Are Hub24 Ltd (ASX: HUB) shares worth buying after the fintech company reported $1.5 billion of net inflows for the December 2018 quarter?

Hub24 is an Australian financial technology business that creates portfolio management and Superannuation software. Founded in 2007, you can think of Hub24’s software as a way to better manage investments in shares and other assets.

HUB24 has a strong management team with decades of experience within the wealth management industry and in the development of platforms. Rask Media contributor William Donnan recently covered Hub24 in detail in this analysis

.

Why Hub24 shares are up 6%

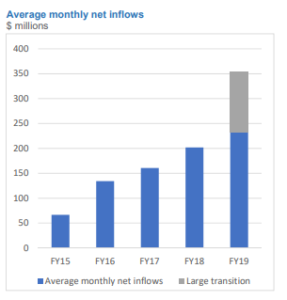

The Hub24 share price is up 6% in early trade with the fintech company reporting it achieved quarterly net inflows of $1.5 billion, or around $750 million excluding a large transition, the highest for any quarter to date. Getting more ‘inflows’ to their platforms means Hub24 can collect more fees for managing the money over time.

Funds under administration (FUA) reached $10 billion during the quarter, which was a rise of 45.6% compared to a year ago. Management was pleased with this considering this quarter saw volatility return to share markets.

Hub24 also launched six licensee branded versions of its platform for advice businesses.

It Hub24 Too Expensive To Buy?

Hub24 is growing impressively each quarter, but its shares are valued at 110 times FY18’s profit, so it is trading too expensively for a typical value investor to consider. As such, there could be better ASX growth shares to consider, such as the two healthcare technology shares outlined in the free report below.

2 rapid ASX growth shares

[ls_content_block id=”14947″ para=”paragraphs”]