The S&P/ASX 200 (INDEXASX: XJO)(^AXJO) is expected to open higher today with the USA’s S&P 500 Index (.INX) rising overnight.

Here are the data points:

Australian Dollar ($A) (AUDUSD): 68.60 US cents

Dow Jones (DJI): up 0.08%

Oil (WTI): $US46.54 per barrel

Gold: $US1,288 per ounce

Sharemarket News

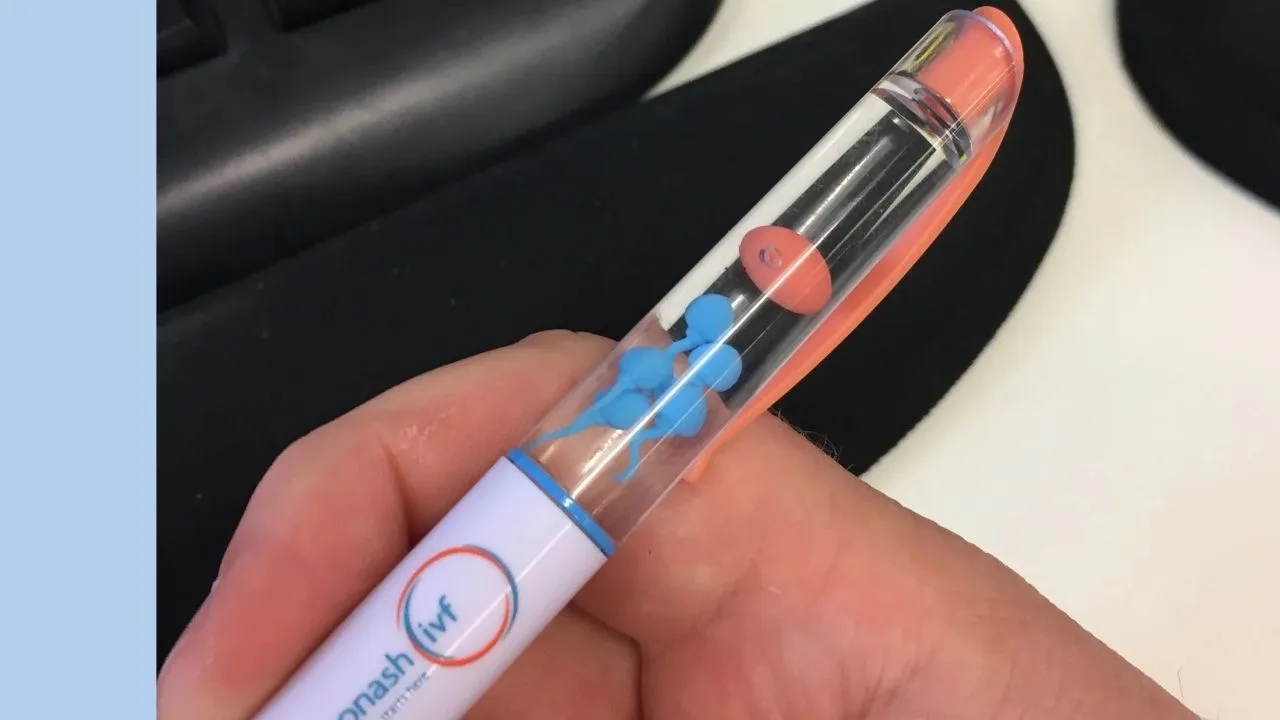

In sharemarket news, the Healius Ltd (ASX: HLS) share price is likely to rise. Healius is a diversified healthcare business with primary care, IVF, hospital and other services. The business formerly known as Primary Health Care Limited (ASX: PRY) has received an “unsolicited and highly conditional” proposal from Jangho – a Hong Kong business – of a preliminary indicative cash offer of $3.25 per share. Jangho already owns nearly 16% of Healius.

The Healius Board has commenced an assessment of the proposal and will keep the market informed. Some of the takeover conditions include due diligence, debt financing and foreign investment regulatory approvals.

Lithium business Pilbara Minerals Ltd (ASX: PLS) revealed two pieces of news. Pilbara Minerals has announced it has agreed terms with Ganfeng and Great Wall to fund its Stage 2 Pilganoora expansion, management are also considering Stage 3 expansion in response to customer demand.

Pilbara also revealed that strong demand from South Korean customers and their partners have encouraged POSCO and Pilbara Minerals to consider a larger South Korean joint venture chemical conversion facility, which will be supported by additional offtake from the larger Pilgangoora Project.

Kathmandu Holdings Ltd (ASX: KMD) shares could come under pressure in morning trade after the outdoor retailer gave a trading update and first half profit guidance. Based on the first 15 weeks of trade, profit was expected to be “strongly” above last year. However, Australian and New Zealand sales during December have been below management expectations and the prior year.

Same store sales for the 22 weeks ending 30 December 2018 are below last year by 1%, with Australian same store sales below by 0.2% and New Zealand same store sales showing a 2.4% decline. The first half profit of FY19 is now expected to be 4% to 8% higher than the first half of FY18.

Kathmandu may be struggling to grow profit in FY19, but the below three shares have been profit growers for a number of years.

[ls_content_block id=”14945″ para=”paragraphs”]