When I think of ‘disruptive’ I immediately think of technology.

I think of Netflix and Blockbuster video, Amazon and bookstores, self-serve checkouts and cashiers.

But sometimes the biggest disrupters do not require an army of software engineers or a university dropout. I’m about to reveal the name of one investor that changed the global finance industry in the biggest way possible, and you probably don’t know who he was.

To understand it, I need to tell you how what he created and why…

In 1974, after being fired from his high-flying finance job, John “Jack” Bogle set about creating something which would later be called an ‘index fund’.

The organisation he started was Vanguard, a customer-owned organisation that now manages more than $US5 trillion dollars — twice as much as can be found in Australian superannuation accounts.

I’ll forgive you for not knowing who Bogle was, what Vanguard does or the trials he had to endure to see his idea flourish.

But I believe the idea Bogle set in motion had the most significant impact on the financial lives of Australians of any person in history.

Consider this…

Each year, even if you don’t invest, Australians shovel around 10% of their wage into Super.

Some of our money gets eaten up by life insurance and income protection, admin fees (which should be below $100 per year if you ask me) and — the biggest one — investment fees.

20 or 30 years ago, when Vanguard’s index funds were just beginning to get noticed, investment funds would routinely charge more than 2% in fees each year.

With a $100,000 balance, a 2% fee is $2,000 of your money going to a fund manager that you probably never met. What else do you spend $2,000 on each year?

But it gets worse.

With a $500,000 balance, an investor would pay $10,000 in fees — nearly $200 per week.

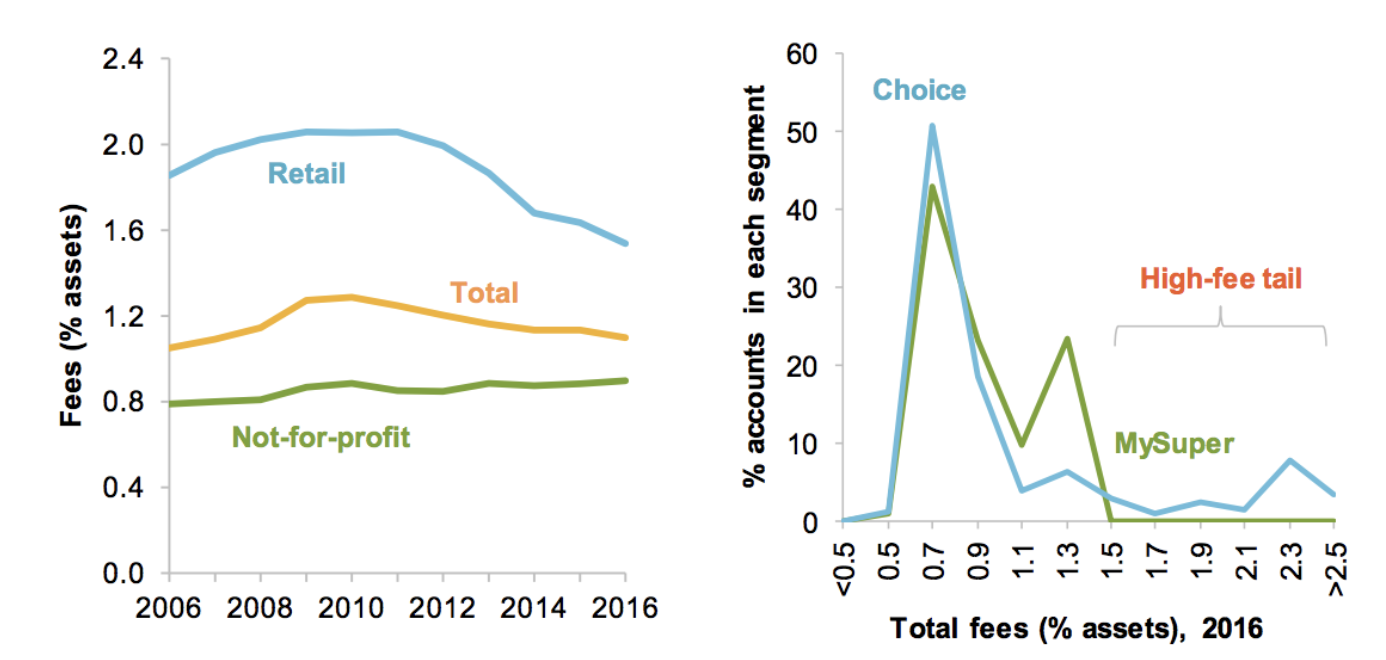

Now, before you think that’s old news, just a couple of months ago it was revealed many Aussies still pay fees higher than 2% per year. Here’s a chart from the Productivity Commission:

Source: Productivity Commission

In some instances, Vanguard index funds charge less than 0.2%. That works out to be fees of $200 on a $100k balance or $1,000 on a $500k balance – a $9,000 saving per year. That’s a big saving.

Over a lifetime, even for a middle-income Aussie, small changes like that will compound into hundreds of thousands of dollars more at retirement.

And Performance?

According to varying studies conducted over different time horizons, index funds like Bogle’s Vanguard funds often perform better than most active funds.

In his Google Talk, author JL Collins quotes studies that show index funds do better than 80% to 85% of active fund managers over a 15 year period.

Over 30 years he says the index does better than 99% of active fund managers.

But what does it all mean to an average Aussie?

Being able to keep our Super fees low and achieve strong performance has had the most profound effect on our financial lives.

How big?

According to the draft Productivity Commission report, the effects of low fees and high performance in Super means some Aussies retire with an extra 2 to 7 years worth of their salary in Super. If that’s not disruptive, I don’t know what is.

More than any investor ever, you can thank Jack Bogle for making this happen.

Index investing is not for everyone. But Bogle and Vanguard’s success had a huge impact on not only the ‘index fund’ industry but also in driving the fees charged by active investors lower.

In my opinion, Jack Bogle had the single-greatest impact of any investor, ever.

Thank you, and Rest In Peace.