I’ll admit that National Australia Bank Ltd’s (ASX: NAB) dividend yield of 8% fully franked looks very tempting.

Today, term deposit savers are lucky to be earning just 2.75% per year.

That means, dividend investors might be able to make nearly 3x the amount for taking some risk and investing in the sharemarket.

In other words, investors like you and me can make a ‘spread’ of over 5% (8% – 2.75% = 5.25%) on the rates offered on term deposits. And I haven’t even considered the positive effect of franking credits — if they make it past the next election.

But I’m sure you’re already thinking one step ahead of me and asking: “but is the extra 5% in income worth the added risk?” After all, dividends are not guaranteed to be paid.

As I explain briefly below, it’s hard for anyone to quantify the risks to investing in bank shares at this time — even if we know what the risks are.

NAB’s 8% Dividend Yield

Firstly, let’s consider how NAB’s dividend is paid.

There are some rules all companies must follow before they are allowed to pay a dividend.

Like all good businesses, NAB needs to make a profit for its dividend to be sustainable. Last week, I explained how banks make money.

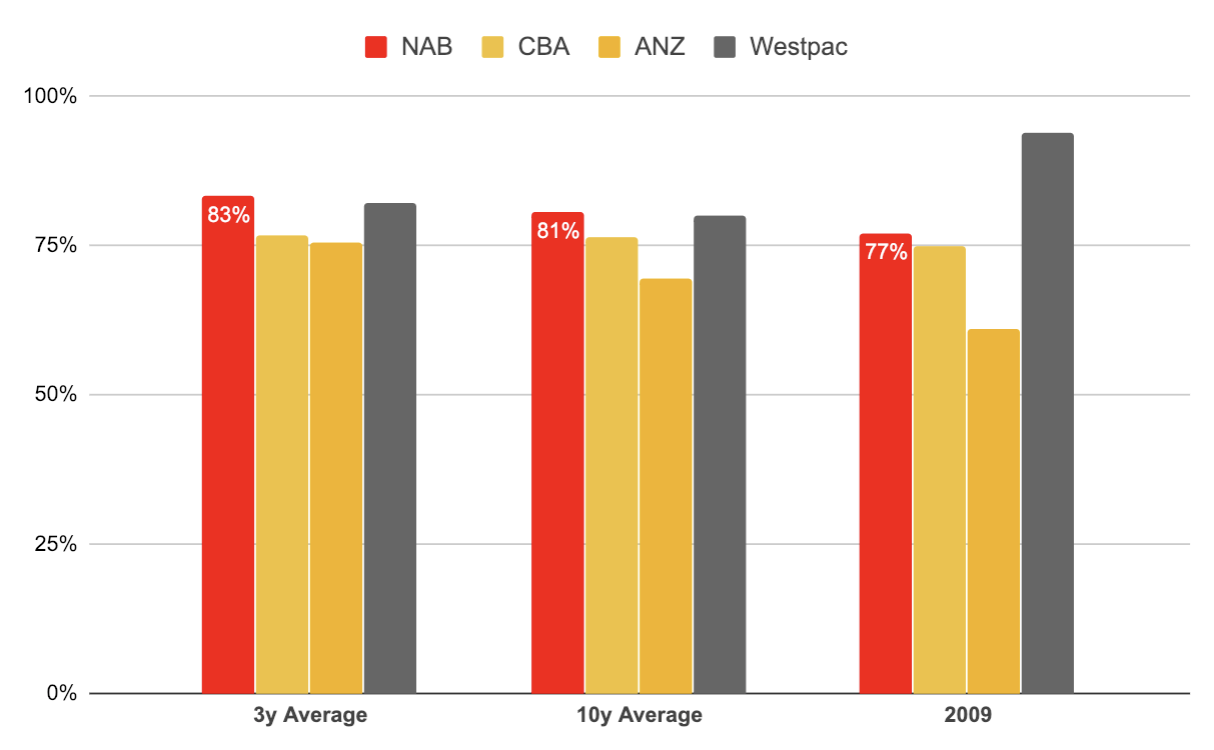

Looking at its recent payouts to shareholders, NAB paid about 83% of its profit as dividends in 2018 (this is called the “payout ratio”).

When I ask myself whether or not NAB will sustain its dividend in the near term, I think it’s more likely than not that NAB will uphold its dividend payments in 2019 – provided the housing market keeps ticking along.

However, it’s what happens after the next 12 months that concerns me.

Here are some of the known risks that investors and analysts have to contend with when evaluating NAB’s dividend:

Rising bad and doubtful debts. My belief is that we’ll see more charges for bad debts in the coming 12-24 months than we have in the past three-to-five years. These debts, which typically represent homeowners and small businesses falling behind on their loans, are a direct hit to profits. In 2018, NAB reported bad debts of $791 million. In 2009, when it had exposure to UK property, NAB’s expenses for bad debts was $3.8 billion.

House prices. Indirectly related to bad debts, lending growth and profitability are house prices. I’m not suggesting NAB will go out of business due to the recent weakness in house prices. Rather, it’s important to remember that dividends will be put on the chopping block if the situation calls for it. As you can imagine, trying to forecast the impact of house prices on NAB’s profit is incredibly difficult and the list of assumptions is endless. Oftentimes it’s only when the expenses show up as bad debts that we realise how bad things have gotten – and by then it’s too late!

Narrowing margins. Yesterday, we witnessed the Bank of Queensland hike its mortgage interest rates ‘out of cycle’ for the second time in eight months. BOQ cited ‘intense’ pressure on its margins. This is something I have been warning bank shareholders about for many months because it can be a vicious cycle for shareholders and homeowners alike. For example, if a bank’s margins get too narrow to cover costs and make a profit they’ll be forced to increase interest rates, which often means more bad debts.

Interest rates. Usually, a central bank would lower ‘official’ interest rates if economic times get tough. But with the RBA’s rates stuck at just 1.5%, homeowners and shareholders could be waiting quite a while for some relief.

So Is The 5% Extra Income Worth The Risk?

I could try to convince you (and myself) that I’ve got a handle on NAB’s profitability over the next 12-24 months. But bargain hunter value investors are often early and wrong.

And as you can see above, there are so many uncertainties clouding NAB’s outlook that it may be better to put its shares in the ‘too hard’ basket, for now, and wait for a more compelling entry point. That’s what I’m doing.

Remember, patience doesn’t lose us money.

If you are in a rush to put your excess cash to work, I think it makes more sense to consider long-term growth stocks, diversifying overseas or investing in a low-cost exchange-traded fund (ETF) at this time — many of the ETFs also sport hefty dividend/distribution yields.

[ls_content_block id=”14948″ para=”paragraphs”]