The Telstra Corporation Ltd (ASX: TLS) share price traded higher today as the broader market, or S&P/ASX 200 (INDEXASX: XJO), bounced back.

What Does Telstra Do?

Telstra is Australia’s largest and oldest telecommunications business, having built the first telegraph line in 1854. Today, it provides more than 17 million retail mobile services, nearly 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services. It also has operations stretching across eHealth, network applications and subsea cabling.

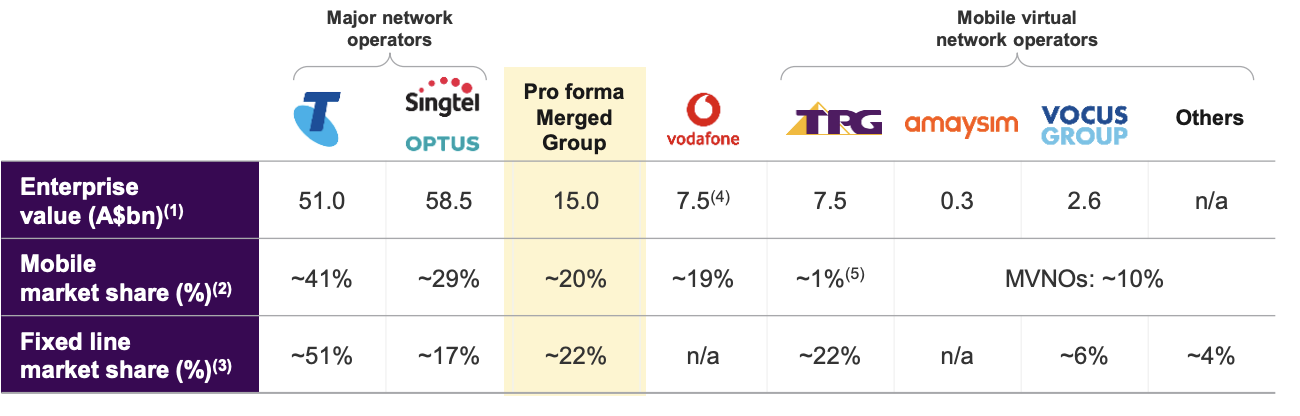

Telstra’s rivals in the mobiles market includes Singapore Telecommunications (SingTel), which owns Optus, and TPG Telecom Ltd (ASX: TPM), which currently plans to merge with Hutchison Telecommunications (aka Vodafone Australia). Then are smaller providers who offer their services on top of the networks operated by Telstra, Optus or Vodafone.

In the broadband market, Telstra is coming to grips with the NBN Co taking of control of Australia’s physical fibre networks and the competition that it brings. Telstra competes against the likes of TPG, Vocus Group Ltd (ASX: VOC) and My Net Fone or MNF Group Ltd (ASX: MNF), among others.

Is Telstra The ASX 200’s Comeback kid?

Starting in 1997 (until 2006), the Australian Government sold Telstra shares to Australian investors via the ASX. The second batch of Government share sales, called “T2”, was conducted in 1999 at $7.40 per share. Since then, Telstra shares have paid generous dividends, but the share price has only ebbed and flowed to a recent low of around $2.60.

Most recently, TPG Telecom’s decision to abandon its plans to roll out its own 5G mobile network appears to have cemented Telstra’s position as the number-one mobile network provider. This has led to a revival in the Telstra share price in 2019, so far.

The reason Telstra shareholders reacted so favourably to TPG’s decision is the growing belief that the NBN will become a second-rate technology to mobile technologies. As the lead mobile provider, Telstra would stand to benefit.

Unfortunately, if the recent share price rally is based on this idea or belief, I think it may be short-lived. Not only are there technological hurdles that may hinder the ability of mobile networks to be replaced by fixed wireless networks there are political risks in the form of a Labor government and its plans for the NBN.

Finally, TPG has only agreed to stop building its own 5G network. Meaning, if it joins forces with Vodafone it’ll acquire the resources to challenge Telstra in mobile regardless. Vodafone Australia currently has millions of mobile subscribers and having a reliable partner like TPG would give it greater firepower against Telstra.

What Now?

What Now?

For me, it’s too early to buy Telstra shares. While the dividend is appealing, it has loads of debt, big capital expenditure requirements in the form of network build-outs and is facing increasing competition and political uncertainty.

Ultimately, with over 2,000 other shares on the ASX, I’m happy to be patient and wait or simply buy better dividend growth shares.

[ls_content_block id=”14945″ para=”paragraphs”]