The Telstra Corporation Ltd (ASX: TLS) share price has snapped back from its recent malaise. Investors are now asking:

Will Telstra Shares Be The #1 Turnaround Story of 2019?

Below I detail two reasons why I love to hate Telstra shares. But first, let’s ask, what does it do?

Telstra is Australia’s largest and oldest telecommunications business, having built the first telegraph line in 1854. Today, it provides more than 17 million retail mobile services, nearly 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services.

It also has operations stretching across eHealth, network applications and subsea cabling. Starting in 1997 (until 2006), the Australian Government sold Telstra to Australian investors via the ASX. The second batch of Government share sales, called “T2”, was conducted in 1999 at $7.40 per share.

2 Reasons I like Telstra

- Mobile Growth. Just this week Telstra shares went bananas when rival telco TPG Telecom Ltd (ASX: TPM) revealed it would drop its plans to build it’s own superfast 5G mobile network. As Rask Media’s, Andrew Schonberger wrote prior to the announcement, “Are TPG Telecom Shares A Buy For Mobile Growth”, TPG had been vying for a spot as one of Australia’s largest mobile network operators.

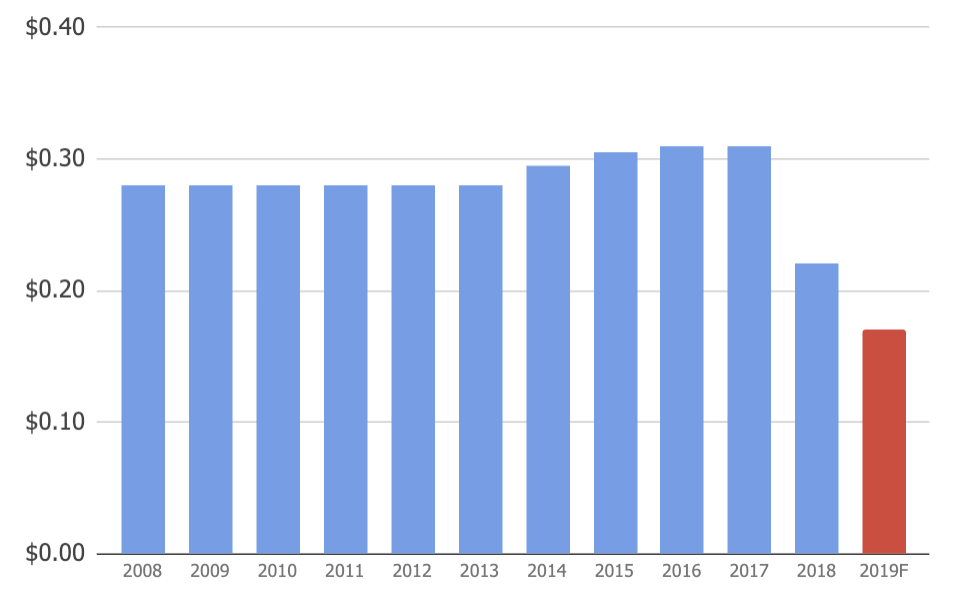

- Dividends. Telstra is Australia’s most widely held ASX stock. It’s also one of the most reliable dividend payers on the ASX. Even with the intense competition, analysts expect Telstra to pay a dividend equivalent to yield over 5%. It’s fully franked too! As we noted here, Telstra’s dividend could be cut or trimmed slightly in 2019.

2 Reasons I Don’t Like Telstra

- Debt. Commonsense — and research — tells us that companies with more debt tend to perform worse than those without it. While debt can make company’s return on equity look better than it really is, buying a company that already has loads of debt deprives you of the optionality of a company without debt! Telstra has too much debt for me to get excited. I think a2 Milk Company Ltd (ASX: A2M) is an example of a great company without debt.

- Competition. TPG might have dropped its own plans to build a mobile network using Chinese-made technology but its merger with Vodafone Australia is still on the cards. If it goes ahead, I wouldn’t be surprised to see Telstra shares come under selling pressure on account of more competition. In an industry with a bleak outlook, it’s another unnecessary risk to take, in my opinion.

Buy, Hold or Sell Telstra

I’m not in a rush to buy Telstra shares for my ASX portfolio, but I’m also not prepared to say it is a sell either. I’d probably give it a label of a ‘hold‘ if you held a gun to my head.

But honestly, if you’re looking for other reliable dividend shares on the ASX, consider Bapcor Ltd (ASX: BAP), which I detailed here; or even a dividend-paying exchange traded fund (ETF). For example, I own one ASX ETF that yields 4%. Another promising ETF can be found in the free report below.

[ls_content_block id=”14948″ para=”paragraphs”]