The Class Ltd (ASX: CL1) share price fell 7% in early trade on Thursday morning following an ASX update to shareholders.

Class is a software company which specialises in products for financial advisers and self-managed superannuation funds (SMSFs). These are called the Class Portfolio And Class Super, respectively.

What Happened?

In its press release, Class reported that its total accounts rose 1,760 to 174,212 and its total number of customers rose by 57 to 1,470.

The company’s core product, Class Super, added 1,529 accounts despite the reduction of 1,000 AMP Limited (ASX: AMP) accounts.

“The lower than expected growth in accounts reflects regulatory uncertainty, increased competition and a lower number of average accounts per new customer,” Class’ update read.

To get back to a leadership position in the market, Class said it will release new features and make it even simpler for accountants and advisers to manage Super funds for their clients.

Recently, rival financial software company HUB24 Ltd (ASX: HUB) reported a strong set of results. Rask Media writer, William Donnan, took a close look at HUB24 in this article.

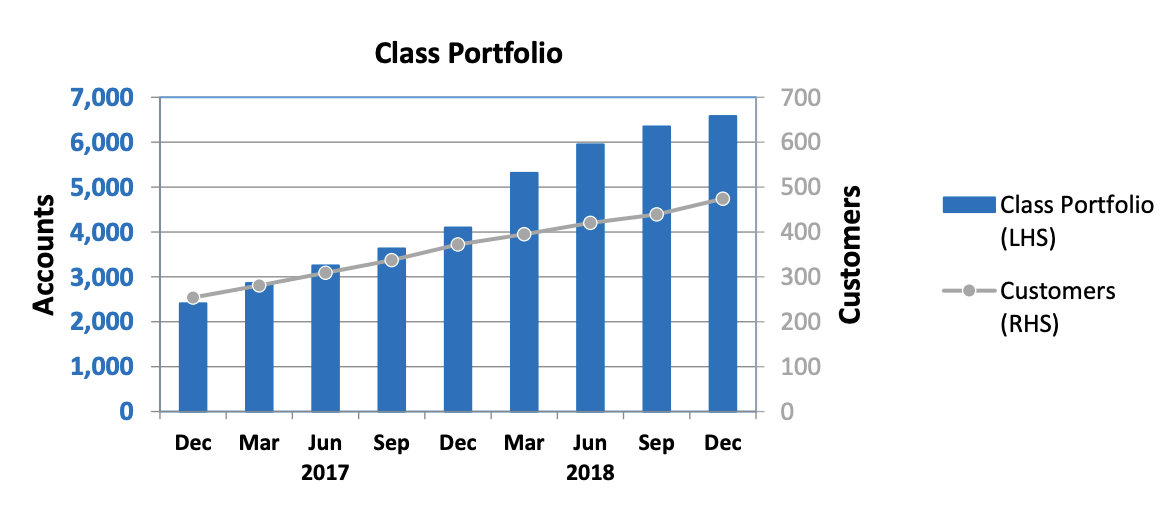

Class Portfolio’s total accounts rose to 6,581 with 32% of Class Super customers now using Class Portfolio.

Class recently launched a managed accounts service and has already signed OpenInvest and InvestSMART Group Ltd (ASX: INV) as partners. The company says this is a potential growth driver.

Revenue Rising

Class said its annualised recurring revenue (ARR) from licence fees for its products rose 10.1% to $37.1 million, as at 31 December 2018. Excluding the loss of AMP advisers, a transition which has been well foreshadowed, Class says it has a customer retention rate of 99.2%.

What CEO?

Unfortunately for Class shareholders, the company is yet to finalise its search for a new CEO. However, it says it is in the final stages of the recruitment efforts and expects to announce the successful candidate before it reports its financial results in February.

Thinking of Buying Class Shares? Read This First…

[ls_content_block id=”14947″ para=”paragraphs”]