The big four banks, Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd. (ASX: NAB), Australia and New Zealand Banking Group (ASX: ANZ) and Westpac Banking Corp (ASX: WBC) all currently provide attractive fully franked dividend yields above 6%.

However, in recent statements made to the market, each bank has highlighted that revenue growth will be slower going forward and profit growth will be driven primarily by cost-cutting.

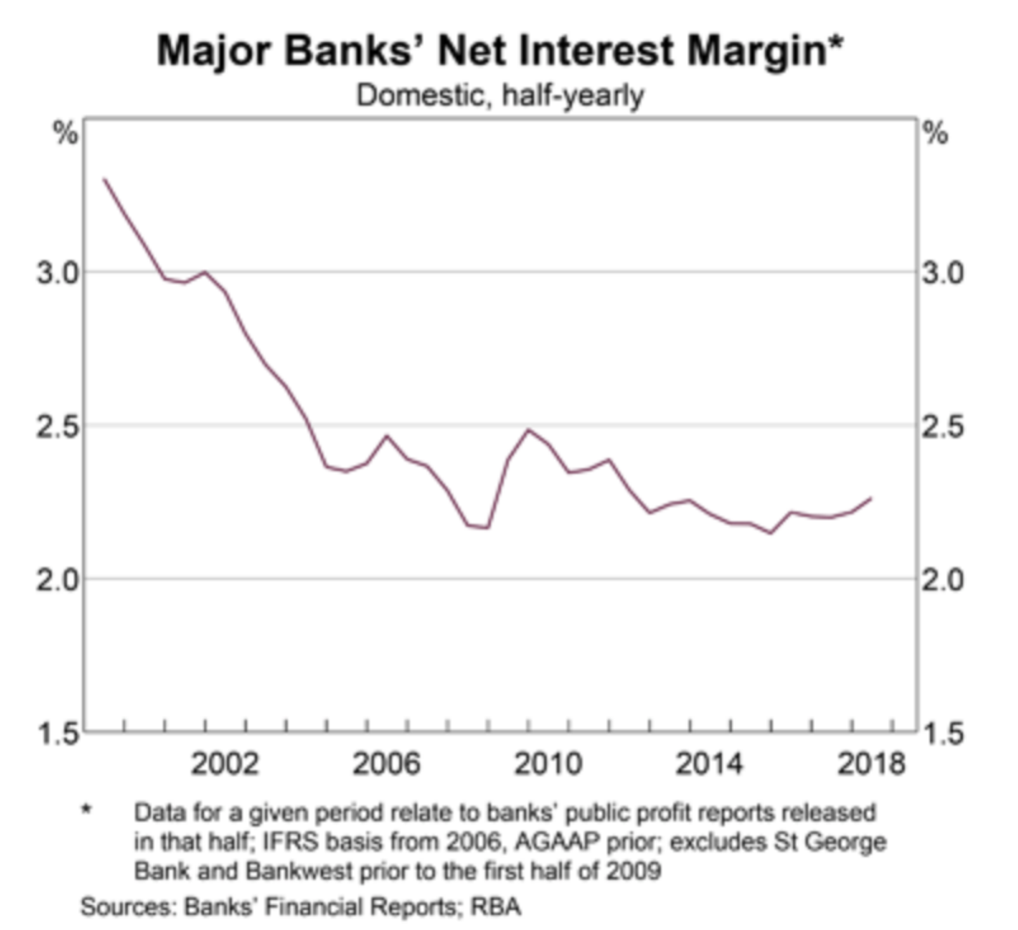

A key driver of bank operating income is their net interest margin (NIM), a ratio that implies the difference between the interest banks charge on their loans and the interest costs they incur to fund these loans. As presented below from the RBA, NIM has fallen over the last decade plus. If NIM were to increase from here, total-banking profits of Australian banks should follow.

The big four banks have advised cost reduction will be achieved by simplifying or “digitising” operational processes and thereby reducing personnel expenses. Pressure to reduce costs comes at a time of intense competition to win customers, which has continued to apply downward pressure on profit margins.

Return on equity (ROE), a key indicator of a banks efficiency, has been negatively impacted by increased regulatory requirements.

Australia’s major banks are now required by the Australian Prudential Regulation Authority (APRA), a key regulator of the banking industry in Australia, to maintain a Common Equity Tier 1 Capital (CET1) ratio of at least 10.5% by 1 January 2020.

Although holding higher levels of capital will allow our banks to better withstand potential financial shocks, it has significantly impacted their ROE.

How do the banks stack up?

We can compare the banks by assessing metrics such as ROE, growth in operating income and valuation ratios such as the Price Earnings (P/E) and price to book (share price / Net assets per share). The below data has been sourced from annual reports and Commsec.

ANZ Banking Group:

- 2014 Operating income $20.05 billion

- 2018 Operating income $19.83 billion,

- Percentage growth in operating income of -1.1%

- 2018 ROE 13.40%.

Valuation ratios:

- Current share price $25.54

- Price to book 1.23

- P/E ratio 9.98

CBA:

- 2014 Operating income $19.42 billion

- 2018 Operating income $26.13 billion,

- Percentage growth in operating income of +34.55%

- 2018 ROE 15.2%

Valuation ratios:

- Current share price $72.65

- Price to book 1.88

- P/E ratio 12.66

NAB:

- 2014 Operating income $18.91 billion

- 2018 Operating income $17.98 billion

- Percentage growth in operating income of – 4.92%

- 2018 ROE 12.4%

Valuation ratios:

- Current share price $24.72

- Price to book 1.28

- P/E ratio 10.67

Westpac

- 2014 operating income $19.94 billion

- 2018 Operating income $22.13 billion

- Percentage growth in operating income of 10.98%

- 2018 ROE 12.7%

Valuation ratios:

- Current share price $25.76

- Price to book 1.37

- P/E ratio 11

Should you consider buying shares in a big four bank?

Over the last 5 years, only CBA and WBC have managed to grow operating income. This may reduce confidence that ANZ and NAB can achieve operating income growth in the future.

Since 2014, CBA has displayed the strongest growth in operating income and holds the highest current ROE. As we may expect the market has rewarded CBA with the highest P/E ratio and price to book ratio of the big four.

Westpac has achieved the second highest growth rate in operating income over this time frame and currently has the second highest price to book and PE ratios.

If I was forced to purchase shares in one of the banks discussed in this highly competitive and low growth environment, it may be safer to select a bank which has displayed an ability to grow its operating income. Although trends in financial performance can turnaround, we may be well advised to heed the advice of one of the greatest ever investors, Warren Buffett.

In 1979 Warren said, “turnarounds seldom turn”.

FREE 2019 INVESTING REPORT: 3 PROVEN GROWTH + DIVIDEND SHARES

[ls_content_block id=”14945″ para=”paragraphs”]

At the time of publishing, William owns shares of NAB, but this could change at any time.