Australian retirees (like my dad) are often attracted to high yielding ASX dividend shares, like Telstra Corporation Ltd (ASX: TLS), drawn to the income they provide.

It is hard to argue against this strategy, considering the low interest rate environment and Australia’s taxation policies, particularly the controversial dividend imputation system. By international standards, Australian companies have high dividend payout ratios, which is mainly a function of shareholder’s preference for dividends, influenced by tax incentives.

Australians love affair for dividends is evident by the backlash against Labor’s plan to scrap excess franking credit refunds. Many investors will be left worse off as a direct result from the policy change.

However, what I find most interesting in terms of the debate, is whether Australian investors (particularly retirees) place too much emphasis on dividends, solely because of tax incentives. Is it possible that Labor’s tax change, if implemented, could indeed benefit investors by shifting their mindset away from a bias towards dividends to growth?

Let me explain by outlining an ongoing argument I have with my old man.

1 Dividend, 2 Steps Back

A favourite income stock of my dads and many retirees looking for income is Telstra.

Telstra has consistently paid a high proportion of its earnings out to shareholders. In fact, over the last 10 years, Telstra has had an average dividend payout ratio of around 90%. Thus, a small amount of profits each year have been re-invested back into the business to fund future growth.

Whilst a high-pay ratio is not bad per se, and is likely the correct action the board should take when capital cannot be re-invested at an attractive return, investors should be aware of the constraint it places on earnings growth and the sustainability of the dividend.

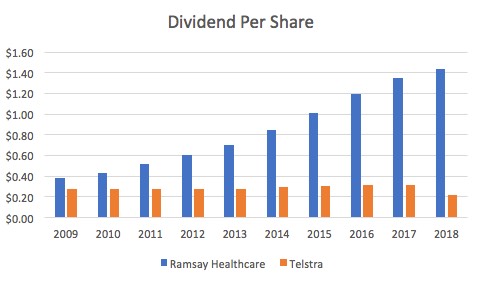

In 2009, investors could buy Telstra shares at a whopping 8% yield. Some would say a no brainer if you’re a retiree looking for income. The problem is if we fast forward 10 years to today, the dividend has not grown at all over this time. In fact, the annual growth of the dividend has been negative. Investors who bought Telstra, have taken on the risk of investing in the sharemarket, to receive only a bond like return!

In comparison, investors who bought Ramsay Health Care Limited (ASX: RHC) in 2009 at a lower yield of 3%, have seen dividends grow from $0.38 to $1.44 per share today.

The growth in dividends can be put down to Ramsay healthcare’s ability to re-invest close to half of the company’s earnings each year at a high rate of return. Although Ramsay Healthcare offered investors initially a lower dividend yield than Telstra, shareholders have been more than compensated by the growth in dividends and capital appreciation.

Obviously, these two companies are very different in terms of size, sector, maturity and so forth. Nonetheless, the comparison illustrates that investors drawn to companies with high payout ratios offering high yields, may be better off shifting their focus to companies with a lower payout ratio, that can re-invest retained profits at high rates of return.

One great example of this is Berkshire Hathaway Inc (BRK.B), which has never paid a dividend. The Chairman/CEO Warren Buffett is confident in his ability to reinvest retained earnings at a much higher rate than what individual shareholders could achieve with the funds received from a dividend. His advice to shareholders who require income is to sell down their holdings.

A reason against companies which retain a high proportion of profits, is management teams frequently blow the money on reckless acquisitions. Investors must be confident that the company has a strong track record of deploying retained earnings wisely at an attractive rate of return.

Investors who merely base an investment solely on yield, face the risk of mediocre returns or worse — loss of capital. My suggestion to my old man (irrespective of age), is that he’s far better to forego an investment with a high yield today with limited growth prospects, for an investment with a lower yield, which can sustainably grow earnings and dividends over time.

[ls_content_block id=”14945″]

Disclosure: At the time of publishing, Sam owned shares of Ramsay Health Care.