Unless you’ve been investing under a rock for five years you will surely know that The a2 Milk Company Ltd

(ASX: A2M) has been one of the ASX’s best success stories.

Just yesterday, the news was airing a video from a supermarket which showed a queue of shoppers lined up to rush into the store and buy some a2 Premium infant formula.

Recently I offered two reasons why a2 Milk’s best days could still be ahead of it. You’ll find my reasons in this article.

3 Charts To Help You Find The Next a2 Milk

I’m about as far from a chartist, market timer or ‘share trader‘ as you’ll find. Nonetheless, here are three charts that build the picture of a2 Milk as one of ASX’s best growth stories.

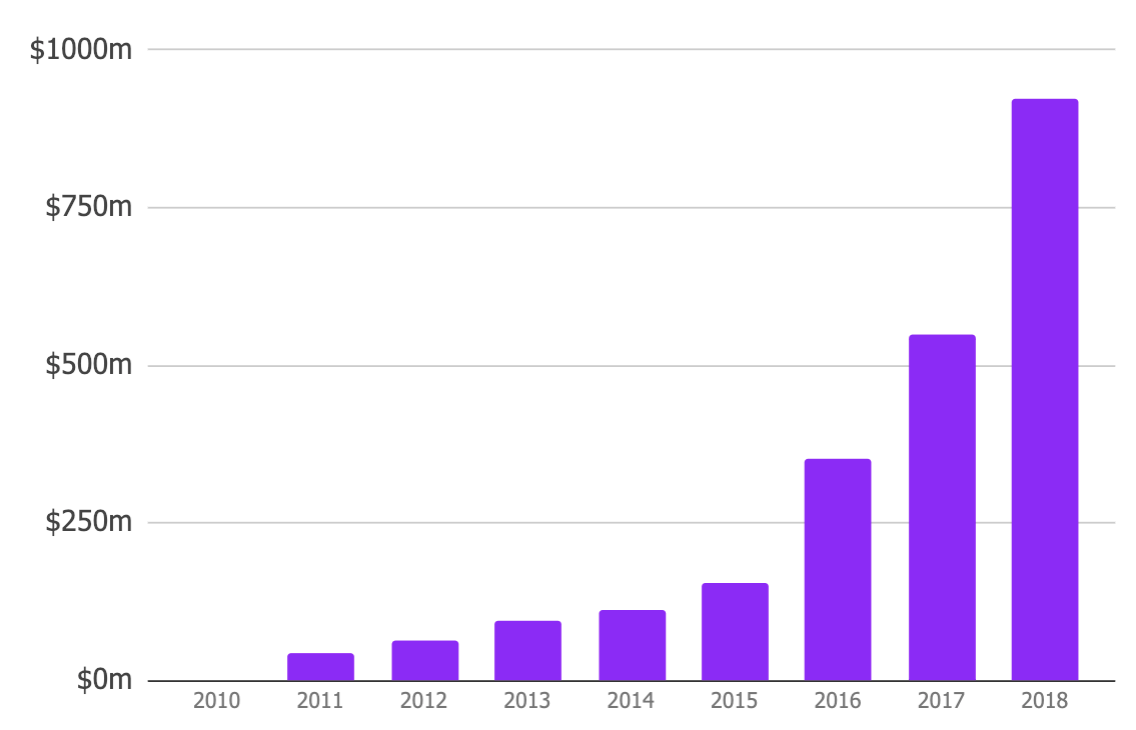

1. Blistering Sales Growth

Nothing says ‘sit up and listen to me’ than consistent sales growth. Since 2011, a2 Milk’s sales have risen from $42 million to nearly $1 billion. But before you think the best days are behind it, a2 Milk’s addressable market is huge – and growing.

