which should be funnelling another 10% of your income into long-term growth investments like local and global shares, I think $1,000 per month puts me and my family on a fast-track towards financial independence.

Don’t believe me?

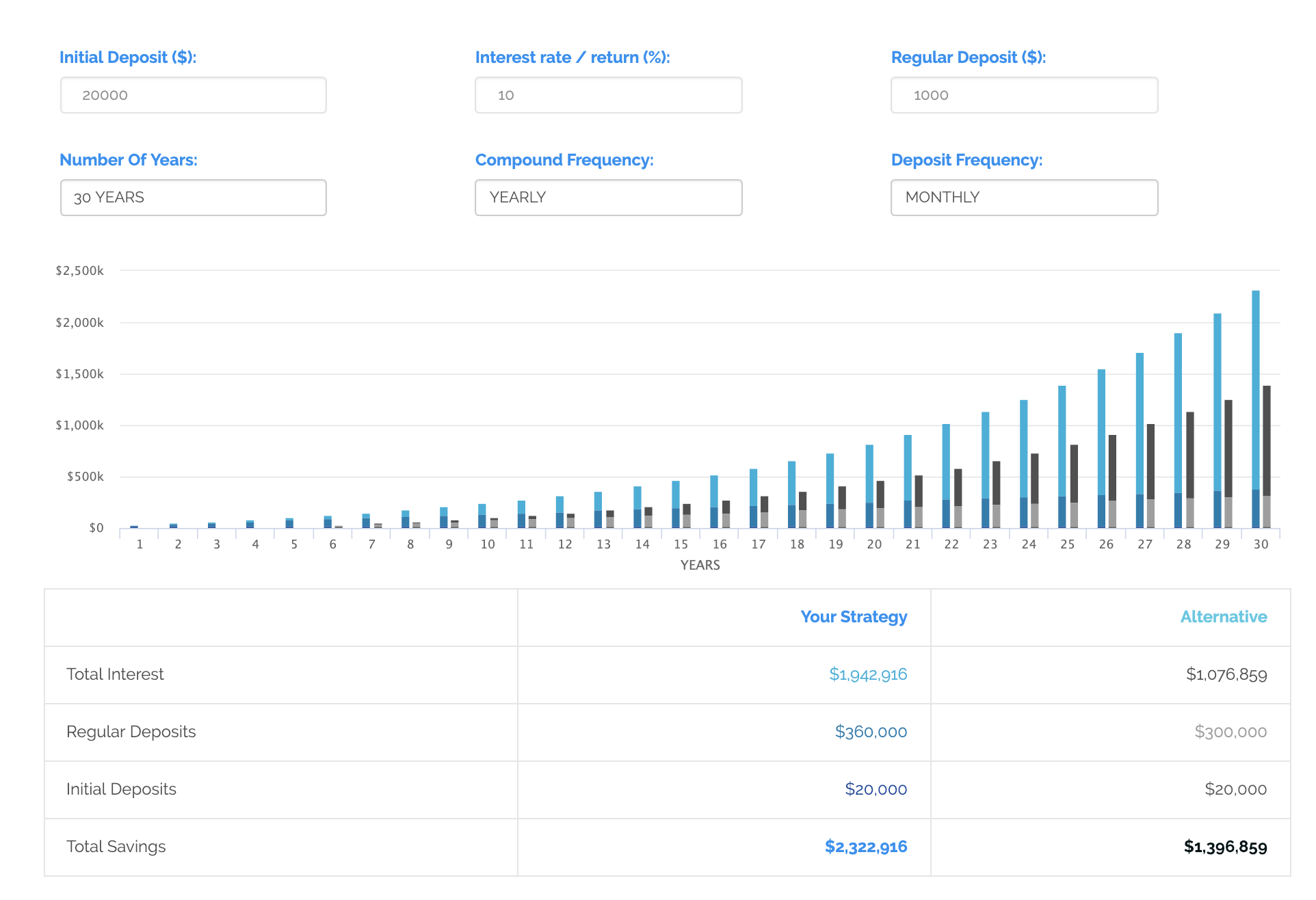

According to the Rask Finance compound interest calculator, available here (try it out!), starting with just $20k and adding $1k per month looks pretty darn good after 30 years…

If I can invest my share portfolio at an average return of 10% per year (net of fees and taxes and excluding inflation), after 30 years I’ll have more than $2.3 million according to the chart!

Obviously, there are absolutely no guarantees I’ll be able to return 10% per year. But I’m backing myself.

Remember, that’s just my share portfolio.

“Sounds Good But…”

Most people say to me ‘I’ll wait for the next market crash’ or ‘the market is looking pretty risky right now – haven’t you seen Trump’s new wig?!’.

By definition, the next market crash is always getting closer than the last one. And shares and ETFs are always going to be risky — especially if you don’t put in the time to understand them.

But my strategy is so-so simple…

Invest $1k in my best ideas no matter what Trump is doing.

No matter if the market is up 20%.

Down 40%.

Or if interest rates are rising.

$1k invested every month.

Rain, hail or shine.

And if the market falls, I should be able to find more bargains.

And if it rises, I can afford to be patient because I know my current investments are going up too.

It’s a win-win — which is why I’m surprised more Aussies don’t invest like this.

What are your money goals?

If you’re stuck for money goals in 2019 just copy and paste mine into your Gmail, Apple or Microsoft calendar program.

It’s important you write them down. Then, put a reminder in your phone (I use my Gmail account) or set-up automatic bank transfers to deposit $1,000 into your investments account or brokerage each and every month. Pay yourself first in 2019.

Finally, on the first day of every third month, sit down and track your progress.

Rinse and repeat.

The Rask Invest strategy is that simple — and effective.

***

Again, from the team here at Rask, I wish you all the best in 2019 and beyond.

Cheers to our financial futures!

Owen Raszkiewicz

Twitter: @owenrask

This article was written by Owen Raszkiewicz, lead adviser of Rask Invest.

[ls_content_block id=”14942″]