Two ASX ETFs to capture fast-growing global trends are iShares Global Healthcare ETF (ASX: IXJ) and BetaShares Asia Technology Tigers ETF (ASX: ASIA).

Why ETFs?

Exchange traded funds (ETFs) have had a profound effect on the investment industry. Although the debate between passive and active investing continues, it is clear that many investors are increasingly choosing simple and low-cost index fund options. Whilst there is merit in both strategies, ETFs can compliment an active investor’s portfolio to gain global diversification, exposure to specific sectors or regions which have long-tailwinds.

The amount of ETFs on the market today has grown exponentially over the last few years. Here are two ETFs which can be bought and sold on the ASX which provide Australian Investors with the opportunity to gain access to two large global thematics — the rise of healthcare spending and the rise of Asia.

Rising Healthcare Spending – IShares Global Healthcare ETF (ASX: IXJ)

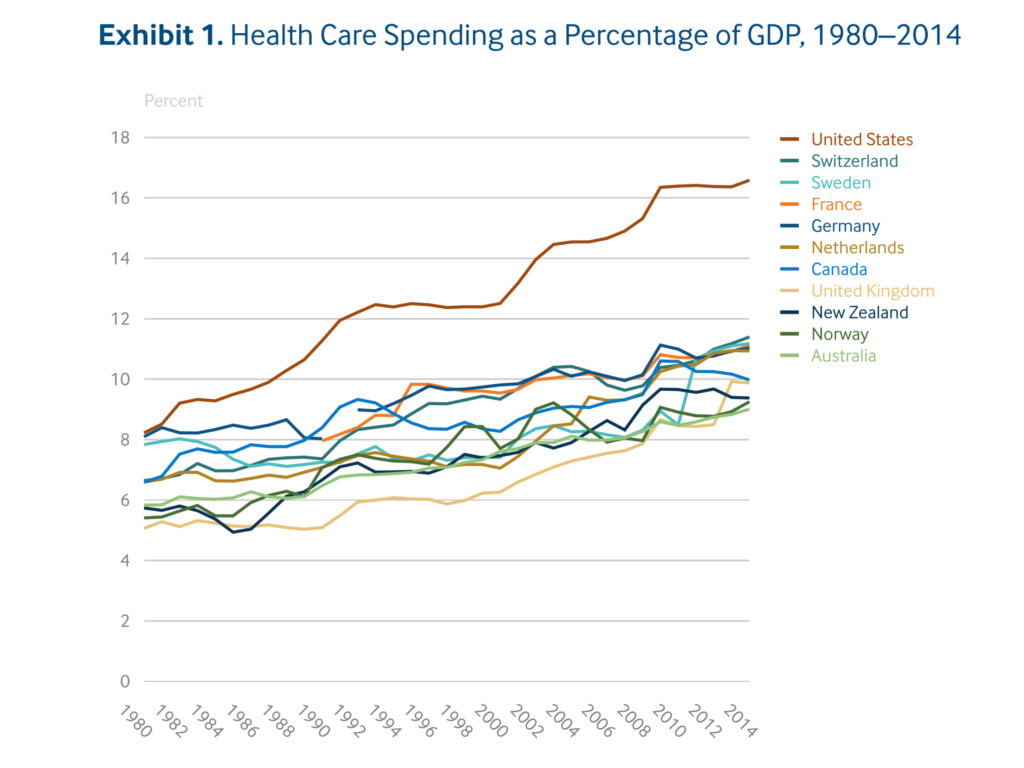

Around the world, people are spending a growing amount of their money on healthcare related costs. As illustrated below, healthcare expenditure has continually become a larger percentage of GDP globally. According to the OECD, the United States spent 17.8% of GDP in 2018 on healthcare.

Source: The Commonwealth Fund

There are a few reasons to be behind this trend.

Firstly, healthcare is a superior good. That is, as peoples income rise around the world, healthcare makes up a larger proportion of their consumption spending.

Secondly, medical advancements have made healthcare more effective, providing humans with a greater chance to survive serious illnesses, which all come at a cost.

Finally, the world’s population is ageing and life expectancy is increasing. These demographic trends support increased demand for healthcare related goods and services.

A cheap cost-effective way to gain exposure to the global healthcare thematic is through iShares Global Healthcare ETF (ASX: IXJ) from BlackRock. IXJ tracks the top 1200 global healthcare stocks, allowing investors to gain exposure to leading pharmaceutical, bio-technological and medical device companies through one single investment.

IXJ currently trades on a trailing P/E of 24.76, which may seem high. However, some would argue the performance of the fund justifies this multiple.

Source: Westpac Investing

Management fees will cost 0.47% p.a, which is deducted from the fund, rather than being an out-of-pocket expense to the investor. The ETF/fund pays two distributions each year and at current prices offers a trailing yield of approximately 1.8%.

It’s worth noting that investors in this fund are exposed to currency risk. Returns may be positively or negatively affected by movements in currency’s, irrespective of the index’s performance.

For me, IXJ is a standout ETF on the ASX as it offers Investors a diversified international portfolio of companies operating in a sector with a strong tailwind to outperform the overall market.

The Rise of Asia – BetaShares Asia Technology Tigers ETF (ASX: ASIA)

The second ETF I’ve chosen combines two global growing trends which have had and will continue to have a large impact in the investment world, the rise of Asia and technology.

It’s well-known that the US based technology companies, like Google, Amazon and Facebook have dominated the investment sphere over the last decade or so, as they’ve been the driving force behind the exceptional performance of passive investments. However, what may surprise some, is that Asia is home to it’s own tech giants which are fast becoming some of the largest companies in the world.

Now thanks to the BetaShares Asia Technology Tigers ETF (ASX: ASIA), these Asian tech companies are all available in a single ETF. The ETF tracks an index of the 50 largest technology and online companies in Asia, excluding Japan. The fund provides Aussie investors access to leading companies like Alibaba, Tencent and Samsung. Which if an investor bought individually would require access to three separate stock-exchanges, outlining the power of an ETF for retail investors.

The ETF also provides a level of geographic diversification and access to fast-growing economies, as the investment allocation predominantly spans across China (53.1%), South Korea (18.5%), Taiwan (18.5%) and India (8.8%).

In terms of dividends, the ETF/fund pays an annual distribution and offers the option for it to be part of a reinvestment plan. The 12-month trailing yield is approximately 1.2% and the P/E is around 20. Total management fees and expenses are 0.67% p.a.

As the ETF was established in 2018, the long-term past performance of the fund is unknown. It is also worth considering the extra volatility which could occur due the nature of the funds investments having an emerging market and currency risk.

For investors who can stomach short-term fluctuations, I believe the ASIA ETF offers an attractive diversified growth proposition for the ultra long-term.

The Final Word

ETFs offer investors an outstanding cost-effective and simple way to gain a diversified portfolio. However, investors must not jump blindly into these investment vehicles. It’s critical that the investor understands the make-up and characteristics of the individual investments inside the ETF before making any investment decisions.

[ls_content_block id=”14947″ para=”paragraphs”]

At the time of publishing, Sam does not own any of the investments mentioned in this article.