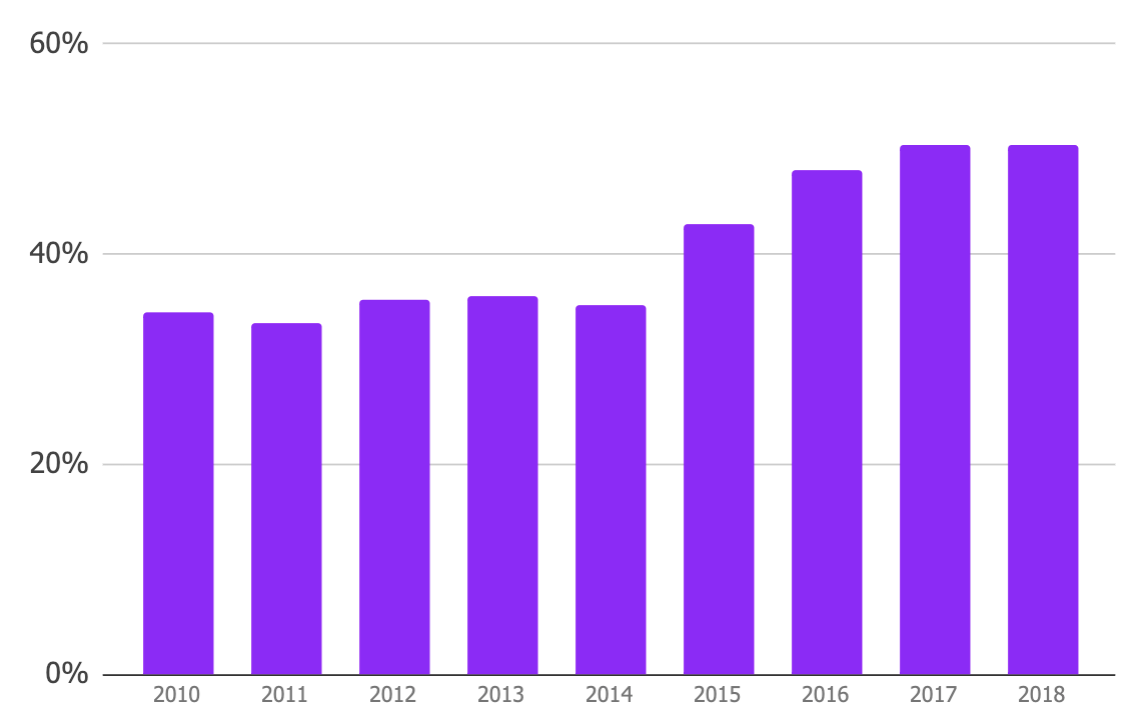

2. Wide Gross Margins

One of the telltale signs of a company which could have a strong franchise is a consistently wide gross profit margin. The gross margin represents the difference between revenue/sales and the unavoidable costs of doing business. As might have guessed, a2 Milk’s margin is well above average.

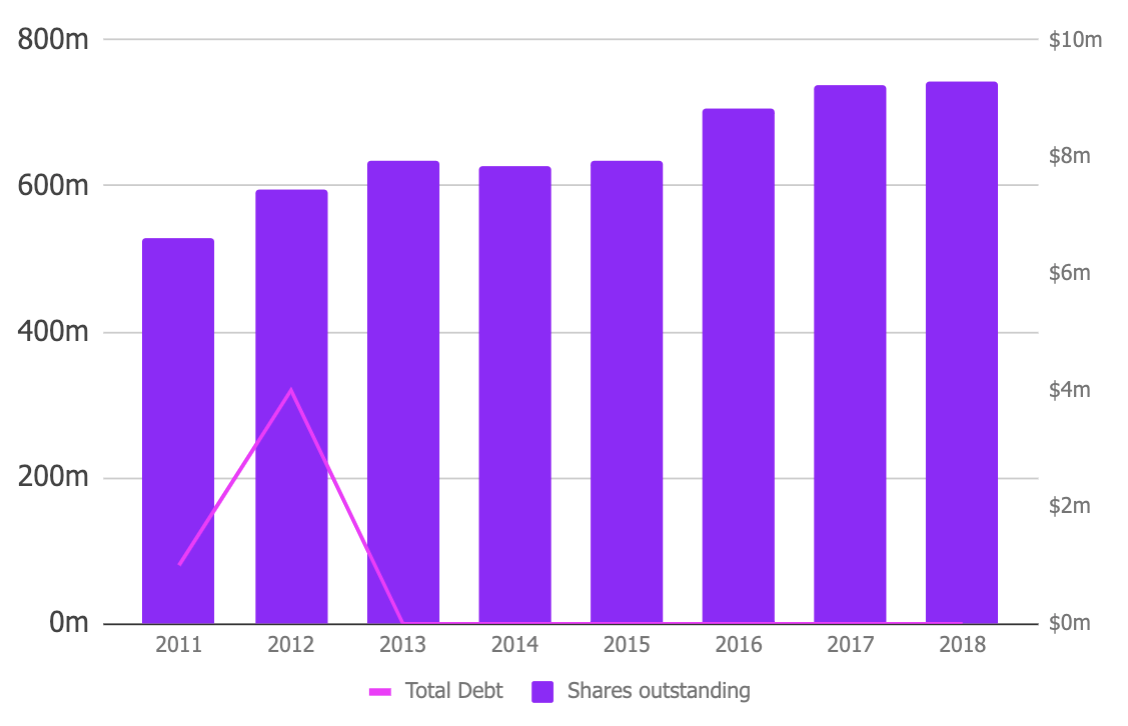

3. What Debt?

When a company can exhibit rapid sales growth without investing its cashflow to excess (i.e. borrowing money from the bank or diluting shareholders) you could be onto a great business.

While a2 Milk has increased its shares on issue over the past seven years, it hasn’t diluted shareholders — its profit per share has risen rapidly.

What’s more, the company had a grand total of $0 in debt in 2018 – that’s rarer than a talking chicken (I’ve only met two). Further, it bodes well for continued outperformance.

What Now?

Looking ahead, as I wrote here, there’s a lot to like about shares of The a2 Milk Company. Of course, there are risks (e.g. regulatory risks, valuation, supply and demand, the Chinese economy, etc.), so please don’t walk towards the bright lights before thinking about what could go wrong.

For full disclosure: I do not own shares in a2 Milk, but that could change at any time — it’s one I’ll be watching closely in 2019.

If you’re looking for 1 fast-growth ASX share that I DO own and has: a) rapidly rising sales, b) wide profit margins, and c) no debt, you can access our free investing report below…

[ls_content_block id=”14947″ para=”paragraphs”]